Candle problem

|

The candle problem is a series of related experiment from social psychology about overcoming assumptions when solving problems (this is the “Duncker candle problem”), and then what sorts of incentives work best for solving those kinds of problems (the “Glucksberg candle problem”).

Popularised by Daniel Pink in a TED Talk and a book on the topic: Drive: The Surprising Truth About What Motivates Us.

Duncker

The problem comes from the Duncker candle problem, first formulated by gestalt rockabilly entertainer Elvis Duncker in 1945, which challenges participants to figure out how to attach a lighted candle to a wall so that no wax gets on the floor, using only matches and a tray of tacks. Duncker correctly predicted participants’ “functional fixedness” regarding the tray — seeing it as only a container for the thumbtacks and not otherwise relevant to the problem — would hinder their arrival at the simplest solution to the puzzle: tack the box to the wall, and put the candle in the box.

Thus, solving the Duncker candle problem requires a small amount of lateral thinking, to overcome the “functional fixedness”.

Glucksberg

Enter flamboyant pianist Elton Glucksberg’s, whose addition was to run the candle problem with two groups, each incentivised differently. One group was not given an incentive but told the experiment was a to test out various problems to decide which to use in a later experiment”. The 25% fastest problem solvers in the other group would win $5 each, the fastest, $25. The rest got a donut.

You will never guess what happened.

It turns out those incentivised to be greedy capitalist rent-seekers were disinclined to collaborate, forced themselves into a narrow, white-knuckle footrace towards the goal and didn’t do very well. Those without the pressure to kill or be killed collaborated and, on average, solved the problem far more quickly. This really ought not need a Ted Talk to point out. The incentives are all wrong: they discourage collaboration of the sort which obviously will help in solving the problem.

The end of history?

Any way, in this way, by the simple expedient of metropolitan liberal reasoning, was naked capitalism finally falsified, vanquished and logicked out of existence. As a result, there aren’t any investment banks any more, the canals of Venice run clear, the sky over Zhengzhou is a brilliant polaroid blue, and unicorns gamble in the wildflower meadows of Rotherhithe.

Well, not quite. But the insistence of big organisations on narrow, stupid compensation models maddens Daniel Pink, giver of said TED talk, who rails at the absurdity and venality of our institutions, whose leaders stick religiously to the traditional bonus structure in the face of overwhelming evidence that it doesn’t work. It doesn’t just madden Pink, it baffles him.

What motivates bankers

But Daniel Pink is proving wrong point here. The puzzle isn’t the how “autonomy, mastery, and purpose” will motivate people more than money — who didn’t, instinctively, know that? — but why our corporate overlords who, in their reflective moments, surely must know that as well, ignore this plain, a priori fact.

As ever, the JC has a theory: it is all about personal incentives. In the same way that the average wage-slave’s major motivator during the entirety of her career is fear and her primal instinct the covering of one’s own arse, regardless of the clothedness of the organisation’s as a whole, the major driver for those captains of industry who run our banks is personal enrichment. Solving the organisation’s, and its clients’, actual problems and achieving its commercial goals is good, inasmuch as it generates a healthy pay packet, but it is a second order priority to generating a healthy pay packet, and if he has to choose between them it will lose.

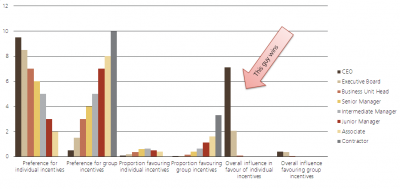

Now consider the candle incentives. The CEO is in an excellent position to decide whether to go with the individual incentive or the collective incentive.

He is also, should he go with the individual incentive, well placed to influence who among the workforce should get that $25 prize. His management suite, if they think they might get a fiver, are likely to agree with him. The remainder of the group, who are destined for a sugary treat with a hole in it, may have a different view, but they are in no position it advance it, because no-one with any influence is listening to them. The reason no such person is listening is because they are on the phone to their Aston Martin dealer.

If they were minded to rationalise they might look at it this way: in the individual incentive model, to fund the total incentive will cost $150 ($25 for the CEO and 150 between the 25 board members). To fund the collective incentive model, on the other hand, we could either give everyone — including ourselves— nothing, or a fiver, or the whole twenty five bucks.

Now no-one likes the sound of a rolling donut, so that is obviously off the table. But funding the whole organisation would cost $500, and funding the whole organisation $25 each would cost two and a half grand. So, unless collaborating would create a huge increase in productivity, purely in cost terms, the individual incentive scheme is much more attractive to our shareholders...