Ultramares v Touche: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (2 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{cn}}{{Casenote|Ultramares|Touche}} is a famous case in {{t|negligence}} which placed bounds on the extent of neighbourliness, and who can claim {{t|damages}} for breach of [[duty of care]]. | {{cn}}{{Casenote|Ultramares|Touche}} is a famous case in {{t|negligence}} which placed bounds on the extent of neighbourliness, and who can claim {{t|damages}} for breach of [[duty of care]]. | ||

The auditors Touche Niven gave Fred Stern & Co., a rubber importer, an unqualified audit certificate, negligently not noticing that it had falsified its accounts | The auditors Touche Niven gave Fred Stern & Co., a rubber importer, an unqualified audit certificate, negligently not noticing that it had falsified its accounts. Touche knew that the audited accounts would be used to raise money. Relying on the accounts, Ultramares lent money to Fred Stern & Co. | ||

You’ll not guess what happened next. | You’ll not guess what happened next. | ||

Stern declared [[bankruptcy]] the following year. Ultramares sued Touche for the debt, declaring that a careful audit would have shown Stern to be insolvent. The audit was found to be [[negligent]], but not [[fraudulent]]. The case then went to the New York Court of Appeals, the great | Stern declared [[bankruptcy]] the following year. Ultramares sued Touche for the debt, declaring that a careful audit would have shown Stern to be insolvent. The audit was found to be [[negligent]], but not [[fraudulent]]. The case then went to the New York Court of Appeals, the great Justice [[Benjamin N. Cardozo]] presiding. | ||

{{cardozo indeterminacy}} | |||

{{sa}} | |||

*[[Cardozo indeterminacy]] | |||

*[[Dilbert’s programme]], a quixotic quest to ''avoid'' Cardozo indeterminacy | |||

Latest revision as of 10:00, 29 September 2021

|

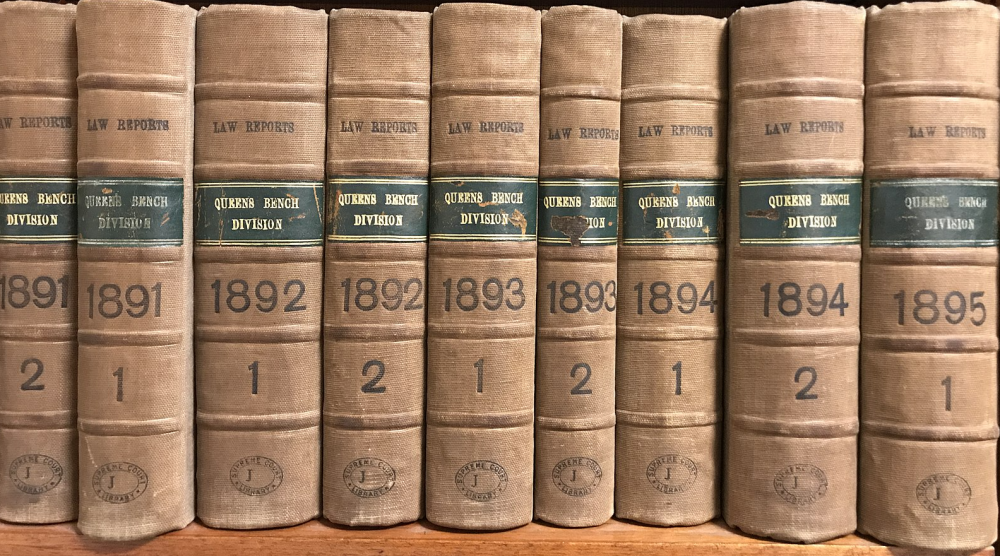

The Jolly Contrarian Law Reports

Our own, snippy, in-house court reporting service.

|

Ultramares v Touche is a famous case in negligence which placed bounds on the extent of neighbourliness, and who can claim damages for breach of duty of care.

The auditors Touche Niven gave Fred Stern & Co., a rubber importer, an unqualified audit certificate, negligently not noticing that it had falsified its accounts. Touche knew that the audited accounts would be used to raise money. Relying on the accounts, Ultramares lent money to Fred Stern & Co.

You’ll not guess what happened next.

Stern declared bankruptcy the following year. Ultramares sued Touche for the debt, declaring that a careful audit would have shown Stern to be insolvent. The audit was found to be negligent, but not fraudulent. The case then went to the New York Court of Appeals, the great Justice Benjamin N. Cardozo presiding.

The great American jurist Benjamin N. Cardozo held[1] that a creditor’s claim in negligence against a debtor’s incontestably negligent auditors failed because the auditors did not owe the company’s creditors a duty of care, there being no sufficiently proximate relationship between them. Articulating a now somewhat outdated shareholder capitalism, Cardozo J held the auditors to owe only the shareholders a duty of care.

Said Cardozo J, in an immortal passage that gave rise to the metajuridical concept of “Cardozo indeterminacy”:

“If liability for negligence exists, a thoughtless slip or blunder, the failure to detect a theft or forgery beneath the cover of deceptive entries, may expose accountants to a liability in an indeterminate amount for an indeterminate time to an indeterminate class. The hazards of a business conducted on these terms are so extreme as to enkindle doubt whether a flaw may not exist in the implication of a duty that exposes to these consequences.”

See also

- Cardozo indeterminacy

- Dilbert’s programme, a quixotic quest to avoid Cardozo indeterminacy