Agency problem: Difference between revisions

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit |

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit Advanced mobile edit |

||

| (16 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

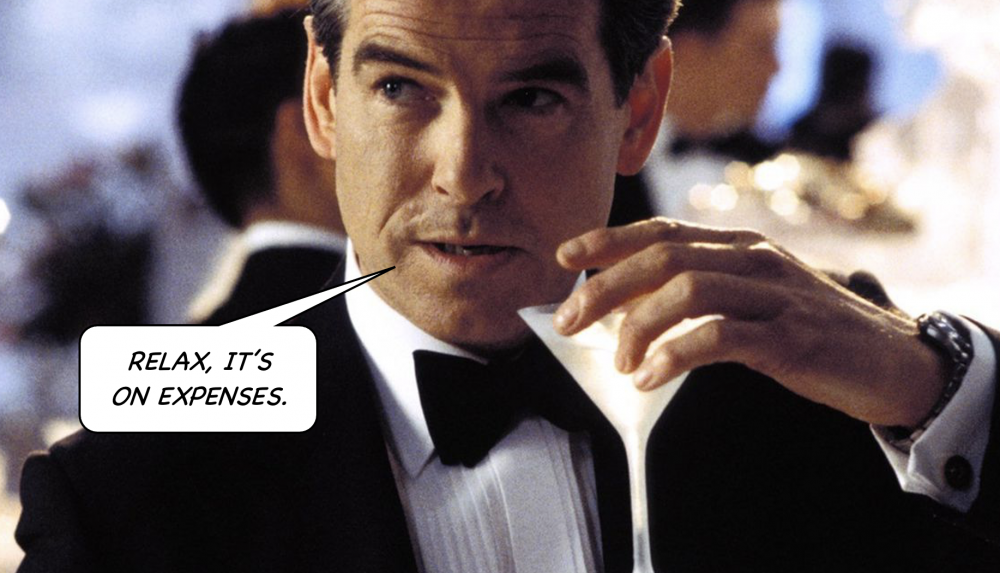

{{a|design| | {{a|design| {{image|Secret agent problem|png|A special agent’s problem, yesterday}}}}{{qd|Agency problem|/ˈeɪʤənsi ˈprɒbləm /|n|The intrinsic [[conflict of interest]] any [[agent]] faces that, as long as it gets its [[commission]], it doesn’t really care a hill of beans what its [[principal]] gets, however much it might protest to the contrary. }} | ||

{{ | {{Drop|B|eing little more}} than an illustration of the [[prisoner’s dilemma]], the agency problem shouldn’t surprise anyone. It ''should'' be cured where the agency has a repetitive, undated nature:<ref>In which case the game is an [[Iterated prisoner’s dilemma|“iterated” prisoner’s dilemma]].</ref> clients have long memories and will remember when you rip them off. | ||

But the [[prisoner’s dilemma]] has some natural limits: one is that it relies on repeated interactions with no, or least an indeterminate, end-point: the promise of another opportunity, on another day, to clip her ticket keeps an agent, literally, honest. Until the sky is falling on her head, whereupon it is a final interaction and the calculus is different. It is a regrettable, but inevitable, fact that agents behave differently at the [[end of days]]. Anyone who has been through the [[global financial crisis]] will surely remember that. | |||

Second, it takes no account of “[[convexity]]” effects that can arise: I can build up my reputation as a good agent incrementally, faithfully carrying out thousands of ''small'' transactions, in which it doesn’t make much odds whether I am a [[good egg]] or not. I can thereby ''appear'' to be a five-star collaborator, only to whip away the rug on the first big transaction. | |||

I can faithfully deliver ten thousand ball-point pens for which you paid in advance, but run off with the money the one you are buying a Ferrari. | |||

When that one outsized | When that one outsized “defection” drowns out all the penny-sized collaborations, an iterated game of [[prisoner’s dilemma]] behaves like a [[single round prisoner’s dilemma|single round]] game. There, the rusk payoff is markedly different.<ref>This is what {{author|Nassim Nicholas Taleb}} calls the “Rubin Trade”.</ref> | ||

The agency problem is the classic “[[skin in the game]]” problem: an agent gets paid, ''no matter what''. The [[investment manager]] puts no capital up, takes a small slice of ''yours'', by way of a fee, ''no matter what''. | |||

Nice work if you can get it. A lot of people in the city can get it. | Nice work if you can get it. A lot of people in the city can get it. | ||

===The agency problem and | ====The agency problem and corporate personality==== | ||

{{drop|T|his tension between}} the overriding life goals of an [[agent]] and her [[principal]]’s is the crux of the problem. Their interests do align — but ''only so far''. | |||

All the more so when the principal is a corporation. It is easy to assume it is the ''[[corporation]]’s'' interests that drive the market. | |||

So legal theory has it: a corporation is a person with its own [[Legal personality|personality]], interests and desires. But the corporation as a “[[res legis]]” — a [[legally significant thing|''legal'' thing]] — is only a “[[Res cogitans|''thinking'' thing]]” through the agency of its personnel, each of whom is a [[res cogitans|thinking thing]] in her own right. | |||

The critical difference is that a [[corporation]] cannot speak, or think, for itself. A ''human'' principal can apprehend the [[conflicts of interest]] of which she may be a casualty, and police them. A pile of papers filed at companies house cannot. It can only ''crowd-source'' the defence of its interests to its “friends” who ''are'' animate, but who have interests of their own. It can seek to nullify any ''one'' agent’s conflicting interest by asking the aggregated weight of its ''other'' agents to represent its against that one agent, in a kind of “wisdom of crowds” way — as if their ''individual'' interests will disappear through a sort of phase cancellation effect to which their ''common'' interest — furthering the interest of their mutual principal the [[corporation]] — is immune. | |||

This works as long as the self-interests of each of the other agents ''do'' cancel themselves out: if all the agents have a ''common'' self-interest which conflicts with the corporation’s, crowdsourcing won’t work. | |||

=== | ====Common conflicting interests==== | ||

{{Drop|S|o do ''all''}} its agents have such a common conflicting interest? ''Yes''. | |||

Any one of its agents is charged with protecting the principal’s interests, but two overriding considerations will inevitably take priority: (i) their wish to protect and perpetuate their own role ''as'' agent, and its accompanying income stream — their need to ''persuade the principal that their role is needed'' whether or not it ''is'' needed — no turkey votes for Christmas; and (ii) their wish to not ''fuck up'' — to demonstrate that not only is the role necessary but ''I am the best person to carry out that role''. | |||

=== | ====Scale==== | ||

Another “tell” is for the size of money at stake to be so large that even a legal bill in the tens of millions will amount to a rounding error. | |||

So, to take our three examples: | |||

=====Advisory M&A, DCM, ECM etc.===== | |||

The business of advising on [[mergers and acquisitions]] and primary transactions in the [[debt capital markets|debt]] and [[equity capital markets]] is generally handled on behalf of target and acquiror by appointed [[investment banks]]. | |||

Each bank will appoint its own law firm to advise ''it'' — the target will have its own independent counsel too — principally on the underwriting, regulatory and reputational risks posed by just being involved. The bank’s legal advisors will conduct due diligence, negotiate contracts, shareholders agreements, draft prospectuses, advise on all kinds of competition issues that may arise, and will issue batteries of [[legal opinion]]s — enforceability opinions, [[true sale opinion]]s, fairness opinions, security opinions, [[10b5 opinion]]s — you name it — all of which are designed to give the [[arranger]] and it's syndicate — the ''banks'' — comfort that ''their'' risk of shareholder action or regulatory censure is minimal. | |||

Who pays for all this legal advice? The bank’s ''client'', of course. This, on top of the underwriting fee, will be raised in the first blushing exchanges of the [[engagement letter]]. | |||

Once the client has agreed to this — it will have no choice — the bank’s internal lawyers have little incentive, beyond basic compassion for defenceless multinationals, to constrain their legal spend, and will allow themselves to descend every open manhole that any deal lawyer can contrive to fall into. | |||

Inhouse advisory teams are often exempt, what’s more, from the usual internal audit rubber glove inspection — requiring competitive tenders, law firm panels, methodological justifications for even talking to lawyers — that follow requests from other parts of the legal department to incur “own legal spend”, even in nugatory amounts, because “the bank isn’t paying for it, so why get bent out of shape about it?” | |||

=====Litigation===== | |||

The sorts of litigation banks get into tend to involve claims of art least hundreds of millions of pounds, and typically banks are on the wrong end of them — it is an unusual investment bank that makes a habit of suing its own, solvent clients — meaning that, unless it is prepared to just admit everything and pay up— this happens a lot more than you would think, thanks to an inverted instance of the agency problem — the bank has little control of the process. Unlike a commercial transaction, there is no critical path, since you don't know how the other side will play, so it is hard to fix or even estimate fees, so “[[time and attendance]]” tend to be the order of the day. | |||

Anyone who has contemplated litigation — if you’ve ever done a loft conversion, that probably includes you — will know how dismal the experience of seeking legal redress through courts can be. Many phases of civil litigation — pleadings, discovery, interlocutories, counterclaims, requests for further and better particulars, witness statements — are time-sinks that exist only for lawyers to spin each others’ wheels, at their respective clients’ expense — and the result is to render ''any'' litigation | |||

futile for a claim not expressed in tens of millions — since the cost of pursuing the claim will outstrip any conceivable dividend of success. | |||

Above that threshold, this no longer holds: there is a hazy interregnum where lawyers know they can be paid handsomely, indefinitely, for carrying on an argument that most likely will never get to court, let alone final adjudication. | |||

JC does not claim this as an original observation, by the way: this is, after all, the premise of {{br|Bleak House}}. | |||

''Plus ça change''. | |||

=====Service providers===== | |||

Especially where you are dealing with investment banks as corporate service providers, you may see this sort of clause: | |||

{{quote|''The Agent may seek and rely upon the advice of professional advisers in relation to matters of law, regulation or market practice, and shall not be deemed to have been [[negligent]] or in [[breach of contract]] with respect to any action it takes [[pursuant to]] such advice.''}} | |||

The airily-advanced explanation is “look, we don’t make much money from this, and we haven’t got [[skin in the game]], so we don’t want to find ourselves facing a claim when we have done the diligent thing and sought legal advice. How can we be blamed? | |||

But your bad advice should not be someone else’s client’s problem. No one is stopping the agent getting whatever advice it wants, on its own dime, and at its own risk. It’s a free country. And no one is stopping the agent ''relying'' on whatever advice it gets. That it did get advice may even be (weak) evidence that it diligently discharged its duty and wasn’t, factually, at fault. | |||

But if the advice turns out to be wrong and the agent can disclaim its own liability, then the lawyers it instructed — for whom the client is probably paying — don’t acquire any liability in the first place. ''But that’s why you pay lawyers'': so they can cover the agent’s sorry arse if their advice turns out to be wrong and their client — you, kind sir — goes on the warpath. | |||

====Legal industry transformation and the agency problem==== | |||

{{Drop|A|ny plan to}} revolutionise the legal industry that does not account for the [[agency problem]] ''will fail''. | |||

Everyone who purports to speak for a corporation does so in a way that, above all else, does not prejudice her own agency with the corporation. | |||

This puts our old friend the [[drills and holes]] conundrum into perspective: it is true that a corporation desires quick, cheap and effective legal services. In many cases, it does not need ''any'' legal services ''at all'' — it could get by not just with cheaper, less fulsome legal protections, but with ''no legal protections at all''. What percentage of legal agreements are ever litigated? | |||

But it is hard for an inanimate pile of papers filed at companies registry to have that sort of insight. It relies on its ''agents'' to arrive at that conclusion on its behalf. But who, amongst the byzantine control structure that those very agents have constructed to help it make decisions of that sort — its [[inhouse counsel]], [[outhouse counsel]], credit risk management, document [[negotiators]], client [[onboarding]] team, [[compliance]] or [[internal audit]] — who of these people would ever say that? And even if one did, would {{sex|he}} not be shut down by the consensus of the others?<ref>Those who don’t believe me should try proposing that you don’t need [[cross default]] in trading agreements. You will get bilateral consensus on this, in private conversations, from almost everyone; no-one will say it in public.</ref> | |||

{{Sa}} | {{Sa}} | ||

*[[The domestication of law]] | |||

*[[Reliance on legal advice]] | |||

*[[Stakeholder capitalism]] | *[[Stakeholder capitalism]] | ||

*[[Drills and holes]] | *[[Drills and holes]] | ||

Latest revision as of 15:04, 7 September 2024

|

The design of organisations and products

|

Agency problem

/ˈeɪʤənsi ˈprɒbləm / (n.)

The intrinsic conflict of interest any agent faces that, as long as it gets its commission, it doesn’t really care a hill of beans what its principal gets, however much it might protest to the contrary.

Being little more than an illustration of the prisoner’s dilemma, the agency problem shouldn’t surprise anyone. It should be cured where the agency has a repetitive, undated nature:[1] clients have long memories and will remember when you rip them off.

But the prisoner’s dilemma has some natural limits: one is that it relies on repeated interactions with no, or least an indeterminate, end-point: the promise of another opportunity, on another day, to clip her ticket keeps an agent, literally, honest. Until the sky is falling on her head, whereupon it is a final interaction and the calculus is different. It is a regrettable, but inevitable, fact that agents behave differently at the end of days. Anyone who has been through the global financial crisis will surely remember that.

Second, it takes no account of “convexity” effects that can arise: I can build up my reputation as a good agent incrementally, faithfully carrying out thousands of small transactions, in which it doesn’t make much odds whether I am a good egg or not. I can thereby appear to be a five-star collaborator, only to whip away the rug on the first big transaction.

I can faithfully deliver ten thousand ball-point pens for which you paid in advance, but run off with the money the one you are buying a Ferrari.

When that one outsized “defection” drowns out all the penny-sized collaborations, an iterated game of prisoner’s dilemma behaves like a single round game. There, the rusk payoff is markedly different.[2]

The agency problem is the classic “skin in the game” problem: an agent gets paid, no matter what. The investment manager puts no capital up, takes a small slice of yours, by way of a fee, no matter what.

Nice work if you can get it. A lot of people in the city can get it.

The agency problem and corporate personality

This tension between the overriding life goals of an agent and her principal’s is the crux of the problem. Their interests do align — but only so far.

All the more so when the principal is a corporation. It is easy to assume it is the corporation’s interests that drive the market.

So legal theory has it: a corporation is a person with its own personality, interests and desires. But the corporation as a “res legis” — a legal thing — is only a “thinking thing” through the agency of its personnel, each of whom is a thinking thing in her own right.

The critical difference is that a corporation cannot speak, or think, for itself. A human principal can apprehend the conflicts of interest of which she may be a casualty, and police them. A pile of papers filed at companies house cannot. It can only crowd-source the defence of its interests to its “friends” who are animate, but who have interests of their own. It can seek to nullify any one agent’s conflicting interest by asking the aggregated weight of its other agents to represent its against that one agent, in a kind of “wisdom of crowds” way — as if their individual interests will disappear through a sort of phase cancellation effect to which their common interest — furthering the interest of their mutual principal the corporation — is immune.

This works as long as the self-interests of each of the other agents do cancel themselves out: if all the agents have a common self-interest which conflicts with the corporation’s, crowdsourcing won’t work.

Common conflicting interests

So do all its agents have such a common conflicting interest? Yes.

Any one of its agents is charged with protecting the principal’s interests, but two overriding considerations will inevitably take priority: (i) their wish to protect and perpetuate their own role as agent, and its accompanying income stream — their need to persuade the principal that their role is needed whether or not it is needed — no turkey votes for Christmas; and (ii) their wish to not fuck up — to demonstrate that not only is the role necessary but I am the best person to carry out that role.

Scale

Another “tell” is for the size of money at stake to be so large that even a legal bill in the tens of millions will amount to a rounding error.

So, to take our three examples:

Advisory M&A, DCM, ECM etc.

The business of advising on mergers and acquisitions and primary transactions in the debt and equity capital markets is generally handled on behalf of target and acquiror by appointed investment banks.

Each bank will appoint its own law firm to advise it — the target will have its own independent counsel too — principally on the underwriting, regulatory and reputational risks posed by just being involved. The bank’s legal advisors will conduct due diligence, negotiate contracts, shareholders agreements, draft prospectuses, advise on all kinds of competition issues that may arise, and will issue batteries of legal opinions — enforceability opinions, true sale opinions, fairness opinions, security opinions, 10b5 opinions — you name it — all of which are designed to give the arranger and it's syndicate — the banks — comfort that their risk of shareholder action or regulatory censure is minimal.

Who pays for all this legal advice? The bank’s client, of course. This, on top of the underwriting fee, will be raised in the first blushing exchanges of the engagement letter.

Once the client has agreed to this — it will have no choice — the bank’s internal lawyers have little incentive, beyond basic compassion for defenceless multinationals, to constrain their legal spend, and will allow themselves to descend every open manhole that any deal lawyer can contrive to fall into.

Inhouse advisory teams are often exempt, what’s more, from the usual internal audit rubber glove inspection — requiring competitive tenders, law firm panels, methodological justifications for even talking to lawyers — that follow requests from other parts of the legal department to incur “own legal spend”, even in nugatory amounts, because “the bank isn’t paying for it, so why get bent out of shape about it?”

Litigation

The sorts of litigation banks get into tend to involve claims of art least hundreds of millions of pounds, and typically banks are on the wrong end of them — it is an unusual investment bank that makes a habit of suing its own, solvent clients — meaning that, unless it is prepared to just admit everything and pay up— this happens a lot more than you would think, thanks to an inverted instance of the agency problem — the bank has little control of the process. Unlike a commercial transaction, there is no critical path, since you don't know how the other side will play, so it is hard to fix or even estimate fees, so “time and attendance” tend to be the order of the day.

Anyone who has contemplated litigation — if you’ve ever done a loft conversion, that probably includes you — will know how dismal the experience of seeking legal redress through courts can be. Many phases of civil litigation — pleadings, discovery, interlocutories, counterclaims, requests for further and better particulars, witness statements — are time-sinks that exist only for lawyers to spin each others’ wheels, at their respective clients’ expense — and the result is to render any litigation futile for a claim not expressed in tens of millions — since the cost of pursuing the claim will outstrip any conceivable dividend of success.

Above that threshold, this no longer holds: there is a hazy interregnum where lawyers know they can be paid handsomely, indefinitely, for carrying on an argument that most likely will never get to court, let alone final adjudication.

JC does not claim this as an original observation, by the way: this is, after all, the premise of Bleak House.

Plus ça change.

Service providers

Especially where you are dealing with investment banks as corporate service providers, you may see this sort of clause:

The Agent may seek and rely upon the advice of professional advisers in relation to matters of law, regulation or market practice, and shall not be deemed to have been negligent or in breach of contract with respect to any action it takes pursuant to such advice.

The airily-advanced explanation is “look, we don’t make much money from this, and we haven’t got skin in the game, so we don’t want to find ourselves facing a claim when we have done the diligent thing and sought legal advice. How can we be blamed?

But your bad advice should not be someone else’s client’s problem. No one is stopping the agent getting whatever advice it wants, on its own dime, and at its own risk. It’s a free country. And no one is stopping the agent relying on whatever advice it gets. That it did get advice may even be (weak) evidence that it diligently discharged its duty and wasn’t, factually, at fault.

But if the advice turns out to be wrong and the agent can disclaim its own liability, then the lawyers it instructed — for whom the client is probably paying — don’t acquire any liability in the first place. But that’s why you pay lawyers: so they can cover the agent’s sorry arse if their advice turns out to be wrong and their client — you, kind sir — goes on the warpath.

Legal industry transformation and the agency problem

Any plan to revolutionise the legal industry that does not account for the agency problem will fail.

Everyone who purports to speak for a corporation does so in a way that, above all else, does not prejudice her own agency with the corporation.

This puts our old friend the drills and holes conundrum into perspective: it is true that a corporation desires quick, cheap and effective legal services. In many cases, it does not need any legal services at all — it could get by not just with cheaper, less fulsome legal protections, but with no legal protections at all. What percentage of legal agreements are ever litigated?

But it is hard for an inanimate pile of papers filed at companies registry to have that sort of insight. It relies on its agents to arrive at that conclusion on its behalf. But who, amongst the byzantine control structure that those very agents have constructed to help it make decisions of that sort — its inhouse counsel, outhouse counsel, credit risk management, document negotiators, client onboarding team, compliance or internal audit — who of these people would ever say that? And even if one did, would he not be shut down by the consensus of the others?[3]

See also

- The domestication of law

- Reliance on legal advice

- Stakeholder capitalism

- Drills and holes

- Agency paradox

- Shift the axis of dispute

References

- ↑ In which case the game is an “iterated” prisoner’s dilemma.

- ↑ This is what Nassim Nicholas Taleb calls the “Rubin Trade”.

- ↑ Those who don’t believe me should try proposing that you don’t need cross default in trading agreements. You will get bilateral consensus on this, in private conversations, from almost everyone; no-one will say it in public.