Limited recourse: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 18: | Line 18: | ||

But, as we shall see, sometimes [[asset manager]]s can be a malign influence, and try to further limit this. | But, as we shall see, sometimes [[asset manager]]s can be a malign influence, and try to further limit this. | ||

==Multi-issuance [[repackaging]] vehicles: secured, limited recourse== | |||

In the world of multi-issuance [[repackaging]] [[SPV]]s, [[secured, limited recourse obligation|secured limited recourse]] obligations are ''de rigueur''. They save the cost of creating a whole new vehicle for each trade, and really only do by [[contract]] what establishing a brand new [[espievie]] for each deal would do through the exigencies of corporation law and the [[corporate veil]]. That said, with [[Segregated portfolio company|segregated cell companies]], you can more or less do this, through the exigencies of the corporate veil, inside a single [[espievie]]. But I digress. | In the world of multi-issuance [[repackaging]] [[SPV]]s, [[secured, limited recourse obligation|secured limited recourse]] obligations are ''de rigueur''. They save the cost of creating a whole new vehicle for each trade, and really only do by [[contract]] what establishing a brand new [[espievie]] for each deal would do through the exigencies of corporation law and the [[corporate veil]]. That said, with [[Segregated portfolio company|segregated cell companies]], you can more or less do this, through the exigencies of the corporate veil, inside a single [[espievie]]. But I digress. | ||

| Line 28: | Line 25: | ||

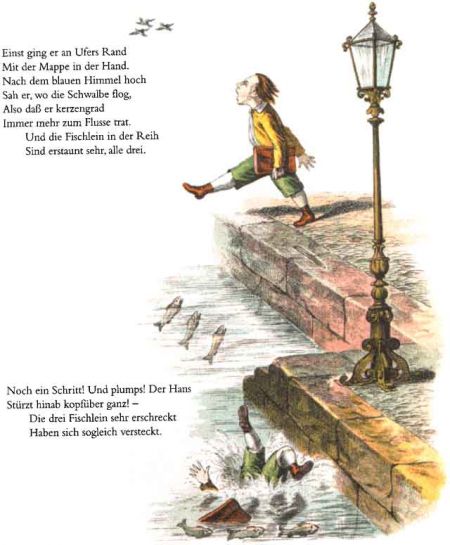

Over the years the secured, limited recourse technology has been refined and standardised, and now plays little part in the education of a modern-day structured finance lawyer, though, at his mother’s knee, he might once have been told fairy stories about what became of poor Fidgety Phillip when he carelessly put “extinction” rather than “no debt due” in a pricing supplement on his way home from school and burned to death.<ref>Come to think of it he may have forgotten to file a [[Slavenburg]].</ref> | Over the years the secured, limited recourse technology has been refined and standardised, and now plays little part in the education of a modern-day structured finance lawyer, though, at his mother’s knee, he might once have been told fairy stories about what became of poor Fidgety Phillip when he carelessly put “extinction” rather than “no debt due” in a pricing supplement on his way home from school and burned to death.<ref>Come to think of it he may have forgotten to file a [[Slavenburg]].</ref> | ||

== | ==[[Investment fund]]s== | ||

Where you are facing an [[investment fund]] held by equity investors it is slightly — but not very — different. Generally, there is no security, since there’s no question of [[ring-fencing]] separate pools of assets. (But investment managers can get in the way and steal options, so be on your guard — see below). | Where you are facing an [[investment fund]] held by equity investors it is slightly — but not very — different. Generally, there is no security, since there’s no question of [[ring-fencing]] separate pools of assets. (But investment managers can get in the way and steal options, so be on your guard — see below). | ||

'''Limiting recourse to the fund’s entire pool of assets''': A provision which says “once all the fund’s assets are gone, you can’t put it into bankruptcy”, is essentially harmless, seeing as once all the fund’s assets are gone there’s no ''point'' putting it into [[bankruptcy]]. This is the same place you would be with a single-issue [[repackaging]] vehicle: the [[corporate veil]] does the work anyway. This provision just keeps the directors of the fund in paid employment. | '''Limiting recourse to the fund’s entire pool of assets''': A provision which says “once all the fund’s assets are gone, you can’t put it into bankruptcy”, is essentially harmless, seeing as once all the fund’s assets are gone there’s no ''point'' putting it into [[bankruptcy]]. This is the same place you would be with a single-issue [[repackaging]] vehicle: the [[corporate veil]] does the work anyway. This provision just keeps the directors of the fund in paid employment. | ||

| Line 42: | Line 39: | ||

What the [[principal]] is doing here is ''broadly'' of a piece with segregated, ring-fenced [[repackaging]]. “Swap dudes: you are trading against, and limited in recourse to, this bucket of assets. Cut your cloth accordingly.” But not ''quite'': for one thing, poor swap counterparty has no security over the pool, and so gets no “quid” for its generously afforded “quo”. The swap counterparty may be limited to that pool of assets, but it has no priority over them as against other general creditors of the fund: should (heaven forfend) the fund blow up our intrepid swap dealer may find itself not only limited to the pool of assets, but even then only recovering cents in the dollar on them. Double whammy. You could fix that by having the fund represent that ''all'' other creditors are similarly limited to ''other'' pools of assets, but that is messy and unreliable. Security is much cleaner and neater, but you’ll never get it. | What the [[principal]] is doing here is ''broadly'' of a piece with segregated, ring-fenced [[repackaging]]. “Swap dudes: you are trading against, and limited in recourse to, this bucket of assets. Cut your cloth accordingly.” But not ''quite'': for one thing, poor swap counterparty has no security over the pool, and so gets no “quid” for its generously afforded “quo”. The swap counterparty may be limited to that pool of assets, but it has no priority over them as against other general creditors of the fund: should (heaven forfend) the fund blow up our intrepid swap dealer may find itself not only limited to the pool of assets, but even then only recovering cents in the dollar on them. Double whammy. You could fix that by having the fund represent that ''all'' other creditors are similarly limited to ''other'' pools of assets, but that is messy and unreliable. Security is much cleaner and neater, but you’ll never get it. | ||

You might also say that the [[principal]] — or more likely the [[agent]] — is engaged in some dissembling here. Whose problem should it be, if, in its dealings with an innocent, arm’s length counterparty trading for value and without notice of turpitude, an agent exceeds its mandate, goes [[crazy-ape bonkers]], or just, in the vernacular, ''royally fucks up''? The general principles of agency, we submit, say this is firstly the principal’s problem, and to the extent it is not the principal’s problem, it is the agent’s problem. The one person whose problem it should ''not'' be is an innocent counterparty’s. Yet this is what agent-pool recourse limitation effectively imposes. It transfers agent risk — perhaps a second-loss risk, but still a material risk, since the first loss is unreasonably limited to an arbitrary number — to the counterparty. It is really hard to understand why a principal’s swap dealer shiould agree to underwrite the risk of misperfoamcne by that principal’s agent. | |||

The answer likely to come: “Well, [[all our other counterparties have agreed this]].” Alas, in this particular case, the agent is probably right. | |||

====The asset pool is indeterminate==== | |||

Secondly, a pool of assets [[for the time being]] allocated to an investment manager is ''kind of nebulous''. What the client giveth, the client can taketh away. If the client’s [[asset manager]] has gone rogue, that is ''exactly'' the time at which it will be anxiously raking its assets back. So the [[swap dealer]] facing that pool of assets — who has been faithfully handling and executing all orders competently and in good faith, of course — may find that nice big juicy bucket of assets to which it has limited its recourse, ''suddenly has a hole in it''. | Secondly, a pool of assets [[for the time being]] allocated to an investment manager is ''kind of nebulous''. What the client giveth, the client can taketh away. If the client’s [[asset manager]] has gone rogue, that is ''exactly'' the time at which it will be anxiously raking its assets back. So the [[swap dealer]] facing that pool of assets — who has been faithfully handling and executing all orders competently and in good faith, of course — may find that nice big juicy bucket of assets to which it has limited its recourse, ''suddenly has a hole in it''. | ||

====This is liability cap, not a credit mitigant=== | |||

Thirdly, and most critically: This is a limitation on the value of your claim against a counterparty who does have available assets. You are leaving money on the table. This is a ''trading'' decision, not a ''credit'' decision. It is as if you have sold your counterparty a put option | |||

===[[Limited recourse]] formulations=== | ===[[Limited recourse]] formulations=== | ||

Revision as of 13:54, 15 October 2020

Of a contract, that the obligor’s obligations under it are limited to a defined pool of assets. You see this a lot in repackagings, securitisations and other structured transactions involving espievies. Security and limited recourse are fundamental structural aspects of contracts with Special purpose vehicles and investment funds.

The basic idea

Investment funds and structured note issuance vehivles tend to be purpose-built single corporations with no other role in life. They issue shares or units to investors and with the proceeds, buy securities, make investments and enter swaps, loans and other transactions with their brokers. The brokers will generally be structurally senior to the fund’s investors (either as unsecured creditors, where the investors are shareholders, or as higher-ranking secured creditors, where the investors are also secured creditors).

So the main reason for limiting the broker’s recourse to the SPV’s assets is not to prevent the broker being paid what it is owed. It is to stop the SPV going into formal bankruptcy procedures once all its assets have been liquidated and distributed pari passu to creditors. At this point, there is nothjing left to pay anyone, so it is academic.

Now, why would a broker want to put an empty SPV — one which has already handed over all its worldly goods to its creditors — into liquidation? Search me. Why, on the other hand, would the directors of that empty SPV, bereft as it is of worldly goods, be anxious for it not to go into liquidation? Because their livelihoods depend on it: being directors of a bankrupt company opens them to allegations or reckless trading, which may bar them from acting as directors in their jurisdiction. Since that’s their day job, it’s a bummer.

But haven’t they been, like, reckless trading? No. Remember, we are in the parallel universe of SPVs. Unlike normal commercial undertakings, SPVs run on autopilot. They are designed to give exposure, exactly, to the pools of assets and liabilities they hold. That’s the deal. Everyone trades with SPVs on that understanding. The directors are really nominal figures: they outsource executive and trading decisions to an investment manager. Their main job is to ensure accounts are prepared and a return filed each year. They are not responsible for the trading strategy that drove the espievie into the wall.[1]

So all an investment fund’s limited recourse clause really needs to say is:

- Our recourse against the Fund will be limited to its assets, rights and claims. Once they have been finally realised and their net proceeds applied under the agreement, the Fund will owe us no further debt and we may not take any further steps against it to recover any further sum.

But, as we shall see, sometimes asset managers can be a malign influence, and try to further limit this.

Multi-issuance repackaging vehicles: secured, limited recourse

In the world of multi-issuance repackaging SPVs, secured limited recourse obligations are de rigueur. They save the cost of creating a whole new vehicle for each trade, and really only do by contract what establishing a brand new espievie for each deal would do through the exigencies of corporation law and the corporate veil. That said, with segregated cell companies, you can more or less do this, through the exigencies of the corporate veil, inside a single espievie. But I digress.

With secured, limited recourse obligations there is a quid pro quo: creditors agree to limit their claims to the liquidated value of the secured assets underlying the deal (usually a par asset swap package), but in return, the issuer grants a first-ranking security over those assets in favour of the creditors, stopping any interloper happening by and getting its mitts on them.

Over the years the secured, limited recourse technology has been refined and standardised, and now plays little part in the education of a modern-day structured finance lawyer, though, at his mother’s knee, he might once have been told fairy stories about what became of poor Fidgety Phillip when he carelessly put “extinction” rather than “no debt due” in a pricing supplement on his way home from school and burned to death.[2]

Investment funds

Where you are facing an investment fund held by equity investors it is slightly — but not very — different. Generally, there is no security, since there’s no question of ring-fencing separate pools of assets. (But investment managers can get in the way and steal options, so be on your guard — see below). Limiting recourse to the fund’s entire pool of assets: A provision which says “once all the fund’s assets are gone, you can’t put it into bankruptcy”, is essentially harmless, seeing as once all the fund’s assets are gone there’s no point putting it into bankruptcy. This is the same place you would be with a single-issue repackaging vehicle: the corporate veil does the work anyway. This provision just keeps the directors of the fund in paid employment.

Limiting recourse to assets managed by an agent

On the other hand, limiting recourse to a pool of assets within a single fund entity — say to those managed by a single investment manager (some funds subcontract out the management of their portfolios to multiple asset managers) — being a subset of the total number of assets owned by the fund — is a different story altogether. This, by sleepy market convention, has become a standard part of the furniture, but to the JC and his friends and relations, seems batshit insane.

The manager is an agent

So firstly, the investment manager is an agent. An agent isn’t liable at all for any of its principals’ obligations. It is a mere intermediary: the JC have waxed long and hard enough about that elsewhere; suffice to say the concept of agency is one of those things we feel everyone in financial services should know; this is not one to drop-kick to your legal eagles: it is fundamental to the workings of all finance.

So why would an agent seek to limit its principal’s liability to the particular pool of assets that principal has allocated to that agent? Probably because the principal has said, I don’t trust you flash fund manager types, with your Sharpe ratios and your intelligent beta. If I am not careful you could put on some insanely cavalier spread play on the seasonal convergence of natural gas futures and blow up my whole fund. I don’t want you to do that. I am only prepared to risk the assets I give to you, and that is the end of it.

What the principal is doing here is broadly of a piece with segregated, ring-fenced repackaging. “Swap dudes: you are trading against, and limited in recourse to, this bucket of assets. Cut your cloth accordingly.” But not quite: for one thing, poor swap counterparty has no security over the pool, and so gets no “quid” for its generously afforded “quo”. The swap counterparty may be limited to that pool of assets, but it has no priority over them as against other general creditors of the fund: should (heaven forfend) the fund blow up our intrepid swap dealer may find itself not only limited to the pool of assets, but even then only recovering cents in the dollar on them. Double whammy. You could fix that by having the fund represent that all other creditors are similarly limited to other pools of assets, but that is messy and unreliable. Security is much cleaner and neater, but you’ll never get it.

You might also say that the principal — or more likely the agent — is engaged in some dissembling here. Whose problem should it be, if, in its dealings with an innocent, arm’s length counterparty trading for value and without notice of turpitude, an agent exceeds its mandate, goes crazy-ape bonkers, or just, in the vernacular, royally fucks up? The general principles of agency, we submit, say this is firstly the principal’s problem, and to the extent it is not the principal’s problem, it is the agent’s problem. The one person whose problem it should not be is an innocent counterparty’s. Yet this is what agent-pool recourse limitation effectively imposes. It transfers agent risk — perhaps a second-loss risk, but still a material risk, since the first loss is unreasonably limited to an arbitrary number — to the counterparty. It is really hard to understand why a principal’s swap dealer shiould agree to underwrite the risk of misperfoamcne by that principal’s agent.

The answer likely to come: “Well, all our other counterparties have agreed this.” Alas, in this particular case, the agent is probably right.

The asset pool is indeterminate

Secondly, a pool of assets for the time being allocated to an investment manager is kind of nebulous. What the client giveth, the client can taketh away. If the client’s asset manager has gone rogue, that is exactly the time at which it will be anxiously raking its assets back. So the swap dealer facing that pool of assets — who has been faithfully handling and executing all orders competently and in good faith, of course — may find that nice big juicy bucket of assets to which it has limited its recourse, suddenly has a hole in it.

=This is liability cap, not a credit mitigant

Thirdly, and most critically: This is a limitation on the value of your claim against a counterparty who does have available assets. You are leaving money on the table. This is a trading decision, not a credit decision. It is as if you have sold your counterparty a put option

Limited recourse formulations

The following, rendered in the linguistic mush you can expect from securities lawyers, are the sorts of things you can expect the limited recourse provision to say without material complaint:

- Recourse limited to segregated assets: your recourse against the SPV will be strictly limited to those assets that are ring-fenced for the particular deal you are trading against. This ring-fencing might take the form of:

- Security and limited recourse: security and contract (in an old-style repackaging with a regular LLC) — there there is a subtle trade off between security over your assets (preferring your claim against all other comers) and limitation of that claim to those secured assets; or

- Corporate structure: by means of a specialist corporate structure providing for segregation of the corporate personality into little cells which may[3] or may not[4] have their own legal personality (if the SPV is a segregated portfolio company or an incorporated cell company);

- No set-off or netting between cells: Netting and set-off will be limited to the specific cell you are facing: this means if your deal goes down, others issued from the same SPV can continue unaffected — boo — and vice versa — hooray.

- Extinction (or non-existence) of outstanding debt: Following total exhaustion of all assets after enforcement, appropriation, liquidation and distribution, and realisation of all claims subsequently arising form those assets, your outstanding unpaid debt will be “extinguished”.

- Here the intention is that you will never have legal grounds for seeking judgment, and thereafter commencing bankruptcy proceedings, for that unpaid amount once your own cell is fully unwound and its proceeds distributed.

- Pendantry alert: some sniff at this “extinction” language, fearing it implies that there was once upon a time, until extinction, a debt for an amount which the company was theoretically unable to pay — meaning that the company was, for that anxious moment in time, technically insolvent. These people — some hail from Linklaters — prefer to say “no debt is due” than “the debt shall be extinguished”.

- A proceedings covenant: You must solemnly promise never to set to put the SPV into insolvency proceedings. If you agree to all the foregoing, you should have concluded you have no literal right to do so, so this shouldn’t tax your conscience too greatly.

See also

References

- ↑ The investment manager is. So should she be barred from managing assets? THIS IS NOT THE TIME OR THE PLACE TO DISCUSS.

- ↑ Come to think of it he may have forgotten to file a Slavenburg.

- ↑ such a company and incorporated cell company.

- ↑ Such a company a segregated portfolio company.