Charge-out rate: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 5: | Line 5: | ||

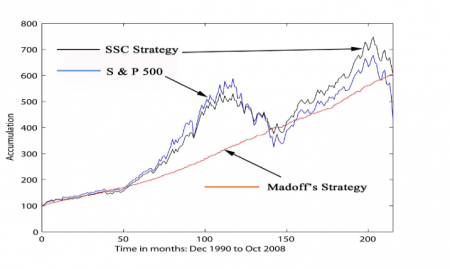

You can plot it through time on a graph, as a straight line rising at more or less the steepest possible gradient at which an independent observer’s eyes will not start involuntarily to water. This rising line will continue inevitably, inexorably and without variation, regardless of market condition, geopolitical angst, or the softness of the labour or investment market, until the very [[end of days]]. | You can plot it through time on a graph, as a straight line rising at more or less the steepest possible gradient at which an independent observer’s eyes will not start involuntarily to water. This rising line will continue inevitably, inexorably and without variation, regardless of market condition, geopolitical angst, or the softness of the labour or investment market, until the very [[end of days]]. | ||

You see the line of the [[charge-out rate]] in its natural environment in two places: | You see the line of the [[charge-out rate]] in its natural environment in two places: | ||

Every other indicator will have its ups and downs: dotcoms will boom, unicorns will bust, credit bubbles will burst, hedge-funds implode — but the hourly rate of the equity partner of a global | A ''malign'' version, in the financial performance of someone who is up to no good: a [[Madoff|Ponzi scheme]], for example, or an insider trader — and here the [[Apocalypse]] may happen at any time, and will be personal to those at whose expense the scheme is being perpetrated; and | ||

A ''benign'' version — benign, at least, as far as our [[Private practice lawyer|learned friends]] are concerned — that describes the growth and development of [[charge-out rate]]s and, more generally, of ''revenue'' through time in a [[magic circle law firm]]. | |||

Here the “[[Apocalypse]]” really means the ultimate limit of [[space-time]] however that might happen to be described (if at all) under prevailing cosmological theory, for the inevitability in the growth of [[Magic circle law firm|magic circle]] revenues and [[charge-out rate]]s is one of the most persistent and predictable phenomena in the known universe. | |||

Every other indicator will have its ups and downs: dotcoms will boom, unicorns will bust, credit bubbles will burst, hedge-funds implode — but the hourly rate of the equity partner of a global law firm will constantly, happily, and irresistibly rise. It is a wonder why no-one is trying to harness it as an exhaustible source of clean, renewable energy. | |||

A bit too much hot-air and methane, I suppose. | |||

{{sa}} | {{sa}} | ||

Revision as of 15:35, 1 October 2021

|

A charge-out rate is a form of cosmological constant.

You can plot it through time on a graph, as a straight line rising at more or less the steepest possible gradient at which an independent observer’s eyes will not start involuntarily to water. This rising line will continue inevitably, inexorably and without variation, regardless of market condition, geopolitical angst, or the softness of the labour or investment market, until the very end of days.

You see the line of the charge-out rate in its natural environment in two places:

A malign version, in the financial performance of someone who is up to no good: a Ponzi scheme, for example, or an insider trader — and here the Apocalypse may happen at any time, and will be personal to those at whose expense the scheme is being perpetrated; and

A benign version — benign, at least, as far as our learned friends are concerned — that describes the growth and development of charge-out rates and, more generally, of revenue through time in a magic circle law firm.

Here the “Apocalypse” really means the ultimate limit of space-time however that might happen to be described (if at all) under prevailing cosmological theory, for the inevitability in the growth of magic circle revenues and charge-out rates is one of the most persistent and predictable phenomena in the known universe.

Every other indicator will have its ups and downs: dotcoms will boom, unicorns will bust, credit bubbles will burst, hedge-funds implode — but the hourly rate of the equity partner of a global law firm will constantly, happily, and irresistibly rise. It is a wonder why no-one is trying to harness it as an exhaustible source of clean, renewable energy.

A bit too much hot-air and methane, I suppose.

See also

- Harry Markopolos’ magnificent No One Would Listen: A True Financial Thriller, which goes to show that even when you point out an obvious fraud, no-one listens. Not even the SEC.

- Magic circle law firm

- Bernard Madoff