Hedge fund: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 11: | Line 11: | ||

*[[Hookers]] | *[[Hookers]] | ||

{{sa | {{sa}} | ||

*[[Backtesting]] | *[[Backtesting]] | ||

*[[Greeks]] | *[[Greeks]] | ||

| Line 18: | Line 18: | ||

*[[Synthetic prime brokerage]] | *[[Synthetic prime brokerage]] | ||

{{ref}} | {{ref}} | ||

{{c|Prime brokerage}} | |||

Revision as of 18:41, 6 January 2021

|

|

Hedge fund /hɛdʒ fʌnd/ (n.)

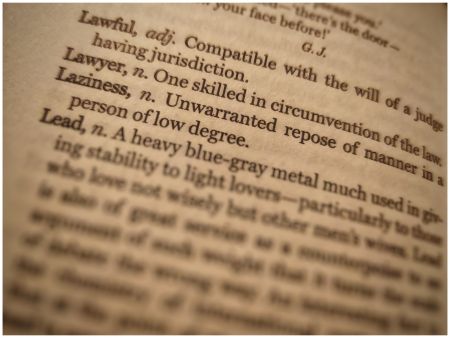

A couple of guys with a bright idea and a rented office in Mayfair. The Oxford English Dictionary says it is an “offshore investment fund, typically formed as a private limited partnership, that engages in speculation using credit or borrowed capital.”

That neglects to mention how much they charge, or that they talk a lot about alpha — even leveraged alpha — and have the back-tests to prove it — while doing a lot of vega.

Vega, by the way, is not a drug.[1] In fairness, in speaking of credit and borrowed capital, it does nod in Vega’s direction.

Hedge funds hang out with

See also

References

- ↑ OR IS IT? For those pursuing yield return, the lure of leverage can be a little addictive, which may or may not be a plot point in Hunter Barkley’s forthcoming novel The ISDA Protocol.