Swap

“Swap” as explained to my neighbor Phil

Swaps come in all shapes and sizes, but at their heart they are agreements to exchange — “swap” — payment streams. In the simplest example, you and I could agree, for a period of 5 years, that I will pay you a fixed rate on an agreed sum, and you will pay me a floating rate on the same sum. Why would we do that? Well, imagine you had a floating rate income (for example, a floating rate note), but a fixed rate liability (say a mortgage). By swapping your floating rate into a fixed rate you will can meet your mortgage payments without having to worry about interest rates falling on your note. On the other hand, you give up the profit if interest rates rise on your note. But you are, in the vernacular, “hedged”. Used in this way, a swap is a form of insurance against your floating rate investment going down. You can enter a swap even if you don't own a source of income paying you the rate you are swapping away. Bankers have all kinds of imaginative names for this kind of activity: pre-hedging; seeking alpha; yield-enhancing, but you will know it as gambling. Warren Buffett calls swaps “financial weapons of mass destruction”. This is a bit of hyperbole, but he still felt pretty smug when the world nearly blew up in 2008 because of complex derivatives called credit default swaps. You can swap all kinds of cashflows - not just interest rates. Cashflows can be derived from any financial asset: bonds, shares, commodities, and even repackaged cashflows on sub-prime mortgages[1]. |

Financial concepts my neighbour Phil was asking about when I borrowed his mower.

Index: Click ᐅ to expand:

Overview

Generally, those derivative contracts entered into under an ISDA Master Agreement. Two rookie mistakes to avoid:

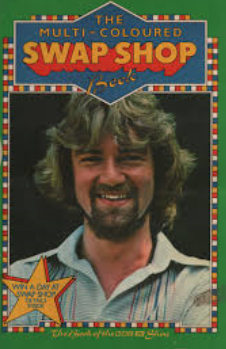

- Firstly, it’s pronounced “sw-ŏp” (to rhyme with chop), but it’s spelled “swap”. Any fan of 1970s children's television will know this. It is not, however, true that Noel Edmonds was a pioneering derivative salesman, but that would make a great play. On no account should you say “sw-æp” (to rhyme with “crap”), unless you want derivatives insiders to dine out on your misfortune for many years. I still tell people about an unfortunate partner of Stephenson Harwood who made this mistake in 1997.

- Secondly, when articulating the word ISDA you say “izder”, not “eye-ess-dee-aye”. This was a closely guarded industry in-joke, designed to reveal ingénues, but sadly the spoil-sport makers of The Big Short[2] have rumbled it.

History

Where did they come from? What were their architects thinking? For this and more, see Swap history.

Present day

What? You want actual information about swaps? Go, then, to the ISDA Anatomy

References

- ↑ Don’t do this. I mean, really, don’t.

- ↑ Let me Google that for you.