Credit Event Upon Merger - ISDA Provision

|

2002 ISDA Master Agreement

Section 5(b)(v) in a Nutshell™ Use at your own risk, campers!

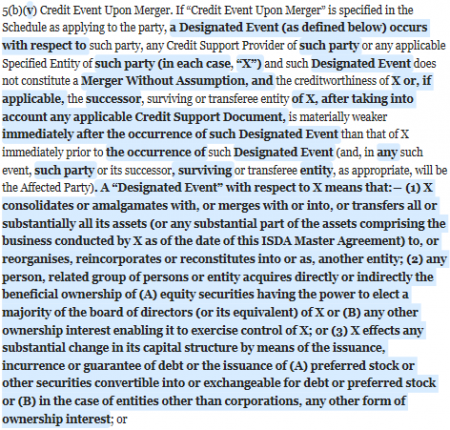

Full text of Section 5(b)(v)

Related agreements and comparisons

|

Content and comparisons

First established in the 1987 ISDA, CEUM was gently upgraded for the 1992 ISDA to include Credit Support Providers and Specified Entities, and to clarify who, upon such a merger, is the Affected Party, as per this comparison.

It then had quite the overhaul of Credit Event Upon Merger between 1992 ISDA and 2002 ISDA as this comparison illustrates.

Designated Event is part of the definition of Credit Event Upon Merger in the 2002 ISDA, and doesn’t have an equivalent in the 1992 ISDA nor, obviously enough,the 1987 ISDA.

The 2002 ISDA introduced the “Designated Event” in an attempt to define more forensically the sorts of corporate events that should be covered by CEUM. They are notoriously difficult to pin down. Even before the 2002 ISDA was published, it was common to upgrade the 1992 ISDA formulation to something resembling the glorious concoction that became Section 5(b)(v) of the 2002 ISDA. The 1992 wording is a bit lame. On the other hand, you could count the number of times an ISDA Master Agreement is closed out purely on account of Credit Event Upon Merger on the fingers of one hand, even if you had lost all the fingers on that hand to an industrial accident.

So — yeah.

Summary

Known among the cognoscenti as “CEUM”, the same way Tax Event Upon Merger is a “TEUM”. No idea how you pronounce it, but since ISDA ninjas communicate only in long, appended, multicoloured emails and never actually speak to each other, it doesn’t matter.

Pay attention to the interplay between this section and Section 7(a) (Transfer). You should not need to amend Section 7(a) (for example to require equivalence of credit quality of any transferee entity etc., because that is managed by CEUM.

Note also the interrelationship between CEUM and a Ratings Downgrade Additional Termination Event, should there be one. One can be forgiven for feeling a little ambivalent about CEUM because it is either caught by Ratings Downgrade or, if there is no requirement for a general Ratings Downgrade, insisting on CEUM seems a bit arbitrary (i.e. why do you care about a downgrade as a result of a merger, but not any other ratings downgrade?)

General discussion

Template:M gen 2002 ISDA 5(b)(v)

See also

References

- Section 5(a)(viii) is Merger Without Assumption.

Pay attention to the interplay between this section and Section 7(a) of the Transfer Section. You should not need to amend Section 7(a) (for example to require equivalence of credit quality of any transferee entity etc because that is managed by CEUM.

Note also the interrelationship between CEUM and the Ratings Downgrade ATE. One can be forgiven for feeling a little ambivalent about CEUM because it is either caught by Ratings Downgrade or, where there is no requirement for a general Ratings Downgrade, insisting on CEUM seems a bit arbitrary (i.e. why do we care about a downgrade as a result of a merger, but not any other downgrade?)

Hedge funds and CEUM

Really, we are a hedge fund, we’re not rated, we’re not going to be and we’re hardly going to merge, are we? and even if we did we wouldn’t do it in a way that disadvantaged existing investors. So must we really have a CEUM?

We really must[1], lest the sky fall in on our heads. For it is written: it is the credit officer’s refrain.

1992 ISDA upgrade

Even before the 2002 ISDA was published it was common to upgrade the 1992 ISDA formulation to something resembling the glorious concoction that became Section 5(b)(v) of the 2002 ISDA. The 1992 wording is a bit lame, really.

Here’s a snapshot of the difference:

References

- ↑ We really need not.