Template:M summ EUA Annex (d)(i): Difference between revisions

Amwelladmin (talk | contribs) Created page with "=== {{euaprov|Settlement}} === {{M summ EUA Annex (d)(i)(1)}} === {{euaprov|Delivery}} === {{M summ EUA Annex (d)(i)(2)}} === {{euaprov|Netting}} === {{M summ EUA Annex (d)(i)..." |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 6: | Line 6: | ||

{{M summ EUA Annex (d)(i)(3)}} | {{M summ EUA Annex (d)(i)(3)}} | ||

=== {{euaprov|Settlement Disruption}} === | === {{euaprov|Settlement Disruption}} === | ||

{{M summ EUA Annex | {{M summ EUA Annex Settlement Disruption}} | ||

=== {{euaprov|Suspension}} === | === {{euaprov|Suspension}} === | ||

{{M summ EUA Annex | {{M summ EUA Annex Suspension}} | ||

Revision as of 11:30, 13 July 2022

Settlement

Settlement (ISDA), Scheduling (EFET), Primary Obligation (IETA) — the core provision that sets out who pays what, where and to whom, for Option Transactions and Forward Transactions.

The JC is no great fan of definitions, but God only knows, in the ISDA one would have come in handy here. You know, a “Purchase Amount” for Forward Transactions, or a “Strike Amount” for Option Transactions (or a “Payment Amount”, for both) might have been nice, given they are the key concepts in Option Transactions and Forward Transactions.

As for “Allowances to be Delivered” — okay, there is at least a term for the physical half of that, but it’s rubbish. What about “Delivery Amount”?

There is a distinction between the “Number of Allowances” — effectively the notional size of the whole trade — and the “Allowances to be Delivered” — the portion of it that is settling on any given day. The difference is that American options can settle in part, on any day in the term of the Transaction. Forwards typically don’t — they all settle on a pre-agreed settlement date

(To be fair to the Emissions ninjas at IETA, they do have this concept: “Contract Amount”).

Well, the JC has introduced these words into the nutshell summary to make life a bit easier to follow. Just remember they are not there in the real thing. Unless you put them in.

Cash Settlement: Trick question. There is no provision for cash-settlement in the emissions trading world. Will that stop counterparties asking you to specify a settlement method? Probably not. Does it matter? Also probably not. What if you want a cash settlement option? Not out of the ballpark — one’s eligibility for EMIR, and as such hedge exemptions, might depend on whether the forward is able to be cash-settled, in theory, or not. (There is no good reason for this: it springs from the paranoid brow of those toiler legal counsel who trying to parse the eligibility or Emissions derivatives under the refitted delegated regulations of MiFID 2 — our advice is just don’t go there — but you just never know.)

Delivery

All tediously quotidian, largely-goes-without-saying stuff, until you stumble over subparagraph (B) like an inattentive trail-runner not noticing a tree-root.

So:

(A)

Transfer from a specified Holding Account

Curious conditionality, across all three versions, where the Delivering Party specifies a Holding Account from which Allowances must be delivered, and not just the account to which they must be delivered. Quite why it should matter whence the Allowances come we cannot say — a vague fretfulness about theft perhaps? — but ok; let’s run with it.

Note, in any case, its moderation in IETA (5.2) whereby one has an obligation to make sure there are sufficient allowances in your account to satisfy your delivery obligation. So even though you can’t be forced to deliver from anywhere else, you can be sued for losses arising from your failure to ensure there was something to deliver in your Holding Account. All rather cack-handed, but in “fundamental upshot” terms, this does get to the right place.

The transfer is done once the Allowances hit the Receiving Party’s account (I know, I know: you don’t say.) But wait: there is an interesting use of the word “whereupon” here, upon which we dwell in a bit more detail in the premium section.

(B)

We’ll talk about (B) in the premium content section.

(C)

If the Receiving Party has designated multiple Specified Holding Accounts — as to why it would have multiple accounts, let alone specify them for a single Transaction we can provide no answer beyond basic bloody-minded perversity — but let’s just say — Delivering Party starts at the top and, if for some reason the first-named accounts are subject to some kind of disruption and the later ones are not — again, search us what might cause that — work its way down until it has delivered all EUAs. (If it gets to the bottom unfulfilled, see Settlement Disruption Event and Suspension Event).

(D)

If you deliver outside the normal window during business hours, your delivery is deemed satisfied at the next moment where a window on business hours opens. Workaday stuff that will be familiar with anyone who deals with the settlement of securities for a living.

But (B)? That’s weird. For more discussion on that, and a compare and contrast with the corresponding IETA provision, see the premium content.

Netting

Template:M summ EUA Annex (d)(i)(3)

Settlement Disruption

Settlement Disruption and Suspension beg for comparison, so here is one: compare them. See also our laborious, but probably wasted effort, of a table parsing when, and when not, to apply them:

Traumnovelle

It is interesting to compare, across all three of the emissions trading documentation suites, the differences and similarities when it comes to resolving an unquenchable Settlement Disruption Event.

- Notification: All are the same: either party can notify a Settlement Disruption Event. If the affected party is the one who calls it — but, curiously, not if it isn’t, which sets up some odd incentives, but hey — it must use reasonable endeavours to overcome a situation that is, by definition, beyond its control.

- Longstop date: all have variations of a longstop of no later than 9 Delivery Business Days after the scheduled Delivery Date, or earlier should a Reconciliation Deadline intervene. ISDA and EFET also throw in an End of Phase Reconciliation Deadline. Which is nice.

- Consequences of hitting the longstop: All of the agreements opt for the “then I woke up and it was all a dream” method of closeout — Payment on Termination for Settlement Disruption, at least as an option. They allow the alternative option for a Payment on Termination: ISDA goes for an Early Termination Date as if an Illegality Termination Event, with no Waiting Period, had occurred. EFET and IETA both try to reconstruct something like the termination methodology of a 1992 ISDA, descending into all that ugliness of “Market Quotation” and “Loss”.

Suspension

Someone has got a mind infested by nefarious phantoms, readers: either the ISDA’s crack drafting squad™ does, collectively, or the JC does. We are totally not ruling out the JC, to be clear. But this is too weird.

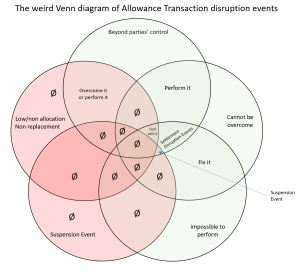

A Suspension Event happens when the official infrastructure falls over so that the parties can’t transfer Allowances to settle a Transaction. It is the fault of neither party — therefore to be distinguished from a Failure to Deliver, which generally will be. While there is overlap between Settlement Disruption Events and Suspension Events (in that both are things beyond the parties’ control) Suspension Event, being narrower and related to the failure of official infrastructure, trumps Settlement Disruption Event where they both apply to the same event. Generalia specialibus non derogant, I suppose.

Note the Long-Stop Date concept, which references 1 June in a year following a set of seemingly arbitrary two-year spells in the Fourth Compliance Period and relates only to Suspension Events, not Settlement Disruption Events, and also appears to bear no relation at all to the Reconciliation Deadline at the end of April in each year.

We have compared Settlement Disruption Events and Suspension Events here.

A curiosity to which the JC has not yet found a plausible answer is why there is a Cost of Carry adjustment for Suspension Events that run over the scheduled Delivery Date, but not for other, ordinary Settlement Disruption Events (or for that matter, Failures to Deliver).

There is no at-market termination provision at a Long-Stop

Also, the “then I woke up and it was all a dream” method of resolving irreconcilable suspensions. Unlike for Settlement Disruption Event, ISDA’s Carbon Squad did not provide for “Payment on Termination for Suspension Event”. We are baffled by this, as we have mentioned elsewhere: it defaults the position to one where the person who thought they had sold forward a risk finds, for reasons entirely beyond their control, that not only was that risk transfer ineffective, but the risk has come about and the asset is, effectively worth zero. If you consider the position of someone who was, for example, financing someone else’s Allowance allocation — hardly out of the question, since that is basically the point of a Forward Purchase Transaction this is transparently the wrong outcome, since the Seller — the person who is borrowing against its Allowances — gets to keep the money. Madness.