Credit Event Upon Merger - ISDA Provision: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 5: | Line 5: | ||

Note also the interrelationship between [[CEUM]] and the {{isdaprov|Ratings Downgrade}} {{isdaprov|ATE}}. One can be forgiven for feeling a little ambivalent about {{isdaprov|CEUM}} because it is either caught by {{isdaprov|Ratings Downgrade}} or, where there is no requirement for a general Ratings Downgrade, insisting on {{isdaprov|CEUM}} seems a bit arbitrary (i.e. why do we care about a downgrade as a result of a merger, but not any other downgrade?) | Note also the interrelationship between [[CEUM]] and the {{isdaprov|Ratings Downgrade}} {{isdaprov|ATE}}. One can be forgiven for feeling a little ambivalent about {{isdaprov|CEUM}} because it is either caught by {{isdaprov|Ratings Downgrade}} or, where there is no requirement for a general Ratings Downgrade, insisting on {{isdaprov|CEUM}} seems a bit arbitrary (i.e. why do we care about a downgrade as a result of a merger, but not any other downgrade?) | ||

==[[Hedge Funds]]=== | |||

Really, we are a [[hedge fund]], we're not rated and we’re most unlikely to merge, are we. So must we really have a CEUM? Cue the [[credit officer’s refrain]]. | |||

===1992 upgrade=== | ===1992 upgrade=== | ||

Even before the {{2002ma}} was published it was common to upgrade the {{1992ma}} formulation to something resembling the glorious concoction that became Section 5(b)(v) of the {{2002ma}}. The 1992 wording is a bit lame, really. | Even before the {{2002ma}} was published it was common to upgrade the {{1992ma}} formulation to something resembling the glorious concoction that became Section 5(b)(v) of the {{2002ma}}. The 1992 wording is a bit lame, really. | ||

Revision as of 14:02, 11 December 2018

|

ISDA Anatomy™

view template

view template

|

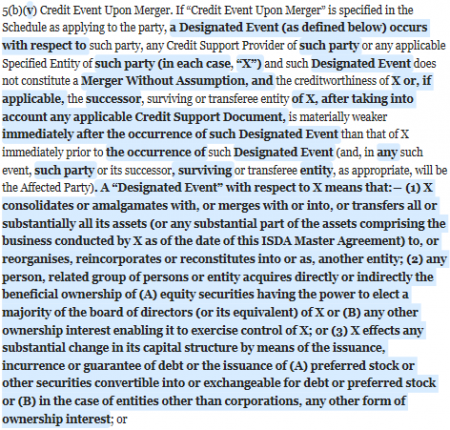

- Section 5(a)(viii) is Merger Without Assumption.

Pay attention to the interplay between this section and Section 7(a) of the Transfer Section. You should not need to amend Section 7(a) (for example to require equivalence of credit quality of any transferee entity etc because that is managed by CEUM.

Note also the interrelationship between CEUM and the Ratings Downgrade ATE. One can be forgiven for feeling a little ambivalent about CEUM because it is either caught by Ratings Downgrade or, where there is no requirement for a general Ratings Downgrade, insisting on CEUM seems a bit arbitrary (i.e. why do we care about a downgrade as a result of a merger, but not any other downgrade?)

Hedge Funds=

Really, we are a hedge fund, we're not rated and we’re most unlikely to merge, are we. So must we really have a CEUM? Cue the credit officer’s refrain.

1992 upgrade

Even before the 2002 ISDA was published it was common to upgrade the 1992 ISDA formulation to something resembling the glorious concoction that became Section 5(b)(v) of the 2002 ISDA. The 1992 wording is a bit lame, really.

Here’s a snapshot of the difference: