Tax Event - ISDA Provision: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 8: | Line 8: | ||

:''(3) required to make a deduction from a payment under an {{swapclearprov|Associated LCH Transaction}} where no corresponding [[gross up]] amount is required under the corresponding {{isdaprov|Transaction}} Payment under this {{isdaprov|Agreement}}.'' | :''(3) required to make a deduction from a payment under an {{swapclearprov|Associated LCH Transaction}} where no corresponding [[gross up]] amount is required under the corresponding {{isdaprov|Transaction}} Payment under this {{isdaprov|Agreement}}.'' | ||

===Gist=== | ===Gist=== | ||

Basically the gist is this: if you have to [[gross up]] an {{isdaprov|Indemnifiable Tax}}, you have a right to get out of the trade, rather than having to ship the gross up for the remainder of the | Basically the gist is this: if the rules change after the {{isdaprov|Trade Date}} such that you have to [[gross up]] an {{isdaprov|Indemnifiable Tax}} would weren't expecting to when you priced the trade, you have a right to get out of the trade, rather than having to ship the gross up for the remainder of the {{isdaprov|Transaction}}. | ||

Revision as of 10:06, 23 September 2019

|

ISDA Anatomy™

view template

view template

|

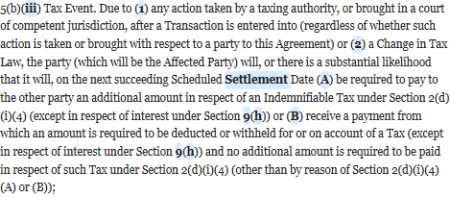

No real change from the 1992 ISDA

Note, unhelpfully, the subpara reference in the 1992 ISDA is (1) and (2) and in the 2002 ISDA is (A) and (B). Otherwise, pretty much the same:

Note, also unhelpfully, that this paragraph is a bastard to understand. Have a gander at the JC’s nutshell version and you’ll see it is not such a bastard after all, then. In the context of CCP, you typically add a third limb, which is along the lines of

- (3) required to make a deduction from a payment under an Template:Swapclearprov where no corresponding gross up amount is required under the corresponding Transaction Payment under this Agreement.

Gist

Basically the gist is this: if the rules change after the Trade Date such that you have to gross up an Indemnifiable Tax would weren't expecting to when you priced the trade, you have a right to get out of the trade, rather than having to ship the gross up for the remainder of the Transaction.