Prime brokerage charging: Difference between revisions

Amwelladmin (talk | contribs) Created page with "{{a|PB|}}{{equity derivative charging}}" |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{a|PB|}}{{equity derivative charging}} | {{a|PB| | ||

[[File:Charging.png|450px|frameless|center]] | |||

}}{{equity derivative charging}} | |||

Revision as of 18:10, 2 February 2021

|

Prime Brokerage Anatomy™

|

Remember our theory of the game, synthetic PB ninjas: synthetic PB is just margin lending done with swaps. That should offer some clues about how clients pay for it. The economics are the same. This is about the economic cost of entering margin loans, not the economic exposure you have to the stock you have bought. Though that does come into it.

Physical prime brokerage

Physical longs

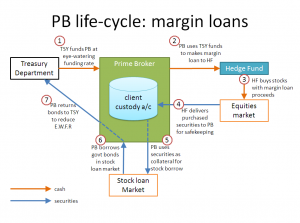

In a physical margin loan — representing a long equity position — the client expects two types of cost:

- Financing: The financing costs it will incur from its prime broker in borrowing the money it needs to buy the stock, and

- Commission: The brokerage commissions it will incur from its equity broker in buying (and when it is ready to, selling again) the stock.

To offset its costs, the prime broker can rehypothecate the stock, which it holds in custody for the client. Now when it does so, the PB does not take price risk to the stock: remember; it does not have a directional view on the stock. So it will not sell the stock outright, but more likely will use it as collateral in the market, to raise cash (under a repo) or high-quality assets (under a stock loan). If the stock increases in value, happy days for all concerned: the PB will receive more cash, and at the limit may reach its rehypothecation limit and have to return some of the rehypothecated stock to the client. If the stock declines in value, the PB will be able to raise less cash against it, but will be able to call for more margin from the client.

Physical shorts

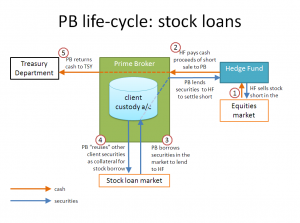

In a short position on margin, the client expects the following costs:

- Financing: The financing costs it will incur from its prime broker under the stock loan by which it borrows the security it wants to short, and

- Commission: The brokerage commissions it will incur from its equity broker in selling (and when it is ready to, buying back) the stock it has borrowed.

Here the client also has something it can offer the prime broker to offset its internal funding costs: the proceeds of sale of the borrowed stock, which it banks in its cash account with the PB. That has the effect of reducing the client’s overall indebtedness. Now its exposure moves around under the stock loan with the prime broker. If the stock increases in value, the client’s liability under the stock loan also increases, and the PB will call for margin. If the stock decreases in value, happy days for the client: the value of its stock loan liability (to return that stock to the PB) will decline, meaning its overall indebtedness declines meaning at the limit the PB may reach its rehypothecation limit and have to return some of the rehypothecated stock to the client.

Synthetic prime brokerage

Under an equity swap, the client never actually buys the stock, but it puts on a Transaction with its prime broker that replicates the economics of doing so, on margin:

Synthetic longs

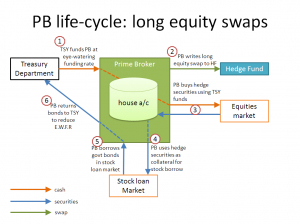

In a long synthetic equity swap — the synthetic equivalent of a physical long, of course — the client expects two types of cost:

- Financing: The financing costs its swap dealer incurs in borrowing the money it needs to buy its hedge position, and

- Commission: The equivalent of brokerage commissions it would pay its dealer for executing the trade (and when it is ready to, terminating it).

To offset its costs, the swap dealer can raise finance against its Hedge Position, which it owns outright, in the repo/stock loan market. since the stock hedges its swap position, the dealer will not sell the stock outright, but will use it as collateral in the market, to raise cash (under a repo) or high-quality assets (under a stock loan). If the stock increases in value, happy days: the dealer will get more cash, but will need that for variation margin it owes its client to the swap. If the stock declines in value, the dealer will be able to raise less cash against it, but will be able to call for more variation margin from the client.

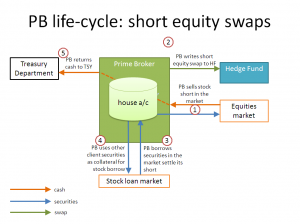

Synthetic shorts

In a short synthetic equity swap — the synthetic equivalent of a physical short, of course — the client expects the following costs:

- Financing: The financing costs the swap dealer incurs under the stock loan the dealer executes as a Hedge Position to the short swap, under which it borrows the physical underlying security and sells it short, and

- Commission: The equivalent of brokerage commissions it would pay its dealer for executing the trade (and when it is ready to, terminating it).

- Here the dealer obtains the proceeds of short sale of its Hedge Position and it can use these to offset its internal funding costs of collateralising its stock loan hedge. Now ther client’s exposure under the short swap tracks the swap dealer’s exposure under the stock loan Hedge Position: If the underlier increases in value, the client’s liability under the short and the dealer’s liability under its stock loan hedge increase, and the dealer will call the client for variation margin, which it can use to meet its margin call on its hedge. If the stock decreases in value, happy days: the dealer will receive collateral back from its stock loan hedge counterparty, but will have to pay out variation margin to the client.