Charge-out rate

|

A charge-out rate is a form of cosmological constant.

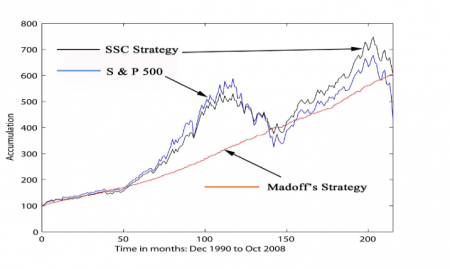

You can plot it through time on a graph, as a straight line rising at more or less the steepest possible gradient at which an independent observer’s eyes will not start involuntarily to water. This rising line will continue inevitably, inexorably and without variation, regardless of market condition, geopolitical angst, or the softness of the labour or investment market, until the very end of days.

You see the line of the charge-out rate in its natural environment in two places:

A malign version, in the financial performance of someone who is up to no good: a Ponzi scheme, for example, or an insider trader — and here the Apocalypse may happen at any time, and will be personal to those at whose expense the scheme is being perpetrated; and

A benign version — benign, at least, as far as our learned friends are concerned — that describes the growth and development of charge-out rates and, more generally, of revenue through time in a magic circle law firm.

Here the “Apocalypse” really means the ultimate limit of space-time however that might happen to be described (if at all) under prevailing cosmological theory, for the inevitability in the growth of magic circle revenues and charge-out rates is one of the most persistent and predictable phenomena in the known universe.

Every other indicator will have its ups and downs: dotcoms will boom, unicorns will bust, credit bubbles will burst, hedge-funds implode — but the hourly rate of the equity partner of a global law firm will constantly, happily, and irresistibly rise. It is a wonder why no-one is trying to harness it as an exhaustible source of clean, renewable energy.

A bit too much hot-air and methane, I suppose.

The end of the charge-out rate is nigh

From the “... and monkeys will fly out of my butt” department. Around the marketplace of ideas, you will see the occasional sandwich board-donning lunatic preaching through wild hair and crazed eyes, that the end of this tyrannical regime is nigh. Death to the billable hour! they shriek, to whatever patient, spittle-flecked audience they can find. This argument, proceeding as it does from the purest precepts of cold logic is, on its own terms, unimpeachable and therefore, in the real world, utterly hopeless.

No matter how much everyone[1] hates them, and no matter how good the logic against them is, charge-out rates are a brute fact of life. They have survived, and flourished, until now. As brute facts tend to, they have proven adept at resisting the cold hypothetical theorising of modernisers and thought leaders.

It’s a means of account

Essentially, the billable hour is an internal unit of account: means for those who like to measure, manage and monitor things to make sure the firm is properly sweating its assets. The six-minute unit is not an end in itself, and if you got rid of it that would not stop big law firms sweating their assets. Massacring associates is what they do: it is in their nature.

The point is mainly to make as much money, as consistently as possible, and like it or not, over a long period that is a function of time spent. Yes, you might have moments of ineffable genius but, in the more industrialised parts of the capital markets, opportunities for these are few. For the most part, it is a grind. Part of what makes a successful private practice lawyer is the ability to relentlessly grind.

So part of the point is to weed out the ones who can’t hack it. This is elite sport. Remember: these winsome little lambs whom big law is now tenderising? Short days ago they were elbowing each other in the eye and clambering over their grandmothers’ graves just to snag that summer internship. Getting monstered is part of the deal: if you don’t accept that, don’t do it. There are plenty of other things to do with your time.

Outrage might be informed, too, by how much big law firms charge for their attorneys’ time, and how little of that gets back to the poor, put-upon attorneys. Again, this is the deal. Always has been. If you have the game, and the match fitness, to stay with the game, you’ll get yours soon enough. But if you think Coward Slaughter LLP is going to take less money any time soon, in the name of the work life balance of 25 year olds it hires as cannon fodder? Think again.

Alignment of interests

Anyone who has spent any time in the trenches of a financial services transaction will know what an uncontrollable monster these things can be. Not only is there the extreme over-complicatedness of the legal documents,[2] but the unmanageable interests of all the conflicting interests and agents. The law firm holding the pen has no control over how idiotic its own client is, how convoluted its instructions, how contradictory, how often it will change its mind, and who is really steering the ship. It has even less over the attitude of other counterparties to the deal, and even less over their legal advisors. Much of modern legal practice involves disentangling stupid questions, trying to make head or tail of gnomic pronouncements from some senior luminary on the client’s upper management who doesn’t have the first clue about the deal or for that matter the business, waiting fruitlessly on clear news of what is meant to be happening, and fending off frustration techniques from opposing lawyers that are precisely designed to run down the clock and rack up legal expense. All of this takes time, and imposing an hourly rate is a neat, effective, and sobering hedge for a firm against being taken advantage of utterly by other participants with their own personal agendas. Fixed fees, conditional fee arrangements, percentages and caps are necessarily blunter tools, inviting more after-the-fact complaint, than actual hours spent. You obliged my associate to spend seventy five hours re-writing legal docs because your original instructions were unclear is quite hard to argue against.

Lawyers in private practice secretly quite like them

There is something of the labour theory of value to hours clocked up. Native private practitioners actually like the feeling of accomplishment and self-worth that comes from spending 2,500 hours a year slogging away at meaningless textual rockfaces. Those who argue against them are talking their own book: mainly technologists and other refugees from “big law” you will not find senior partners of white-shoe law firms — or, really, those that aspire to being partners of white-shoe firms — railing against charge-out rates.

See also

- Harry Markopolos’ magnificent No One Would Listen: A True Financial Thriller, which goes to show that even when you point out an obvious fraud, no-one listens. Not even the SEC.

- Magic circle law firm

- Bernard Madoff

References

- ↑ Not everyone hates them. Everyone with an opinion on LinkedIn hates them. This is different.

- ↑ Curious? Have a look at this 370-page beauty.