Hedge fund: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 14: | Line 14: | ||

{{sa}} | {{sa}} | ||

*[[GameStop]] | |||

*[[Backtesting]] | *[[Backtesting]] | ||

*[[Greeks]] | *[[Greeks]] | ||

Revision as of 11:25, 29 January 2021

|

Hedge fund /hɛdʒ fʌnd/ (n.)

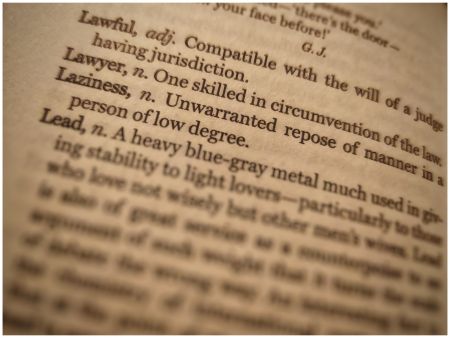

A couple of guys with a bright idea and a rented office in Mayfair. The Oxford English Dictionary says it is an “offshore investment fund, typically formed as a private limited partnership, that engages in speculation using credit or borrowed capital.”

That neglects to mention how much they charge, or that they talk a lot about alpha — even leveraged alpha — and have the back-tests to prove it — while doing a lot of vega.

They also like shorting. This was a more fun game before the world got rocked on its axis by people on Reddit, and the Wikipedia effect came to the financial services market.

Vega, by the way, is not a drug.[1] In fairness, in speaking of credit and borrowed capital, it does nod in Vega’s direction.

Hedge funds hang out with

See also

References

- ↑ OR IS IT? For those pursuing yield return, the lure of leverage can be a little addictive, which may or may not be a plot point in Hunter Barkley’s forthcoming novel The ISDA Protocol.