Template:Archegos capsule: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

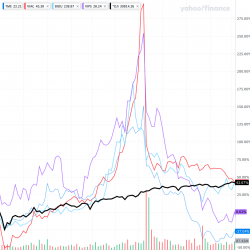

[[File:Archegos Positions.png|250px|thumb|left|When [[variation margin]] attacks: ViacomCBS, Tencent, Baidu and Vipshop against the Dow (black)]]In the months leading up to March 2021, [[Archegos|Archegos Capital Management]] took [[Synthetic equity swap|synthetic]] positions [[Margin loan|on margin]] in on four comparatively [[Illiquidity|illiquid]] stocks — ViacomCBS, Tencent Music Entertainment, Baidu Inc and Vipshop. Trading across multiple [[prime broker]]s, Archegos’ total holdings were big enough to move the market. As the [[Underlier|underliers]] appreciated, so did Archegos’ [[net equity]] with its [[prime broker]]s. Archegos used its equity to double down on the same investments, pushing the stocks up yet ''further''. The higher they went, the thinner their trading volume, and the more of the market Archegos represented. | [[File:Archegos Positions.png|250px|thumb|left|When [[variation margin]] attacks: ViacomCBS, Tencent, Baidu and Vipshop against the Dow (black)]]In the months leading up to March 2021, [[Archegos|Archegos Capital Management]] took [[Synthetic equity swap|synthetic]] positions [[Margin loan|on margin]] in on four comparatively [[Illiquidity|illiquid]] stocks — ViacomCBS, Tencent Music Entertainment, Baidu Inc and Vipshop. Trading across multiple [[prime broker]]s, Archegos’ total holdings were big enough to move the market. As the [[Underlier|underliers]] appreciated, so did Archegos’ [[net equity]] with its [[prime broker]]s. Archegos used its equity to double down on the same investments, pushing the stocks up yet ''further''. The higher they went, the thinner their trading volume, and the more of the market Archegos represented. | ||

On 22 March, Archegos’ Viacom | On 22 March, Archegos’ position in Viacom had a gross market value of USD5.1bn.<ref>{{credit suisse archegos report}}</ref> In a cruel irony, Viacom concluded that market sentiment was so strong that it should take the opportunity to raise capital.<ref>As it was [[Synthetic equity swap|synthetic]], Viacom may not have realised Archegos was the only buyer in town: if it had, it may never have tried to raise capital in the first place.</ref> Alas, not even Archegos was interested in its USD3bn share offering at that price since it was tapped out of equity with its prime brokers. | ||

The capital raising failed and hell broke loose. | The capital raising failed and [[Archegos|all hell broke loose]]. | ||

Revision as of 18:59, 27 November 2021

In the months leading up to March 2021, Archegos Capital Management took synthetic positions on margin in on four comparatively illiquid stocks — ViacomCBS, Tencent Music Entertainment, Baidu Inc and Vipshop. Trading across multiple prime brokers, Archegos’ total holdings were big enough to move the market. As the underliers appreciated, so did Archegos’ net equity with its prime brokers. Archegos used its equity to double down on the same investments, pushing the stocks up yet further. The higher they went, the thinner their trading volume, and the more of the market Archegos represented.

On 22 March, Archegos’ position in Viacom had a gross market value of USD5.1bn.[1] In a cruel irony, Viacom concluded that market sentiment was so strong that it should take the opportunity to raise capital.[2] Alas, not even Archegos was interested in its USD3bn share offering at that price since it was tapped out of equity with its prime brokers.

The capital raising failed and all hell broke loose.

- ↑ Report on Archegos Capital Management

- ↑ As it was synthetic, Viacom may not have realised Archegos was the only buyer in town: if it had, it may never have tried to raise capital in the first place.