Oubliette: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit |

||

| Line 7: | Line 7: | ||

Let’s say your [[credit department]] has it in its head that [[cross default]] is an important protection in a [[Securities financing transaction|securities financing arrangement]]. This is a peculiar view, shared by few in the market and lacking a solid base in common sense, but of such gems of incongruous conviction propel many a livelihood in the Square Mile and we should not gainsay them. They are inexplicable brute facts of the universe, like the cosmological constant or the popularity of golf. | Let’s say your [[credit department]] has it in its head that [[cross default]] is an important protection in a [[Securities financing transaction|securities financing arrangement]]. This is a peculiar view, shared by few in the market and lacking a solid base in common sense, but of such gems of incongruous conviction propel many a livelihood in the Square Mile and we should not gainsay them. They are inexplicable brute facts of the universe, like the cosmological constant or the popularity of golf. | ||

Your [[credit officer]] will say, “well, [[it won’t hurt]] to just ''ask''” for a cross default, but just asking will prompt a discussion the parties needn’t otherwise have had, about the sorts of fantastic calamities that might come about in the possible universes that risk managers visit in their delirious dreams. The hypotheticals thrown into this debate will be as imaginative as they are tendentious: there will be a tangible air of prepostery emanating from either side’s submissions. But such is the path-dependency of negotiation: had no-one started this ball rolling, on a whim, none of imaginative perversity would have been given voice. | Your [[credit officer]] will say, “well, [[it won’t hurt]] to just ''ask''” for a cross default, but just asking will prompt a discussion the parties needn’t otherwise have had, about the sorts of fantastic calamities that might come about in the possible universes that risk managers visit in their delirious dreams. The hypotheticals thrown into this debate will be as imaginative as they are tendentious: there will be a tangible air of prepostery emanating from either side’s submissions. But such is the path-dependency of negotiation: had no-one started this ball rolling, on a whim, none of imaginative perversity would have been given voice. | ||

It might jazz your risk colleagues, and it will doubtless appeal to your own [[Rube Goldberg]]ian instinct — every transactional [[legal eagle]] has | Before you know it, the parties will be reciting the 14 stations of [[set-off]]. Perhaps someone will have the idea of importing some definitions from the {{isdama}}, and from there all hope is lost. There is one way back, an infinite number of ways forward, into the [[abyss]], and [[negotiator]]s have no reverse gear. | ||

It might jazz your risk colleagues, and it will doubtless appeal to your own [[Rube Goldberg]]ian instinct — every transactional [[legal eagle]] has one, however deeply buried, and it will overjoy your opponent [[buyside counsel|legal eagle]]. | |||

As as you descend into the [[abyss]], it will drive your clients up the ''wall''. | |||

{{sa}} | {{sa}} | ||

Revision as of 21:54, 11 June 2021

|

Negotiation Anatomy™

|

Negotiation oubliette

/nɪˌgəʊʃɪˈeɪʃən/ /ˌuːblɪˈɛt/ (n.)

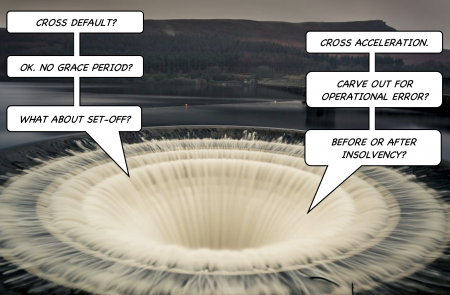

A naturally occurring subterranean cavern that forms when the opinionated gather to argue about trifles. Given enough nest-feathering, posturing and guano, even the most robust topic will tend to fray and weaken and may in time collapse: those discussing it suddenly find themselves in a dungeon of their own making, not knowing how they got there, but rather enjoying it all the same.

Oubliettes have a cosmological quality: like any black hole, they are impossible to see directly. We detect them only by their signature detritus: crushed aspirations of clarity and elegance, swirling around an event horizon of pedantry like so many gossamer dreams of greatness, gurgling around a galaxy-sized plughole. We enter these space-tedium singularities often, but always unwittingly, and it is only when scrabbling desperately for a way back out that we realise just what we have fallen into.

Into the oubliette you will go, taking the whole negotiation with you, the moment anyone proposes to accommodate any of the infinite count of tail events that in logical theory could but in recorded history never have come about. Seeing an oubliette coming early is vital, as is the right response, since falling into it is very easy to do. The notion of a “clabby conversation” translates very well into the world of contract negotiation.

Let’s say your credit department has it in its head that cross default is an important protection in a securities financing arrangement. This is a peculiar view, shared by few in the market and lacking a solid base in common sense, but of such gems of incongruous conviction propel many a livelihood in the Square Mile and we should not gainsay them. They are inexplicable brute facts of the universe, like the cosmological constant or the popularity of golf.

Your credit officer will say, “well, it won’t hurt to just ask” for a cross default, but just asking will prompt a discussion the parties needn’t otherwise have had, about the sorts of fantastic calamities that might come about in the possible universes that risk managers visit in their delirious dreams. The hypotheticals thrown into this debate will be as imaginative as they are tendentious: there will be a tangible air of prepostery emanating from either side’s submissions. But such is the path-dependency of negotiation: had no-one started this ball rolling, on a whim, none of imaginative perversity would have been given voice.

Before you know it, the parties will be reciting the 14 stations of set-off. Perhaps someone will have the idea of importing some definitions from the ISDA Master Agreement, and from there all hope is lost. There is one way back, an infinite number of ways forward, into the abyss, and negotiators have no reverse gear.

It might jazz your risk colleagues, and it will doubtless appeal to your own Rube Goldbergian instinct — every transactional legal eagle has one, however deeply buried, and it will overjoy your opponent legal eagle.

As as you descend into the abyss, it will drive your clients up the wall.