Co-head: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

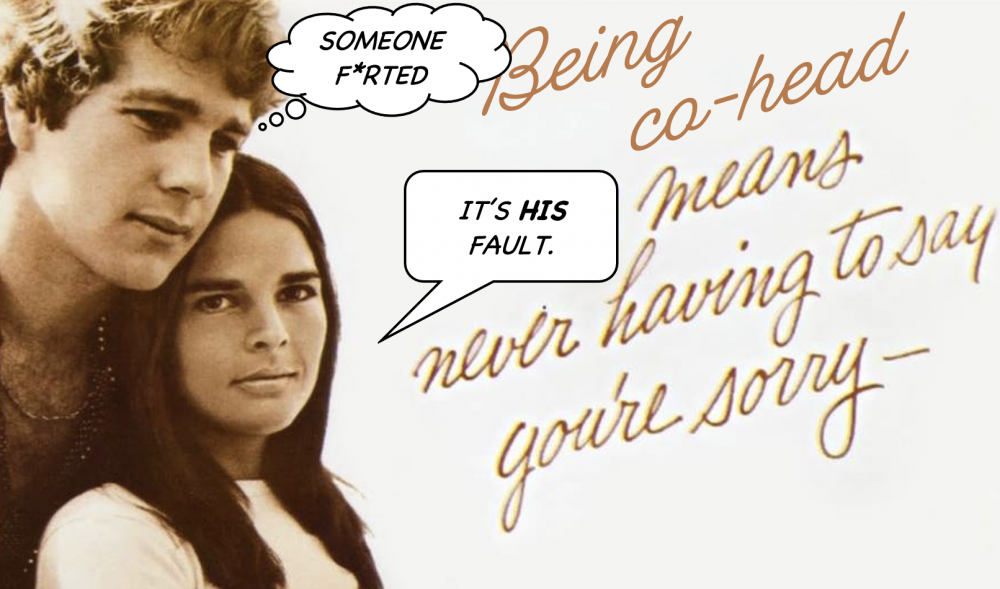

{{a|work|{{image|Love story|png|}}}}{{ | {{a|work|{{image|Love story|png|}}}}{{qd|Co-head|kəʊ-hɛd|n|One appointed to lead a business jointly with another such that each may, at the same time, individually take all credit and yet pass of all blame for the varying fortunes of the unit.}} | ||

{{drop|T|o ''appoint'' a}} co-head is to convey the impression one has ''overdone'' managerial responsibility whilst creating a vacuum of it. To ''be'' a co-head is to claim credit for the cake that is kept, and blame someone else for all the cake that is eaten. | |||

A staple motif of multinational mis-management<ref>See ''here'' for a [https://www.google.com/search?q=%22appoints+co-heads%22&tbm=nws daily-updating hall of shame].</ref>, the “co-head” speaks to the weakness and hubris which holds down the comfy chairs upper management. | A staple motif of multinational mis-management<ref>See ''here'' for a [https://www.google.com/search?q=%22appoints+co-heads%22&tbm=nws daily-updating hall of shame].</ref>, the “co-head” speaks to the weakness and hubris which holds down the comfy chairs upper management. | ||

===“Co-head is no head”=== | ====“Co-head is no head”==== | ||

{{dialogue| | |||

{{Dkt co heads}} | |||

—{{otto}}, {{dkt}}}} | |||

{{drop|T|o appoint co-leaders}} of a division, or the firm itself, is to settle a petulant inter-personal dispute that is, at best, only ''adjacent'' to the institution’s interest — but in all likelihood is positively hostile to it — by undermining the one thing such an appointment is meant to achieve: ''direct personal accountability''. A sole head of business who presides over catastrophic loss may blame inclement weather, Brexit, or regulatory head-winds, but cannot evade the retort that ''managing'' external factors such as these is just the job she was empowered to do. | |||

That dynamic changes should she share the hot-seat with someone else. If something goes wrong, there’s always a reason it wasn’t ''her'' fault. Her hands were tied; it was not her area; others were looking at it. | That dynamic changes should she share the hot-seat with someone else. If something goes wrong, there’s always a reason it wasn’t ''her'' fault. Her hands were tied; it was not her area; others were looking at it. | ||

| Line 15: | Line 15: | ||

The greatest, most glaring example of this is at our old friends Credit Suisse, who found to their cost what [[Archegos|happens when you have co-heads of prime services]]. For those without the stomach for a deep foray into [[hedge fund]] financing, you need know only this: prime brokerage generally splits into ''physical'' and ''synthetic'' components which are [[Form|formally]] quite different but [[Substance|substantively]] the same; Europe and New York are major centres for prime services businesses. Now at the time [[Archegos|a certain hedge fund]] blew up, trading ''synthetic'' products in the Americas, causing Credit Suisse roughly $5 billion in losses, the firm had co-heads of that business: one in the US and one in Europe. These men were duly summoned before the executive board to explain themselves. The American explained that ''he'' was responsible only for ''physical'' prime services, so this was not on his patch. The one European said ''he'' was only responsible for ''European'' prime brokerage, so it wasn’t on ''his'' patch, either. | The greatest, most glaring example of this is at our old friends Credit Suisse, who found to their cost what [[Archegos|happens when you have co-heads of prime services]]. For those without the stomach for a deep foray into [[hedge fund]] financing, you need know only this: prime brokerage generally splits into ''physical'' and ''synthetic'' components which are [[Form|formally]] quite different but [[Substance|substantively]] the same; Europe and New York are major centres for prime services businesses. Now at the time [[Archegos|a certain hedge fund]] blew up, trading ''synthetic'' products in the Americas, causing Credit Suisse roughly $5 billion in losses, the firm had co-heads of that business: one in the US and one in Europe. These men were duly summoned before the executive board to explain themselves. The American explained that ''he'' was responsible only for ''physical'' prime services, so this was not on his patch. The one European said ''he'' was only responsible for ''European'' prime brokerage, so it wasn’t on ''his'' patch, either. | ||

===All credit, no responsibility=== | ====All credit, no responsibility==== | ||

{{drop|I|t will be}} a different story should the business be in rude health, of course. There are few banking executives who won’t claim credit for every iota of positive return, and it will be a rare bank which pays each of its co-heads exactly half what it would pay a single head. | |||

But it should do: the only way a co-head arrangement could work is one that few investment bankers would entertain for a moment: that of [[partnership]]: [[joint and several liability]], and therefore individual responsibility for the totality of any loss, and proportional sharing of any profit. This is, of course, to increase one’s vulnerability to one’s comrades in the service of the firm’s interests, and is not how the professional managerial class like to go about things. | But it should do: the only way a co-head arrangement could work is one that few investment bankers would entertain for a moment: that of [[partnership]]: [[joint and several liability]], and therefore individual responsibility for the totality of any loss, and proportional sharing of any profit. This is, of course, to increase one’s vulnerability to one’s comrades in the service of the firm’s interests, and is not how the professional managerial class like to go about things. | ||

===Rationale=== | ====Rationale==== | ||

{{drop|P|urported rationales are}} to encourage a lean market inside the organisation for ideas, and to sort wheat from chaff. Those captive of the [[libtard]] sect that runs [[personnel]] may even claim this as some modern commitment to consensus and [[diversity and inclusion|diversity]]. | |||

''Time Magazine'' bought it hook, line and sinker: | |||

{{ | {{quote| | ||

“Having more than one person at the helm means more opportunity for a company to infuse its top ranks with [[diversity]] in all aspects, including age, race, gender, and skillset, as well as more experience with management, communications, and digital prowess.”<ref>[https://time.com/charter/6200510/shared-leadership/ The Case For Having More Than One Person in Charge], ''Time'', 22 July 2022.</ref>}} | |||

But no-one | But no-one outside [[HR]] who has the first clue about human nature — it ought to go without saying that people in [[HR]] have not the first clue about human nature — buys that. Pitting two young thrusters against each other is some sort of Spartan matriculation: soon enough, one will emerge from the cage leaving the other behind, a mess of blooded feathers. This is how [[Goldman]] looks at it, anyway. If that is how you do your succession planning, fair enough — but you reap what you sow. | ||

This is not how it works in kinder, lazier places where the co-head gambit is a sop from those without the heart for hard decisions that might damage fragile egos. | This is not how it works in kinder, lazier places where the co-head gambit is a sop from those without the heart for hard decisions that might damage fragile egos. | ||

{{sa}} | {{sa}} | ||

*[[Archegos]] | |||

*{{dkt}} | |||

*[[Co-calculation agent]] | *[[Co-calculation agent]] | ||

*[[Cognitive dissonance]] | *[[Cognitive dissonance]] | ||

Latest revision as of 10:41, 11 September 2024

|

Office anthropology™

|

Co-head

kəʊ-hɛd (n.)

One appointed to lead a business jointly with another such that each may, at the same time, individually take all credit and yet pass of all blame for the varying fortunes of the unit.

To appoint a co-head is to convey the impression one has overdone managerial responsibility whilst creating a vacuum of it. To be a co-head is to claim credit for the cake that is kept, and blame someone else for all the cake that is eaten.

A staple motif of multinational mis-management[1], the “co-head” speaks to the weakness and hubris which holds down the comfy chairs upper management.

“Co-head is no head”

Nuncle: Now steady, here, my lady liege: one hears it oftly said:

One head per pair of shoulders is enough

Less than one a lack, for sure

But no less a lack there is if there is more.Provocatoria: What mean you, Fool? Your riddle stays unspun.

Nuncle: One head’s a head ahead: co-heads are none.

Provocatoria: Must co-operation e’er be seen a fudge?

Nuncle: So try it, ma’am: you be the fool, and I the judge.

To appoint co-leaders of a division, or the firm itself, is to settle a petulant inter-personal dispute that is, at best, only adjacent to the institution’s interest — but in all likelihood is positively hostile to it — by undermining the one thing such an appointment is meant to achieve: direct personal accountability. A sole head of business who presides over catastrophic loss may blame inclement weather, Brexit, or regulatory head-winds, but cannot evade the retort that managing external factors such as these is just the job she was empowered to do.

That dynamic changes should she share the hot-seat with someone else. If something goes wrong, there’s always a reason it wasn’t her fault. Her hands were tied; it was not her area; others were looking at it.

The greatest, most glaring example of this is at our old friends Credit Suisse, who found to their cost what happens when you have co-heads of prime services. For those without the stomach for a deep foray into hedge fund financing, you need know only this: prime brokerage generally splits into physical and synthetic components which are formally quite different but substantively the same; Europe and New York are major centres for prime services businesses. Now at the time a certain hedge fund blew up, trading synthetic products in the Americas, causing Credit Suisse roughly $5 billion in losses, the firm had co-heads of that business: one in the US and one in Europe. These men were duly summoned before the executive board to explain themselves. The American explained that he was responsible only for physical prime services, so this was not on his patch. The one European said he was only responsible for European prime brokerage, so it wasn’t on his patch, either.

All credit, no responsibility

It will be a different story should the business be in rude health, of course. There are few banking executives who won’t claim credit for every iota of positive return, and it will be a rare bank which pays each of its co-heads exactly half what it would pay a single head.

But it should do: the only way a co-head arrangement could work is one that few investment bankers would entertain for a moment: that of partnership: joint and several liability, and therefore individual responsibility for the totality of any loss, and proportional sharing of any profit. This is, of course, to increase one’s vulnerability to one’s comrades in the service of the firm’s interests, and is not how the professional managerial class like to go about things.

Rationale

Purported rationales are to encourage a lean market inside the organisation for ideas, and to sort wheat from chaff. Those captive of the libtard sect that runs personnel may even claim this as some modern commitment to consensus and diversity.

Time Magazine bought it hook, line and sinker:

“Having more than one person at the helm means more opportunity for a company to infuse its top ranks with diversity in all aspects, including age, race, gender, and skillset, as well as more experience with management, communications, and digital prowess.”[2]

But no-one outside HR who has the first clue about human nature — it ought to go without saying that people in HR have not the first clue about human nature — buys that. Pitting two young thrusters against each other is some sort of Spartan matriculation: soon enough, one will emerge from the cage leaving the other behind, a mess of blooded feathers. This is how Goldman looks at it, anyway. If that is how you do your succession planning, fair enough — but you reap what you sow.

This is not how it works in kinder, lazier places where the co-head gambit is a sop from those without the heart for hard decisions that might damage fragile egos.

See also

References

- ↑ See here for a daily-updating hall of shame.

- ↑ The Case For Having More Than One Person in Charge, Time, 22 July 2022.