Oubliette: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

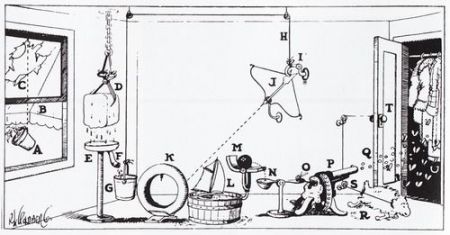

{{a|negotiation|[[File:Rube Goldberg machine.jpg|center|450px|frameless]]}}Where you will go, taking the whole negotiation with you, the moment you nickel-and-dime on some tail-event risk management concern. You know, by reference to 1.3% of the rolling weighted average volume of the monthly mean rainfall on the Amazon basin etc. | {{a|negotiation|[[File:Rube Goldberg machine.jpg|center|450px|frameless]]}}{{oubliette capsule}} | ||

Seeing an oubliette coming early is vital, as is the right response to avoid falling into it, is very easy to do. This translates identically into the world of [[contract negotiation]]: | |||

Let’s say your [[credit department]] has it in its head that [[cross default]] is an important protection in a [[Securities financing transaction|securities financing arrangement]]. This is a peculiar and idiosyncratic view, not shared by anyone in the market and lacking a solid base in common sense, but of such gems of incongruous conviction | |||

Where you will go, taking the whole negotiation with you, the moment you nickel-and-dime on some tail-event risk management concern. You know, by reference to 1.3% of the rolling weighted average volume of the monthly mean rainfall on the Amazon basin etc. | |||

It might jazz your risk colleagues, and it will doubtless appeal to your own [[Rube Goldberg]]ian instinct — every transactional [[legal eagle]] has it, however deeply it will be buried, and it will overjoy your [[buyside counsel]], and as you descend into the [[abyss]], it will drive your clients up the ''wall''. | It might jazz your risk colleagues, and it will doubtless appeal to your own [[Rube Goldberg]]ian instinct — every transactional [[legal eagle]] has it, however deeply it will be buried, and it will overjoy your [[buyside counsel]], and as you descend into the [[abyss]], it will drive your clients up the ''wall''. | ||

Revision as of 10:39, 11 June 2021

|

Negotiation Anatomy™

|

A naturally occurring subterranean cavern that forms when the opinionated gather to argue about trifles. Given enough nest-feathering, posturing and guano, even the most robust topic will tend to fray and weaken and may in time collapse: those discussing it suddenly find themselves in a dungeon of their own making, not knowing how they got there, but rather enjoying it all the same.

Oubliettes have a cosmological quality: like any black hole, they are impossible to see directly. We detect them only by their signature detritus: crushed aspirations of clarity and elegance, swirling around an event horizon of pedantry like so many gossamer dreams of greatness, gurgling around a galaxy-sized plughole. We enter these space-tedium singularities often, but always unwittingly, and it is only when scrabbling desperately for a way back out that we realise just what we have fallen into.

Seeing an oubliette coming early is vital, as is the right response to avoid falling into it, is very easy to do. This translates identically into the world of contract negotiation:

Let’s say your credit department has it in its head that cross default is an important protection in a securities financing arrangement. This is a peculiar and idiosyncratic view, not shared by anyone in the market and lacking a solid base in common sense, but of such gems of incongruous conviction

Where you will go, taking the whole negotiation with you, the moment you nickel-and-dime on some tail-event risk management concern. You know, by reference to 1.3% of the rolling weighted average volume of the monthly mean rainfall on the Amazon basin etc.

It might jazz your risk colleagues, and it will doubtless appeal to your own Rube Goldbergian instinct — every transactional legal eagle has it, however deeply it will be buried, and it will overjoy your buyside counsel, and as you descend into the abyss, it will drive your clients up the wall.