Tax Event - ISDA Provision

|

ISDA Anatomy™

view template

view template

|

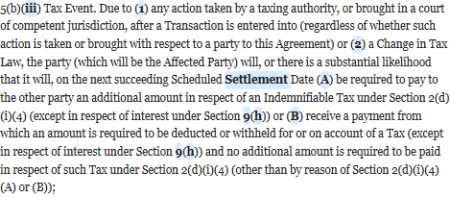

Numbering Discrepancy: Note the numbering discrepancy in Section 5(b) between the 1992 ISDA and 2002 ISDA. This is caused by a new 5(b)(ii) (Force Majeure Event) in the 2002 ISDA before Tax Event, which is thus shunted from Section 5(b)(ii) (in the 1992 ISDA) to Section 5(b)(iii) (in the 2002 ISDA).

Note, unhelpfully, the subpara reference in the 1992 ISDA is (1) and (2) and in the 2002 ISDA is (A) and (B). Otherwise, pretty much the same:

Note, also unhelpfully, that this paragraph is a bastard to understand. Let’s have a look then:

Tax Event in a Nutshell™ (ISDA edition)

- 5(b)(iii) Tax Event It will be a Termination Event when, following a change in tax law or practice after any trade date, an Affected Party is likely to have to either:

- (1) Gross up an Indemnifiable Tax deduction (other than for interest under Section 9(h)); or

- (2) receive a payment net of Tax which the Non-Affected Party is not required to gross up (other than where it is caused by the Non-Affected Party’s own omission or breach).

- (1) Gross up an Indemnifiable Tax deduction (other than for interest under Section 9(h)); or

Not such a bastard after all, then. In the context of CCP, you typically add a third limb, which is along the lines of

- (3) required to make a deduction from a payment under an Template:Swapclearprov where no corresponding Gross Up amount is required under the corresponding Transaction Payment under this Agreement.}}