Dividend Recovery - Equity Derivatives Provision

|

2002 ISDA Equity Derivatives Definitions Section Dividend Recovery in a Nutshell™ Use at your own risk, campers!

Full text of Section Dividend Recovery

|

Content and comparisons

You may see this kind of malarkey in a Equity Derivatives Master Confirmation. To be clear, the ISDA version is lifted from the 2002 ISDA Equity Derivatives User’s Guide, not the 2002 ISDA Equity Derivatives Definitions themselves, so here you have not only the nutshell version, but below, an even less nutty version. Or more nutty, depending on your view as you read on.

This is a patch job to correct what looks to be a blip in the 2002 ISDA Equity Derivatives Definitions about the timing and payment of Dividend Amounts

Summary

Careful: it’s (meant to be) about timing, not amount

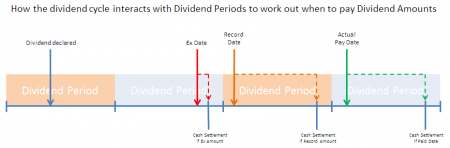

So what is the difference betwixt a Record Amount, Paid Amount and Ex Amount? To be clear, it is not about whether you get paid, nor how much, but when. A Dividend Amount is a Dividend Amount: in each case “100%[1] of the gross cash dividend per Share”, end of the day. What this is all to do with is when a Dividend Amount is deemed to occur, which in turn is a function of which Dividend Period the trigger for the dividend falls in.

- The trigger where Record Amount applies is the record date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the record date falls.

- The trigger where Ex Amount applies is the ex date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the ex date falls.

- The trigger where Paid Amount applies is the payment date for the dividend in question. You should pay the gross cash dividend on the Cash Settlement Payment Date for that Dividend Period in which the dividend is paid.

Hang on a minute. “Paid”? Is that, like, different to “declared”? On purpose?

Is Paid Amount meant to be different from Record Amount or Ex Amount, in referencing not what is declared, but what the Issuer actually physically, real-world, paid out?

On one hand, on a natural reading it seems so: Record Amount and Ex Amount specify an amount by reference to the amount “declared by the Issuer to holders of record of a Share”, whereas Paid Amount references the amount “paid by the Issuer during the relevant Dividend Period to holders of record”. On the other hand there’s no sensible reason for supposing an Equity Amount Payer would want to keep the risk of solvency of an Issuer if it pays early[2] but not have it if it pays on the payment date. Examination of the world wide web seems to offer little help.

But here’s a common-sense explanation. Remember the timing of the dividend process: first it is declared, then, a short settlement cycle before the record date the share trades “ex-div” (this is the “ex date”), and only then, two or three weeks after the record date, is the actual Dividend Payment Date. And remember this whole farrago is to determine in which Dividend Period the Dividend Amount gets paid.

Now, if you chose Ex Amount, your Cash Settlement Payment Date may well fall before the actual Dividend Payment Date, in which case it doesn’t make sense to talk about the dividend paid by the issuer, because it won’t have been paid yet. If you selected Paid Amount, the Cash Settlement Payment Date necessarily will fall after the Dividend Payment Date, so it is safe to talk about the dividend having been paid. Because it must have been — and in the disaster scenario where it hasn’t — ie, the corporate failure of the underlying issuer — the Equity Amount Payer won’t want to be paying out a Dividend Amount anyway.

But as for the very good question why would any equity derivative purport to pay out a Dividend Amount before the actual real-world payment date for the Dividend it is synthetically replicating? This is a question only ISDA’s crack drafting squad™ would be placed to answer, and they’re not talking.