Normal distribution: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 9: | Line 9: | ||

{{sa}} | {{sa}} | ||

*[[Social proof]]the figures implied that it would take a so-called ten-sigma event—that is, a statistical freak occurring —for the firm to lose all of its capital within one year. | *[[Social proof]]: the figures implied that it would take a so-called ten-sigma event—that is, a statistical freak occurring —for the firm to lose all of its capital within one year. | ||

Revision as of 16:26, 23 July 2021

|

|

A Gaussian, or normal distribution of a series of events, indicates that the events are independent of each other, in that the occurrence of one does not affect the probability of another. Coin flips are independent of each other. So are rolls of a die, or the distribution of heights in a classroom. Homo sapiens being the fickle, biddable species it is, its cognitive decisions — particularly those concerning fashionable ideas, to depart quickly from crowded theatres when someone yells fire or to hysterically buy, and then sell, Enron stock for fear of missing out — are not.

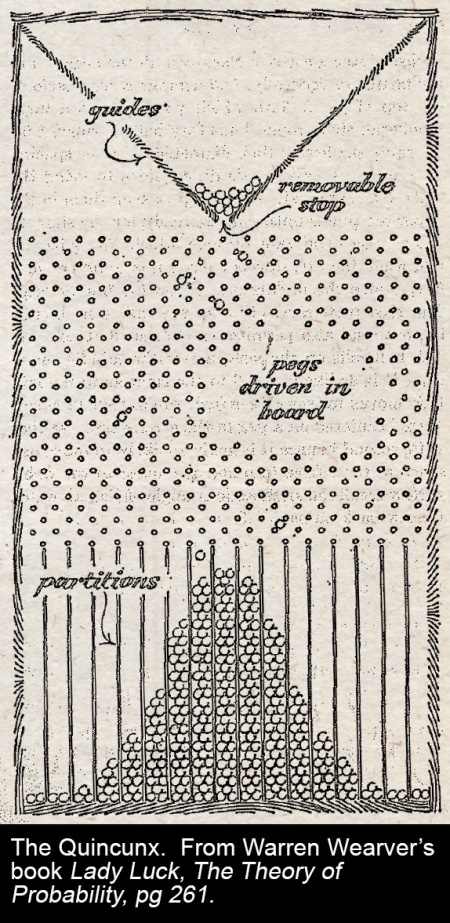

Independent events fit nicely to a bell curve, as the quincunx pictured, likes to demonstrate. Bell curves confidently prescribe standard deviations, probability intervals, and allow one the comfort to say, “the odds of x are such that one wouldn’t expect it in several lives of the universe”. When x really is an independent event (or a series of them) this is prudent enough: “the odds of flipping a coin and getting 99 consecutive heads is 0.5 x 1099, which you wouldn’t expect in several lifetimes of the universe.”

Then those “ten-sigma” events — like, ooooh, say the correlation of a Russian government default with a spike in the price of all other G20 Treasury securities, just to pick something at random — that should, in the world of normal distributions, happen only once in every 1024 times — say, ten million years — but, since investment decisions are not even remotely independent events, happened once— and only needed to happen once, to blow Long Term Capital Management and much of the market to smithereens — in four years.

See also

- Social proof: the figures implied that it would take a so-called ten-sigma event—that is, a statistical freak occurring —for the firm to lose all of its capital within one year.