Bitcoin

|

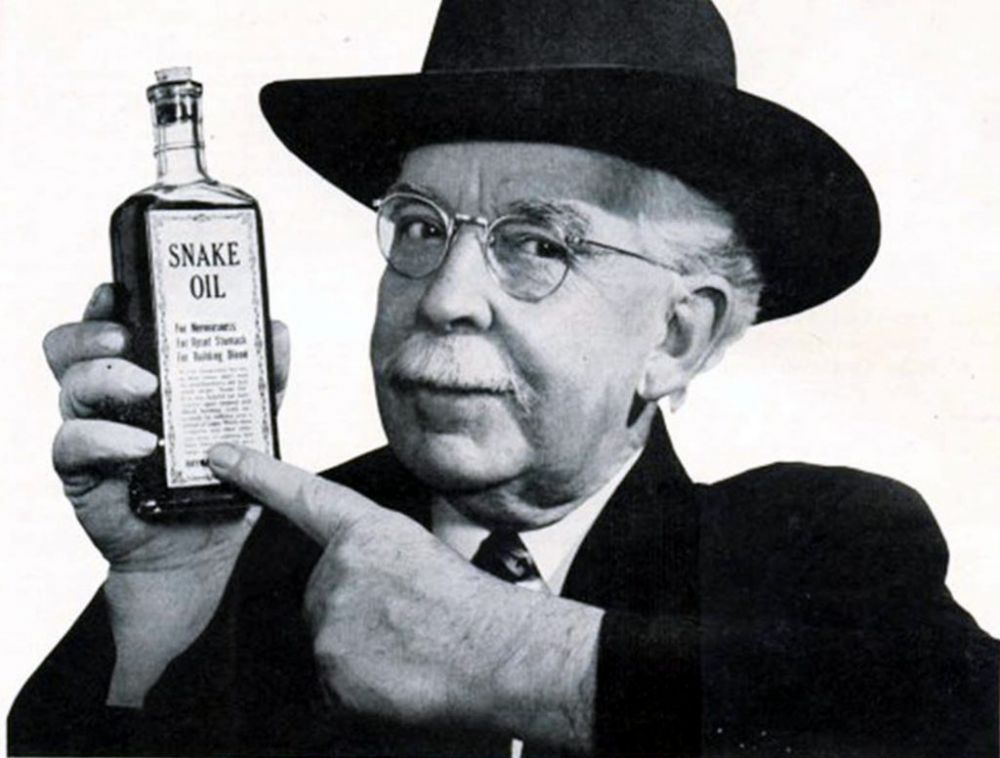

The JC’s crypto-dyscomium™

|

Don’t. Just don’t.

Bitcoin isn’t a currency

Cash, as you’ll know if you’ve had the pleasure of the JC’s frequent tedious perorations on the subject, is a special, elusive thing. It is the foundational fabric of trust in the financial system — the leap of intellectual faith that all merchants make, that their goats, or furnishings, or hovercraft, can be fully and equally represented in economic terms by a thing of vanishingly immaterial aspect[1] — printed paper, small items of minted copper, electronic impulses on a ledger — such that one can attend a market without the messy business of barter or other exchange of articulated things. A currency is a kind of derivative: an articulation of abstract, distilled value. All other things being equal, if you accept a florin for a bushel of your wheat, you can expect to give that same florin to someone else for an equivalent bushel of their wheat. Thus, one needs a consensual trust in your token of value — that it really is worth something now, that it will be worth that same amount tomorrow, and that any other merchant you might find in the market tomorrow will share your opinion.

It is quite a leap of faith but, without it, the massively multiplayer online role-playing game of iterated prisoner’s dilemma we know as the free market would have blown up when the first rascal defected on the first trade on the first day of trading. Instead, we can survey the Pyramids of Giza, the Jacquard loom, the symphonies of Beethoven, internal combustion engine and the collateralised debt obligation and marvel at the riches this conjuring trick of our forebears have showered on Planet Earth.

To be sure, “fiat” currencies — to “coiners”, that is a term of abuse, not endearment — have a rock in their pocket to encourage that leap of faith: their backing by the sovereign political authority in the place where the currency is exchanged: the agency with the practical power to tax, and which accepts the currency as unconditional payment of due taxes, and having the power to enforce contracts denominated in that currency by compulsion of payment therein, on pain of surrender of the equivalent value of real assets (goats, rental properties, hovercraft) to settle that payment. We are motivated by the machinery of the state to see the value in its currency.

Currencies do fluctuate in value, of course — the theory being these reflect the changing values of underlying goods, and economies, rather than the currency itself, but an element of that is clearly tied up with the performance and activity of the central bank which has issued it. Each has supreme executive power, bounded only by the awesome power of the market. A bank which prints too much money risks inflation — in essence, the systematic devaluation of its mandated token of exchange. Should this get out of control the currency itself, and the state which issues it, may not be long for this world.

It isn’t an asset

See also

References

- ↑ Want to go deeper? There’s an analogue between the separation of cash’s value from its substrate, and the final separation of information from its substrate.