Hedging Party - Equity Derivatives Provision: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{fullanat|eqderiv|12.9(a)(ix)|}} | {{fullanat|eqderiv|12.9(a)(ix)|}} | ||

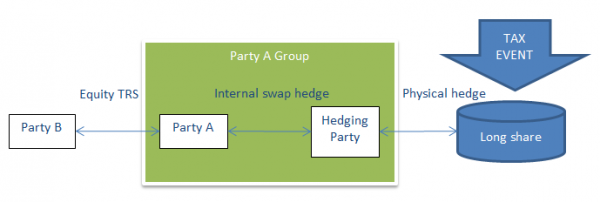

[[File:Hedging_Party.PNG| | [[File:Hedging_Party.PNG|600px|thumb|right|the conceptual confusion caused by physical hedging not being done by the counterparty in person]] | ||

Relevant in the context of {{eqderivprov|Additional Disruption Events}} and hedging disruption as the entity which is actually carrying out the hedging activity, if it isn't the party itself (where not specified, it defaults to the parties themselves. | Relevant in the context of {{eqderivprov|Additional Disruption Events}} and hedging disruption as the entity which is actually carrying out the hedging activity, if it isn't the party itself (where not specified, it defaults to the parties themselves. | ||

Revision as of 14:33, 21 August 2017

Relevant in the context of Additional Disruption Events and hedging disruption as the entity which is actually carrying out the hedging activity, if it isn't the party itself (where not specified, it defaults to the parties themselves.

In this case there will be a string of intermediate hedging contracts - usually derivatives - but these may not behave in exactly the way that a real underlier would (in terms of market disruption, tax events, liquidity etc). and what the Equity Derivatives Definitions are meant to do is pass on the risk associated with the actual underlier.

So for example in the example below Party A provide exposure to client, hedges that with a equity TRS to Hedging Party, which goes long the physical share. Now the Hedging Party, not Party A, has the risk of the physical assets. If there is a market disruption, or a tax event on the physical hedge this is reflected in the price that Hedging Party will have to pay to Party A, but it isn’t a market disruption or tax event directly on Party A itself (and in fact might not be – Party A might be domiciled in a jurisdiction benefitting from a different tax treaty with the jurisdiction of the underlier, for example). So in this case we need to reference the position as held by a person other than the counterparty to the swap.

Note also that "Non-Hedging Party" definition somewhat assumes that the Hedging Party will indeed be the actual counterparty to the Transaction.

See also

See, for example, definitions: