Slavenburg: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 12: | Line 12: | ||

Sadly all now defunct — the [[Slavenburg]]<ref>Named for a case featuring the Slavenburg’s bank in Holland; these days part of Crédit Lyonnais.</ref> met its Waterloo in the ''UK Overseas Companies (Execution of Documents and Registration of Charges) (Amendment) Regulations 2011'' and, if that didn’t do it, for we financial markets folk, the [[Financial Collateral Regulations]] had, since 2003, rendered it a dead letter anyway. | Sadly all now defunct — the [[Slavenburg]]<ref>Named for a case featuring the Slavenburg’s bank in Holland; these days part of Crédit Lyonnais.</ref> met its Waterloo in the ''UK Overseas Companies (Execution of Documents and Registration of Charges) (Amendment) Regulations 2011'' and, if that didn’t do it, for we financial markets folk, the [[Financial Collateral Regulations]] had, since 2003, rendered it a dead letter anyway. | ||

Except in [[Ireland]] of course. Isn’t that right, [[Central Bank of Ireland]]? | |||

{{sa}} | {{sa}} | ||

Revision as of 10:41, 21 March 2020

|

A word about credit risk mitigation

|

Proof that the kids of today are lucky.

The practice of modern financial law may be inane, tedious and confusing, but at least you don’t get sent to Companies House to file something with the express intent of having it thrown back in your face because you didn’t need to file it. This was a work-a-day experience for a young clerk in the last — I mean 20th —century.

Successive UK Companies Acts required those benefiting from security interests granted by UK companies to be register them at Companies House. You had exactly 21 days from the date of delivery of the deed creating the charge to do it, on pain of your security being rendered finally, fatally, and irrevocably void. Should you have been the one so lacking in the fastidious qualities all solicitors must have as to forget, your own sorry hide would be summarily executed by the staff partner, after a brief show-trial. All excellent fun.

Now before about 2011, you also had to register charges against foreign business with a UK “place of business”. Since no one knew what that meant and, by any lights, it could change over time, stripling clerks were shunted off to Companies House weekly to register charges against any foreign company, including those without a hint of a UK dimension, and indeed those (UK tax-sheltering espievies for example) that owed their utter, abject existence to not, in their weakest moment, having the merest fleeting conception that they might one day have a place of business in the UK.

This was also a tremendous jolly, and articled clerks would come home gleefully clutching a letter from matron politely explaining that registration of the charge wasn’t needed, wasn’t wanted, but nonetheless acknowledging young sir had made this foolhardy attempt to do it all the same, and had been stoutly rebuffed at the door.

By way of plausible deniability, Companies House ran an ad hoc register of these failed charges, just in case anyone — a staff partner in urgent need of letting off steam, for example — should later challenge such a charge as being unregistered without good cause. The vibe was this, for poor young Dodger, back at the dosshouse: I TRIED TO REGISTER THE DAMN THING. WHAT ELSE WAS I SUPPOSED TO DO?

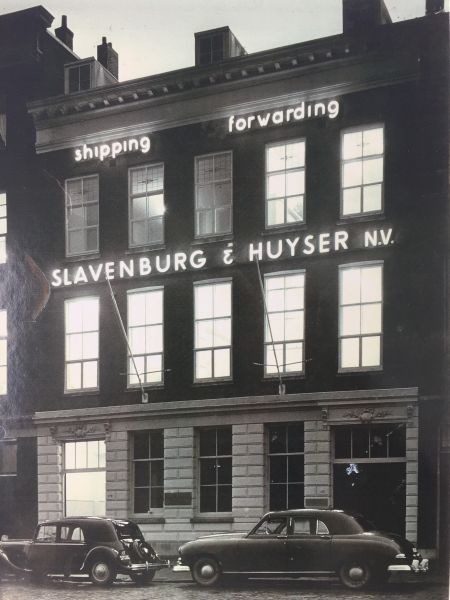

Sadly all now defunct — the Slavenburg[1] met its Waterloo in the UK Overseas Companies (Execution of Documents and Registration of Charges) (Amendment) Regulations 2011 and, if that didn’t do it, for we financial markets folk, the Financial Collateral Regulations had, since 2003, rendered it a dead letter anyway.

Except in Ireland of course. Isn’t that right, Central Bank of Ireland?

See also

- Registration of charges

- Slavenburg’s Bank N.V. v International Natural Resources Ltd [1980] 1AllER 955

References

- ↑ Named for a case featuring the Slavenburg’s bank in Holland; these days part of Crédit Lyonnais.