Bitcoin

|

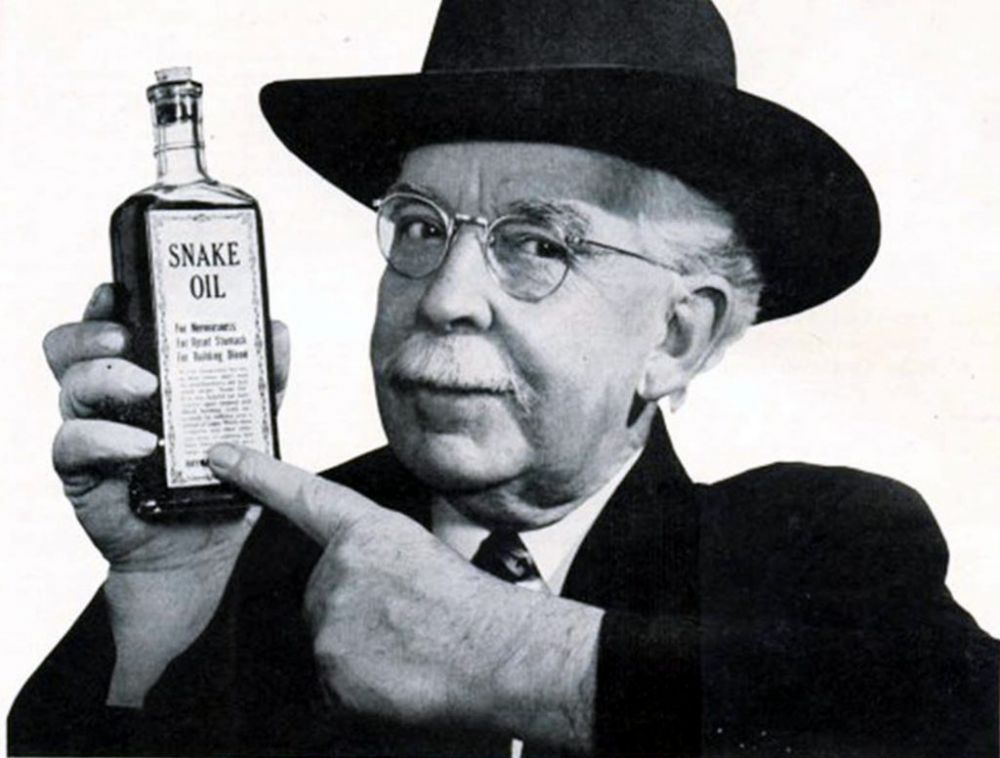

The JC’s crypto-dyscomium™

|

Don’t. Just don’t.

Bitcoin isn’t a currency

Cash, as you’ll know if you’ve had the pleasure of the JC’s frequent tedious perorations on the subject, is a special, elusive thing. It is the foundational fabric of trust in the financial system — the leap of intellectual faith that all merchants make, that their goats, or furnishings, or hovercraft, can be fully and equally represented in economic terms by a thing of vanishingly immaterial aspect[1] — printed paper, small items of minted copper, electronic impulses on a ledger — such that one can attend a market without the messy business of barter or other exchange of articulated things. A currency is a kind of derivative: an articulation of abstract, distilled value. All other things being equal, if you accept a florin for a bushel of your wheat, you can expect to give that same florin to someone else for an equivalent bushel of their wheat. Thus, one needs a consensual trust in your token of value — that it really is worth something now, that it will be worth that same amount tomorrow, and that any other merchant you might find in the market tomorrow will share your opinion.

It is quite a leap of faith but, without it, the massively multiplayer online role-playing game of iterated prisoner’s dilemma we know as the free market would have blown up when the first rascal defected on the first trade on the first day of trading. Instead, we can survey the Pyramids of Giza, the Jacquard loom, the symphonies of Beethoven, internal combustion engine and the collateralised debt obligation and marvel at the riches this conjuring trick of our forebears have showered on Planet Earth.

To be sure, “fiat” currencies — to “coiners”, that is a term of abuse, not endearment — have a rock in their pocket to encourage that leap of faith: their backing by the sovereign political authority in the place where the currency is exchanged: the agency with the practical power to tax, and which accepts the currency as unconditional payment of due taxes, and having the power to enforce contracts denominated in that currency by compulsion of payment therein, on pain of surrender of the equivalent value of real assets (goats, rental properties, hovercraft) to settle that payment. We are motivated by the machinery of the state to see the value in its currency.

Currencies do fluctuate in value, of course — the theory being these reflect the changing values of underlying goods, and economies, rather than the currency itself, but an element of that is clearly tied up with the performance and activity of the central bank which has issued it. Each has supreme executive power, bounded only by the awesome power of the market. A bank which prints too much money risks inflation — in essence, the systematic devaluation of its mandated token of exchange. Should this get out of control the currency itself, and the state which issues it, may not be long for this world.

There was once a time where, nominally, a banknote was a receipt for something, albeit a something — gold — that was itself an abstract store of value with little intrinsic value. Gold has many of the features of a currency: it is transportable, small (if heavy), it doesn’t go off and, for all the alchemist’s best efforts over the centuries you can’t manufacture it, and, there is a limited supply of the stuff. Unlike money you can go and find more of the stuff, but it's hard. The value of gold is relatively stable — that’s what’s so good about it — and where the cost of finding a troy ounce of gold, exceeds the present value of a troy ounce of gold, people stop mining gold.

But gold, and fiat currencies, have something else that set them apart: a history in which they gradually evolved into stores of value. Money was not created overnight, out of thin air, at the whim of some anonymous brainbox publishing a white paper. It was not released fully formed onto an unsuspecting world, creating instant gazillionaires of the people who were smart — or lucky — enough to hoard it while the going was good and it was cheap. No-one invented it. Money evolved. You can, and anthropologists do, argue about the emergence of indebtedness , and markets and the significance — or even existence — of barter[2] but it is hard to credit that money arise other than gradually over centuries, as a token representing the worth of a given merchant’s assets. It naturally accrued to people according to their existing wealth. There was no gold rush — another drawback, literally, of gold — and it did not upset the mercantile order. It may well have supercharged it — you can see how a common, imperishable token reliably reflecting the perceived value of tradable goods and services in a community enabled merchants to optimise and finance their businesses — which would obviate the practical drawbacks of barter — but these arose through application and deployment of money not just by sitting on it. Typically a store of value that you just sit on depreciates — it is a dead weight. (To bank your own cash is not to sit on it: it is to lend it to a bank).

Creating a transferrable token which people could use to represent their indebtedness and creditworthiness — their worth — to each other turned out to be a good evolutionary trick.

It is worth running the thought experiment: how would the creator of a brand new currency, from scratch (not one issued to replace an existing currency), solve that initial problem of making the currency worth something?

What is a newborn currency’s initial, pre allocation, un-backed value? Necessarily, zero. It is pre-printed, so it doesn't even have value as paper. This is why you can't buy groceries with Monopoly money.[3]

How would you move beyond that initial nil value? How would you persuade a merchant to give you something for a piece of paper with no intrinsic value? How would you allocate that new token to participants in the market other than by exchange, and who will knowingly exchange an goat, a bushel or a butt of marmsey for a token you know to be worth zero? How to bootstrap nothing into something, that can then be used to stably store and exchange value?

Asset

At this point we might sharply contrast money with an asset. Money has nothing behind it: it its idealised form it is ageless, timeless, stable articulation of abstract value. It is fully transferable and utterly inert. If anyone who holds it

It isn’t an asset

See also

References

- ↑ Want to go deeper? There’s an analogue between the separation of cash’s value from its substrate, and the final separation of information from its substrate.

- ↑ David Graeber’s magnificent Debt: The First 5000 Years is very good on this.

- ↑ But you can buy Mayfair, or your way out of jail.