Contracts (Rights of Third Parties) Act 1999: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{a|negotiation|}}It is now lost in the mists of time, but once upon a time there must have been a reason why the international capital markets were so collectively hostile to the [[Contracts (Rights of Third Parties) Act 1999]], a small piece of well-intended legislation which allowed contractual | {{a|negotiation| | ||

[[File:Third man.jpg|450px|thumb|center|Why the hostility towards third parties, [[counsellor]]? What did they ever to do you?]] | |||

}}It is now lost in the mists of time, but once upon a time there must have been a reason why lawyers of the international capital markets were so collectively hostile to the [[Contracts (Rights of Third Parties) Act 1999]], a small piece of well-intended legislation which allowed contractual parties to agree that persons benefiting from their contract, but who were not parties to it (and therefore did not have “[[privity of contract]]” required by the [[common law]]), might, upon a breach, be allowed to sue directly to recover their loss. | |||

Who could object to that? | |||

Well, the community of English lawyers did, most likely, through its instinctive, huffy, reactionary petulance — perhaps understandable in 1999 but, ladies and gentlemen, come on: haven't we grown out of that now? | |||

Nonetheless, the great canon of capital markets [[boilerplate]] is shot through with hostility to this poor act. There's Para 27.10 of the {{gmsla}} for example: the very last paragraph, when all else is said and done, they knife the poor [[CRTPA]] just when, perhaps, it thought it had got away with it. | Nonetheless, the great canon of capital markets [[boilerplate]] is shot through with hostility to this poor act. There's Para 27.10 of the {{gmsla}} for example: the very last paragraph, when all else is said and done, they knife the poor [[CRTPA]] just when, perhaps, it thought it had got away with it. | ||

It seems to [[Jolly Contrarian|your correspondent]] the [[CRTPA]] has its | It seems to [[Jolly Contrarian|your correspondent]] the [[CRTPA]] has its uses. To a careful user of the English language — and is there a carefuller one than a member of the worshipful company of solicitors? — it really ought not present much risk. And there are cases where it might be interesting: | ||

*{{casenote|Secure Capital|Credit Suisse}} [2017] EWCA Civ 1486: A [[bearer security]] held as a global note by a [[common depositary]] on behalf of clearing systems which has a CRTPA provision excludes the right of the end noteholder (in the clearing systems) to sue the issuer. Held: end noteholder could not pursue the issuer directly. | *{{casenote|Secure Capital|Credit Suisse}} [2017] EWCA Civ 1486: A [[bearer security]] held as a global note by a [[common depositary]] on behalf of clearing systems which has a CRTPA provision excludes the right of the end noteholder (in the clearing systems) to sue the issuer. Held: end noteholder could not pursue the issuer directly. | ||

*{{casenote|Chudley|Clydesdale Bank plc}} — a classic case where the CRTPA delivers a sound result where the [[common law]] of {{t|contract}} fails to. | *{{casenote|Chudley|Clydesdale Bank plc}} — a classic case where the CRTPA delivers a sound result where the [[common law]] of {{t|contract}} fails to. | ||

{{ | {{sa}} | ||

*[[Privity of contract]] | *[[Privity of contract]] | ||

{{egg}}{{draft}} | {{egg}}{{draft}} | ||

{{ref}} | {{ref}} | ||

Revision as of 11:17, 6 December 2019

|

Negotiation Anatomy™

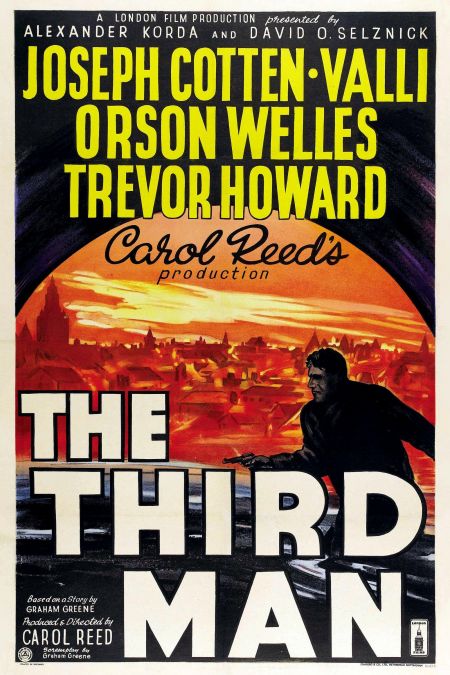

Why the hostility towards third parties, counsellor? What did they ever to do you?

|

It is now lost in the mists of time, but once upon a time there must have been a reason why lawyers of the international capital markets were so collectively hostile to the Contracts (Rights of Third Parties) Act 1999, a small piece of well-intended legislation which allowed contractual parties to agree that persons benefiting from their contract, but who were not parties to it (and therefore did not have “privity of contract” required by the common law), might, upon a breach, be allowed to sue directly to recover their loss.

Who could object to that?

Well, the community of English lawyers did, most likely, through its instinctive, huffy, reactionary petulance — perhaps understandable in 1999 but, ladies and gentlemen, come on: haven't we grown out of that now?

Nonetheless, the great canon of capital markets boilerplate is shot through with hostility to this poor act. There's Para 27.10 of the 2010 GMSLA for example: the very last paragraph, when all else is said and done, they knife the poor CRTPA just when, perhaps, it thought it had got away with it.

It seems to your correspondent the CRTPA has its uses. To a careful user of the English language — and is there a carefuller one than a member of the worshipful company of solicitors? — it really ought not present much risk. And there are cases where it might be interesting:

- Secure Capital v Credit Suisse [2017] EWCA Civ 1486: A bearer security held as a global note by a common depositary on behalf of clearing systems which has a CRTPA provision excludes the right of the end noteholder (in the clearing systems) to sue the issuer. Held: end noteholder could not pursue the issuer directly.

- Chudley v Clydesdale Bank plc — a classic case where the CRTPA delivers a sound result where the common law of contract fails to.