Money: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

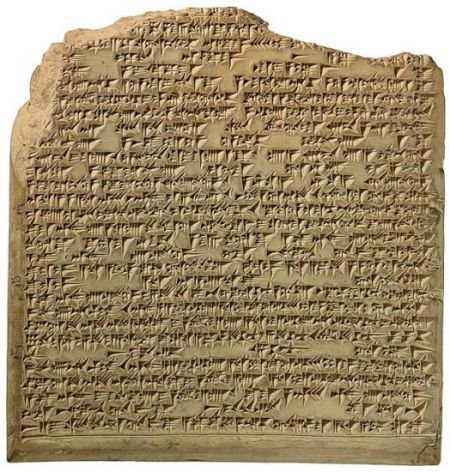

{{a|glossary|}}:''“I don’t need [[money]]. I need questions answered.'' <br> | {{a|glossary|[[File:Hammurabi.jpg|450px|thumb|center|A theoretical conceptualisation of money yesterday]]}}:''“I don’t need [[money]]. I need questions answered.'' <br> | ||

:''Question number one: Can I have some [[money]]?”'' | :''Question number one: Can I have some [[money]]?”'' | ||

::—Ford Fairlane, in {{fr|The Adventures of Ford Fairlane, Rock ’n’ Roll Detective}} | ::—Ford Fairlane, in {{fr|The Adventures of Ford Fairlane, Rock ’n’ Roll Detective}} | ||

| Line 10: | Line 10: | ||

===Whoever holds it owns it. No exceptions.=== | ===Whoever holds it owns it. No exceptions.=== | ||

Transfer of [[cash]] to another person — this is called “[[payment]]”, not “[[delivery]]” — with the expectation of its return fundamentally, ''necessarily'', creates [[indebtedness]]. By transferring cash you convert | Transfer of [[cash]] to another person — this is called “[[payment]]”, not “[[delivery]]” — with the expectation of its return fundamentally, ''necessarily'', creates '''[[indebtedness]]'''. By transferring cash to someone else in expectation of its return, you convert your own ''holding'' of that abstract token to a claim on the estate of the person to whom you transferred it for [[repayment]] of that [[debt]]. There can be no kind of [[bailment]] or [[custody]] arrangement over cash. | ||

This isn’t just an English law point. It is not a function of the {{t|CASS}} rules. It is fundamental to the nature of cash in any place, under any law. It dates back to the Code of Hammurabi. Anything which doesn’t automatically create indebtedness ''is not [[money]]''. | This isn’t just an English law point. It is not a function of the {{t|CASS}} rules. It is fundamental to the nature of [[cash]] in any place, under any law. It dates back to the Code of Hammurabi. Anything which doesn’t automatically create indebtedness ''is not [[money]]''. | ||

Therefore you cannot eliminate credit exposure to a person who holds | Therefore, you cannot eliminate [[credit exposure]] to a person who holds money you have given them unless they physically and permanently put it aside – that is, they take an equal amount of cash out of circulation and put in a vault or something – ''and'' the [[debt]] represented by that cash payment benefits from some kind of statutory protection against claims from other [[creditor]]s. So the [[cash]] not only has to be physically present in full, it also has to be preferred. Even this only amounts to a statutory preference as against the holder which defeats claims of lower-ranking creditors. | ||

If the | If the receiver is entitled to use cash in its operations, as surely it must be, the debt it represents ''must'' be part of its insolvency estate. All “segregation” can possibly mean is that a protected creditor has a better claim to repayment of its debt that any other creditor for the payment of the debt due to it. This is totally different to non-cash, where the custodian never has legal title to the asset and it never falls into its insolvency estate. | ||

{{sa}} | |||

{{ | |||

*[[Credit risk]] | *[[Credit risk]] | ||

*[[Client money]] | *[[Client money]] | ||

Revision as of 10:42, 8 November 2019

|

- “I don’t need money. I need questions answered.

- Question number one: Can I have some money?”

- —Ford Fairlane, in The Adventures of Ford Fairlane, Rock ’n’ Roll Detective

A simple, but gravely misunderstood thing.

It is misunderstood by tech people (bitcoin isn’t cash; it’s a fraudulent asset); by people who ask for client money protection from a bank, and by those who aspire to take security over it.

A token of abstract value

Cash is not an asset. It is not property. Cash is is a token of abstract value. It is a will ’o’ the wisp, a woodland sprite, an ephemerality which floats freely of the mortal chains of commerce. It is derivative of nothing beyond the common opinion of all merchants in the town square. It is like Sandy Denny, or one of those free-spirited hippie types that dances round toadstools: It cannot be owned, only held[1] — which is another way of saying whoever holds it owns it, outright, against all the world. Cash requires your total commitment, or nothing: you can’t futz around with it, you can’t declare a trust over it, pledge it, or hold it for anyone other than yourself. If you could, this would undermine the practical value of money as money: a £5 note, to be meaningful, must be a token worth exactly £5. It has no intrinsic value — it’s a scruffy bit of paper. If the notional value is £5 but there is a risk that the person giving it to you may not own it — that some random may snatch it from your hands after you have given up your goods in exchange for it, alleging some prior ownership right — then it does not have a value of £5 any more.

Whoever holds it owns it. No exceptions.

Transfer of cash to another person — this is called “payment”, not “delivery” — with the expectation of its return fundamentally, necessarily, creates indebtedness. By transferring cash to someone else in expectation of its return, you convert your own holding of that abstract token to a claim on the estate of the person to whom you transferred it for repayment of that debt. There can be no kind of bailment or custody arrangement over cash.

This isn’t just an English law point. It is not a function of the CASS rules. It is fundamental to the nature of cash in any place, under any law. It dates back to the Code of Hammurabi. Anything which doesn’t automatically create indebtedness is not money.

Therefore, you cannot eliminate credit exposure to a person who holds money you have given them unless they physically and permanently put it aside – that is, they take an equal amount of cash out of circulation and put in a vault or something – and the debt represented by that cash payment benefits from some kind of statutory protection against claims from other creditors. So the cash not only has to be physically present in full, it also has to be preferred. Even this only amounts to a statutory preference as against the holder which defeats claims of lower-ranking creditors.

If the receiver is entitled to use cash in its operations, as surely it must be, the debt it represents must be part of its insolvency estate. All “segregation” can possibly mean is that a protected creditor has a better claim to repayment of its debt that any other creditor for the payment of the debt due to it. This is totally different to non-cash, where the custodian never has legal title to the asset and it never falls into its insolvency estate.