Futures

|

Futures

/ˈfjuːʧəz/ (n.)

Derivative contracts, usually traded on exchange, obliging parties to buy or sell an underlier at a predetermined future date at a pre-agreed price on expiry, whatever the prevailing market price of the underlier may be at that time. A future, like an option, is an exchange-traded derivative. These are standardised, simple contracts: traditionally the dullest of all financial contracts — but hte process of clearing and executing them is positively Kafkaesque.

Hey-ho, the futures’s not what it used to be.

So would the last one out please turn off the lights?

Free advice

If you were thinking of embarking on a career lawyering exchange traded derivatives, here’s a tip. Become a regulatory margin specialist instead. It is[1] so much more rewarding, constructive, and fun. Yes, I know what you are thinking. Regulatory margin is not rewarding, constructive or fun. But there are thousands of people around the world engaged in doing it, and you can cry into each other’s beers, should you want to, on one of those inspiring Phase Three Initial Margin Workshop seminars that Mayer Brown run every week.

In fairness to Mayer Brown, they do actually manage to make their Initial Margin Seminar marketing videos quite funny. This is largely down to Ed Parker — one of the few people in the world who manages to see the funny side of financial services regulation. Here’s one.

If you really can’t be persuaded, here’s a a start:

http://www.futuresindustry.org/party-definitions.asp

See also

- Exchange-traded derivatives

- Futures Industry Association

- Futures and Options Association

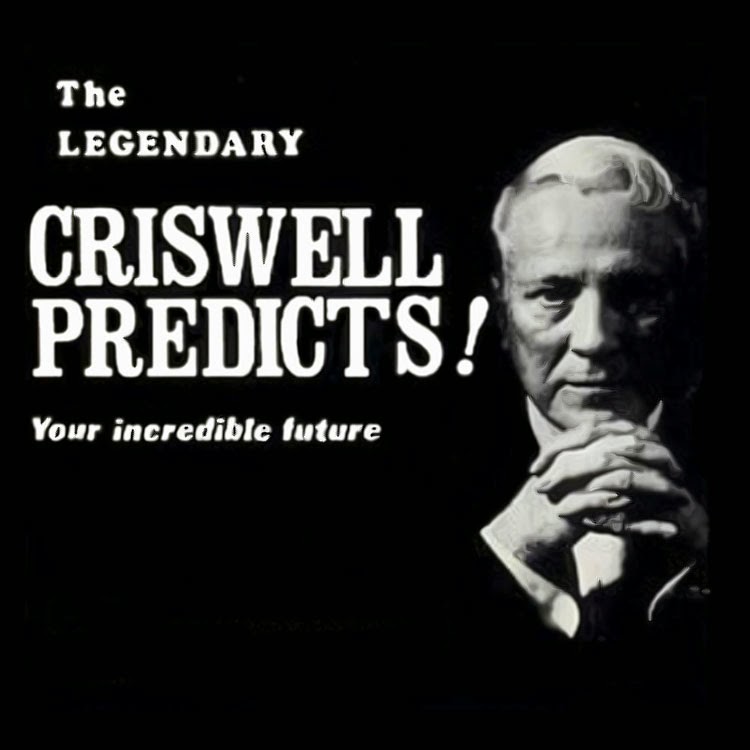

- Criswell

- Plan 9 From Outer Space

References

- ↑ (not)