Margin lending: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 8: | Line 8: | ||

I must pay you [[initial margin]] as cover should the value of my new asset decline against repayment value of the outstanding margin loan. | I must pay you [[initial margin]] as cover should the value of my new asset decline against repayment value of the outstanding margin loan. | ||

===The life cycle of a [[margin loan]]=== | |||

The steps, in order, are: | The steps, in order, are: | ||

1. '''Treasury funding''': The [[PB]] borrows from its own [[treasury department]]. Business being business, and capital charges being capital charges, this is eye-wateringly expensive for the [[prime broker]]. <br> | |||

2. '''[[Margin loan]]''': Where the client is buying shares outright'': The [[PB]] lends that money to its [[hedge fund]] client in a [[margin loan]] to the client can buy some shares. ''Where the client is taking synthetic exposure to the shares'': The [[PB]] uses the treasury funds to buy shares for its own book to hedge the [[synthetic equity swap]]. This latter case is not, technically a margin loan — it’s an equity swap — ''but the two are economically identical''. So we will treat [[equity swap]]s as [[margin loan]]s for all intents and purposes. | |||

3. ''''Share settlement''': ''For [[cash prime brokerage]]'': The client will direct the [[prime broker]] to deliver shares into its custody account with the PB in settlement of the trade. ''For [[synthetic prime brokerage]]'': The [[prime broker]] settles the shares into its own hedge account. In some markets this may happen by the mysterious process of the [[equity give-up]]. | |||

4. The PB [[reuse]]s the share. If it is a custody asset that the client bought outright it “[[rehypothecate]]s” it (takes title to it, basically). If it was a hedge to an equity swap, the broker already owned it outright. In either case the prime broker then uses the shares as [[collateral]] in a [[stock loan]] under which it borrows good-credit quality bonds that meet its treasury department’s exacting standards. It will often source these from an [[agent lender]] under an agency stock lending arrangement. Once these have settle the [[prime broker will... | |||

5. Deliver the borrowed bonds back to the treasury department in reduction of the amount it borrowed under step 1. | |||

Easy. | Easy. | ||

Revision as of 14:33, 22 January 2020

|

SFTR Anatomy™

3(10) ‘margin lending transaction’ means a transaction in which a counterparty extends credit in connection with the purchase, sale, carrying or trading of securities, but not including other loans that are secured by collateral in the form of securities; Regulation on Transparency of Securities Financing Transactions and of Reuse (2015/2365/EC (EUR Lex)), aka the securities financing transactions regulation

|

A margin lending transaction is one where one party lends money to another so it can buy or sell securities. The lender will lend up to a certain value of the securities. If the securities fall in value, the lender may ask the borrower to post margin to cover the value of the margin loan.

Usually the borrower lets the lender hold the securities as collateral for the margin loan. The borrower may also allow the lender to use those securities in the market to offset its funding costs of making the margin loan.

This is the classic prime brokerage trade. I’m a hedge fund, and I am all about Vega — the Greek that denotes leverage.[1]

How do I get my spectacular returns? Alpha Leverage, that’s how. I buy securities “on margin”. This means I buy the security, and you, dear prime broker, pay for it.

Well, strictly speaking, you lend me the funds I need so I can pay for it, but in practice, you will be settling the transaction directly with the executing broker and taking delivery of the security on my behalf, under our margin loan. That’s right: in return for lending me the money, you get to “look after” the shares for me, so you can both (i) take security over them to secure the loan, and (ii) reuse those shares — usually using them as collateral when you borrow treasuries in the stock loan market which you can give to your treasury department to offset the funding costs they charged you to to finance the margin loan you made to me in the first place.

I must pay you initial margin as cover should the value of my new asset decline against repayment value of the outstanding margin loan.

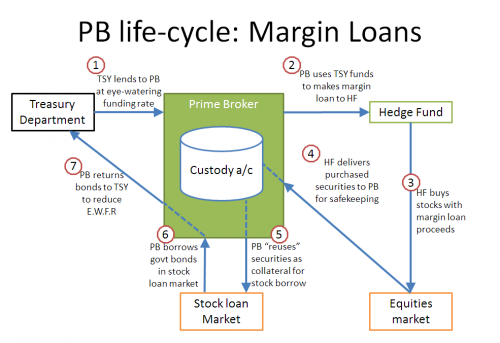

The life cycle of a margin loan

The steps, in order, are:

1. Treasury funding: The PB borrows from its own treasury department. Business being business, and capital charges being capital charges, this is eye-wateringly expensive for the prime broker.

2. Margin loan: Where the client is buying shares outright: The PB lends that money to its hedge fund client in a margin loan to the client can buy some shares. Where the client is taking synthetic exposure to the shares: The PB uses the treasury funds to buy shares for its own book to hedge the synthetic equity swap. This latter case is not, technically a margin loan — it’s an equity swap — but the two are economically identical. So we will treat equity swaps as margin loans for all intents and purposes.

3. 'Share settlement: For cash prime brokerage: The client will direct the prime broker to deliver shares into its custody account with the PB in settlement of the trade. For synthetic prime brokerage: The prime broker settles the shares into its own hedge account. In some markets this may happen by the mysterious process of the equity give-up.

4. The PB reuses the share. If it is a custody asset that the client bought outright it “rehypothecates” it (takes title to it, basically). If it was a hedge to an equity swap, the broker already owned it outright. In either case the prime broker then uses the shares as collateral in a stock loan under which it borrows good-credit quality bonds that meet its treasury department’s exacting standards. It will often source these from an agent lender under an agency stock lending arrangement. Once these have settle the [[prime broker will...

5. Deliver the borrowed bonds back to the treasury department in reduction of the amount it borrowed under step 1.

Easy.

See also

References

- ↑ “My name is Vega. I live on the second floor. I live upstairs from you. Yes, I think you’ve seen me before.” — Suzanne Luca