Account control agreement: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 3: | Line 3: | ||

|[[File:Triparty Diagram.png|center|450px]]}}Also known as a [[tri-party collateral arrangement]]; an arrangement wherein a debtor [[pledge]]s collateral to a [[custodian]] to hold it for that [[pledgor]], but subject to a security in favour of a [[pledgee]]. The agreement generally provides that neither party may instruct the custodian to do anything with the asset without the other's consent, except in the direst of circumstances. | |[[File:Triparty Diagram.png|center|450px]]}}Also known as a [[tri-party collateral arrangement]]; an arrangement wherein a debtor [[pledge]]s collateral to a [[custodian]] to hold it for that [[pledgor]], but subject to a security in favour of a [[pledgee]]. The agreement generally provides that neither party may instruct the custodian to do anything with the asset without the other's consent, except in the direst of circumstances. | ||

===[[ | ==[[Indemnity]] corner== | ||

{{joint and several indemnity}} | ===[[Joint and several]] [[indemnity]]=== | ||

{{joint and several indemnity capsule}} | |||

===Indemnity before action=== | ===Indemnity before action=== | ||

Even in those dark days the custodian will be reluctant to do anything and may ask for an | Even in those dark days the custodian will be reluctant to do anything and may ask for an [[indemnity]]. Why would you indemnify the [[Custodian]] for actions it takes under an [[account control agreement]]? | ||

The logic runs something like this: | The logic runs something like this: | ||

Latest revision as of 11:46, 13 August 2024

|

A word about credit risk mitigation

|

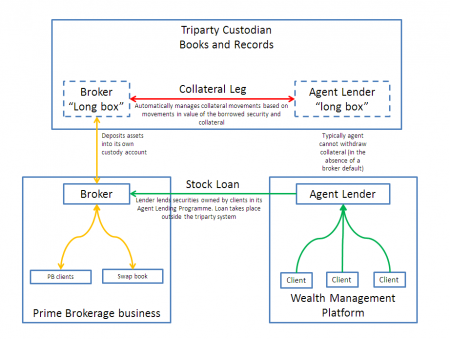

Also known as a tri-party collateral arrangement; an arrangement wherein a debtor pledges collateral to a custodian to hold it for that pledgor, but subject to a security in favour of a pledgee. The agreement generally provides that neither party may instruct the custodian to do anything with the asset without the other's consent, except in the direst of circumstances.

Indemnity corner

Joint and several indemnity

As do all custodians, a custodian acting as an independent third party holding collateral on behalf of counterparties to a master agreement of some kind — think an IM custodian or a triparty custodian — will be hot on the topic of indemnities. It will want one from both pledgor and pledgee, and it will ask them to accept joint and several liabilities for claims it sustains acting in good faith in its role.

Cue negotiation oubliette onslaught.

Two are standard custody indemnities that, in a bilateral custody arrangement, we would accept without question. Only one is specific to escrow arrangements, and I don’t see it presents any “contribution” risk at all.

Standard bilateral custody indemnities

Taxes imposed on assets: Be they:

- Expected taxes and those unexpectedly imposed on assets while still held in escrow: these, being of course the vast preponderance of likely tax claims, would naturally be withheld out of distributions to the beneficial owner under the withholding tax provision (i.e. without reference to this joint indemnity)

- Unexpected taxes imposed retrospectively and after disposal of the assets'. Here we would still expect the custodian to claim from the beneficial owner in the first case (don’t forget innocent parties will have a commercial relationship which it will endeavour to flex to persuade the custodian to go after the right rascal), with the indemnity as a fallback if the right rascal was insolvent or not in funds, or refused to pay. we adjudge retrospective imposition of taxes on innocent but wealthy triparty agents a somewhat remote contingency

Litigation by third parties: This is a truly distant risk – we think a holdover from the time when securities were certificated things that could be bodily stolen and squirrelled away in offshore accounts. Here the custodian says, “if some random sues me for appropriating its asset, and it’s an asset one of you guys gave me, then you are indemnifying me for that. Since there are two of you, you both are”.

But stealing dematerialised book-entry certificates, is hard, and tracing them through to a custodian is also hard. Again, the innocent party would use its relationship to persuade the custodian to claim first against malfeasor, with the fall back to itself only as a last resort.

Special tri-party indemnity risks

Litigation claims between the parties to the collateral arrangement: this is the key one for tri-party arrangements. The people most likely to be angry with each other about assets held by a triparty custodian are, by miles, the pledgor and pledgee themselves. You can easily see each being furious that the custodian has acted on the other’s instructions in a stress scenario and caused loss. You can also easily see them having a go at the custodian as a nearby deep-pocketed bystander. So, the custodian says, “ok, to head off that scenario, why don’t both of you guys indemnify me, jointly and severally”. This is like a cloak of Mithril: a sort of “right back at ya” move. It enables the custodian to recuse itself from litigation, striking out the claim, by establishing on the face of the documents that whoever is liable for the loss, it is not the custodian. Therefore, it refocuses the dispute where it should be, between pledgor and pledgee.

Indemnity before action

Even in those dark days the custodian will be reluctant to do anything and may ask for an indemnity. Why would you indemnify the Custodian for actions it takes under an account control agreement?

The logic runs something like this:

- Custodian is in the middle. It has no skin in the game.

- If there’s an enforcement event and Pledgee wants to take control of the collateral:

- If Pledgee instructs Custodian wrongly then:

- If Pledgor loses any money as a result:

- Doubtful Custodian has a contractual breach claim against Pledgee, because it was complicit in the breach. Therefore:

- Pledgee can control the liability under the indemnity easily:

- Don’t take control of the collateral when it is not entitled to

- The liability is in any case determinate – it is the contractual damages that the Pledgor can claim from Custodian as a result.

- Assuming Pledgee doesn’t go bust, Pledgee can return the collateral and maybe suffer some buy in costs but that’s realistically it.

- Pledgee would have exactly the same liability if it held the collateral itself as Custodian and didn’t return it when Pledgor was entitled to it.