Template:M summ GMSLA 9.3: Difference between revisions

Amwelladmin (talk | contribs) Created page with "{{gmsla9commentary}}" |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{gmsla9commentary}} | {{gmsla9commentary}} | ||

Note also the clear exclusion of indirect and [[consequential loss]]es, as well as losses to which the Transferee is contributorily [[negligent]]. <ref>If you are thinking I just made up the [[adjective]] “contributorily”, and were about to conclude I’m maybe a bit ''[[reckless]]'' you might be interested to know it is actually a [https://en.wiktionary.org/wiki/contributorily word].</ref> | |||

===Default interest=== | |||

Are references here to [[interest]] to, like ''default'' interest under Clause {{gmslaprov|11.7}}? And if so are we in a world of {{t|LIBOR}} remediation? | |||

Well, this old fellow’s opinion is ''no''. Clause {{gmslaprov|11.7}} of the {{gmsla}} is specific to costs following ''actual'' [[close out]] on an {{gmslaprov|Event of Default}} (a {{gmslaprov|Buy-in}} ''isn’t'' an {{gmslaprov|Event of Default}}), and only on professional expenses. The vibe here is ''you reimburse me my ''actual'' costs''. So, the ''actual interest'' cost I incurred in funding the securities I bought in, rather than some abstract derivative notion of my costs represented by a [[benchmark]]. | |||

===Replacement costs and [[ISDA]] [[hedging]] language=== | |||

Does it make sense to replace this clause with some convoluted shtick about the costs of {{isdaprov|Replacement Transaction}}s or otherwise hedging the innocent party’s exposure? To determine follow this flow chart: | |||

[[File:GS Tree.png|frameless|470px|center|Not called the [[vampire squid]] for nothing, you know.]] | |||

{{sa}} | |||

*[[Goldman]] | |||

*[[Chicken licken]] | |||

*{{wasteprov|Over-processing}} | |||

{{ref}} | |||

Revision as of 16:42, 17 November 2020

Mini close-out

See the discussion on mini close-out under the 2010 GMSLA (and the 1995 OSLA for that matter) and also the general discussion with regard to this clause in its wider context at clause 9.

Note also the clear exclusion of indirect and consequential losses, as well as losses to which the Transferee is contributorily negligent. [1]

Default interest

Are references here to interest to, like default interest under Clause 11.7? And if so are we in a world of LIBOR remediation?

Well, this old fellow’s opinion is no. Clause 11.7 of the 2010 GMSLA is specific to costs following actual close out on an Event of Default (a Buy-in isn’t an Event of Default), and only on professional expenses. The vibe here is you reimburse me my actual costs. So, the actual interest cost I incurred in funding the securities I bought in, rather than some abstract derivative notion of my costs represented by a benchmark.

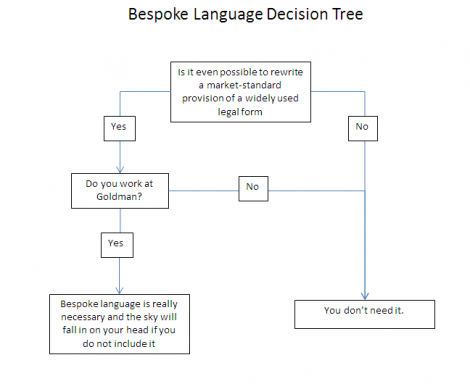

Replacement costs and ISDA hedging language

Does it make sense to replace this clause with some convoluted shtick about the costs of Replacement Transactions or otherwise hedging the innocent party’s exposure? To determine follow this flow chart: