Contractual negligence

|

An attorney eyes you wistfully and slides a draft across the table to you. It includes the following:

- My client shall not be liable for any losses, howsoever caused, unless they arise directly from its own [[negligence}}, fraud or {{tag|wilful default]].

What to make of this?

At a glance it seems reasonable: it is time-honoured boilerplate, thrown into contracts to close them out like chump change tossed into the bill platter at the end of an agreeable meal with passable company of whom one has now had enough.

But does it make sense to fritter away a contractual claim this way? In your correspondent’s opinion, no, except in one special case: under an indemnity.

Fraud

You can’t exclude contractual liability for fraud: to do so is to step beyond the hermeneutic boundaries of the game one plays in entering a legal arrangement[1]. A contract where, by its terms, one could behave fraudulently would be an arch affair. So it’s hardly a great concession to say so.

Nul points for remembering to exclude fraud, therefore.

Wilful default

A heartily-bandied phrase[2] which sounds like it ought to mean something. Our best guess is something like a “deliberate refusal to perform one’s obligations under a contract”: not too far removed from fraud (it raises a presumption of fraudulence on the part of the actor in agreeing to the obligation in the first place) but, in any weather, a subset of the class of events comprising a “breach of contract”.

Now breaches of contract, under the law of contract, entitle a wronged fellow to redress. That’s what it means to be a breach. So it ought not cause your heart to leap to have your counterparty offering to be responsible for wanton examples of this behaviour. It is hardly a mark of generosity. Indeed; you might wonder why he seeks to exclude less wilful “defaults” - or even unwilled defaults - being, as they are, defaults.

For here’s the point: The point of a contractual obligation is to have some means of making the person who owes it do it - or, failing that - compensating you for not doing it. Why else have one?

So is that what negligence is meant to do?

Negligence

What about excluding liability for breach of contract where you haven’t been negligent? It sounds all right at first blush. But does negligence make sense in the context of a contract?

Now negligence is all good fun: reasonable men (and women), Clapham omnibuses, snails, ginger-beer, escaping domestic animals and so on — but it evolved ad hoc to address a particular human dilemma that does not exist where you have a contract: that is, the plight of an unseen neighbour: a person with whom you share the planet, the highway, or a boundary, but with whom you have no formalised framework of civil obligations. Outside the criminal law on one hand and the bounds of an enforceable legal contract on the other, the law would have nothing to say about how individuals should treat each other had the common law of tort not arisen to bridge that gap.

There is no such gap when you have a contract[3]: you know damn well who your neighbour is, having spent six months hammering out a legal agreement with the blighter. You know what you expect your neighbour to do, and what your neighbour expects of you. So it is a bit feeble to suddenly fall back on a standard devised by imaginative judges to look after the interests of contract-less folk who found themselves struck by a punt being carelessly navigated the wrong way up a flooded avenue.

And what does “negligence” even mean, in the context of a contract, where two merchants have looked each other in the eye and agreed precisely the duties they do owe one another? Would not any breach of those duties be “negligent”? Since we have a contract, we know exactly who our “neighbour” is – the counterparty – and we know exactly what our duty is: it is written in the contract. If we do not perform the contract according to its terms, we have fallen short of an express duty to our “neighbour”.

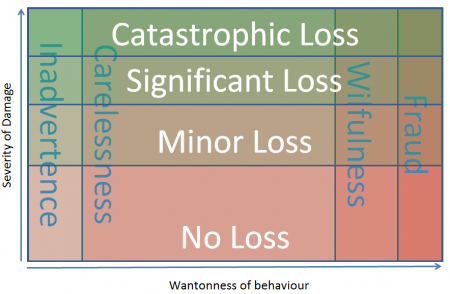

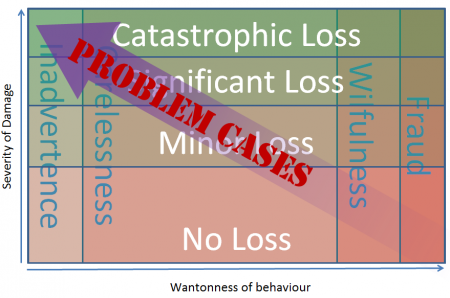

Consider the handsome table to the right. This charts all conceivable breaches of contract. The easiest cases are in the bottom right: not much loss, but the defaulting party has been gratuitous in its behavior and however paltry the claim, has no leg to stand on.

The hard cases are in the top left: here there has been little culpable misbehaviour as such (but note our condition to entry: the contract has been breached), but a significant loss has come about nonetheless.

Are these the examples an exclusion from liability for negligence is meant to cover? Surely not: a contractual obligation is a contractual obligation. Doing things this way betrays laziness or a lack of legal acuity from your counsel. It is not that you wish to exclude contractual liability if a party hasn’t been negligent: what you mean to say is that your counterparty is only obliged in the first place to exercise a certain standard of care[4]. If you craft the contract that way, you don’t need to exclude liability for prudent behaviour, because thast is all you had to do to comply with the contract in the first place.

But isn’t this an easier catch-all?

“But”, yon lazy attorney wails, “adopting that approach means we have to write in a standard of care to every obligation under the contract! As a plain English denizen you can’t really want that? Surely it’s easier to carve it out!”

But a contract is meant to stipulate what you are expected to do. For some obligations, a “reasonable standard of care” rider is not appropriate. The payment of money, for example.

- Bill borrows Ben’s car. He agrees to return it to Ben on Thursday at 3pm. At the appointed time Bill presents himself to Ben, but announces that he has just been mugged, and the car has been stolen. His mugger was quite unexpected, applied overwhelming force, and immediately drove the car into a wall and wrote it off. Through no fault of his own, Bill is unable to perform his obligation. Should he be able to rely on a carve out from liability because he has not been negligent?

What about concurrent liability in tort and contract?

Warning: written from a finance lawyer’s perspective. Construction lawyers: take with an even greater pillar of salt than usual.

Brethren attorneys will occasionally caution you that the four corners of a contract might not be the extent of your liability: You might get sued in tort.

Extraordinary though it seems, technically it is true. Lord Scarman’s sensible observations in Tai Hing Cotton Mills v Liu Chong Hing Bank, that there isn’t “anything to the advantage of the law’s development in searching for a liability in tort where the parties are in a contractual relationship” has been long since overruled - 1995’s Henderson v Merrett being a prominent example. There, Lord Goff noted that the law of tort is the general law, the law of contract in a way a specific instance of it. So, first, establish the duty in tort, and then see if the duties in a contract modify or replace it:

- “Yet the law of tort is the general law, out of which the parties can, if they wish, contract: [...]. Approached as a matter of principle, therefore, it is right to attribute to that assumption of responsibility, together with its concomitant reliance, a tortious liability, and then to enquire whether or not that liability is excluded by the contract because the latter is inconsistent with it.”[5]

In the case of financial contracts, generally it will. In other, unusual cases, it might not. But these are typically “builders’ liability” cases where a Defendant built a house for Person A, who sold it to Person B, upon whom, at some significant remove, it collapsed. Uniquely here, there is a gap between contractual bat and pad:

- Person A had a contract, for six years from the date of construction, and therefore a cause of action for breach against the Defendant but, sold the house at full value and has suffered no loss.

- Person B has suffered a loss all right, but has no contract with (and therefore no cause of action for breach of one against) the Defendant, and cannot sue Person A who was innocent of any knowledge of the defect when it sold the house.

The Defendant might say, well, my liability arises here under a contract, so therefore no action sounds in tort. Yet instinctive human fairness demands that Person B be compensated, and that the Defendant should be the one to pay, but the strict contractual lines seem to get in the way. (it isn’t clear that they do, by the way: because I have a contract with A, carrying it out carelessly cannot affect my civil obligations to B or C or D, if they are people whose interests I ought to hold in contemplation as I do).

A concurrent duty in tort owed by the builder to that narrow and determinate group of “neighbours” — and they might literally be neighbours, if the house is terraced — or those who end up owning the house in the six years after it builds it — is a neat way of plugging the gap. But that group should not include the contracting counterparty itself, so really this isn’t true “concurrent liability” at all.

When the cause of action accrues

In any weather, these are unusual cases. In the normal run of things — at least when your rights and liabilities extent to instantly observable things like paying money and delivering securities — there’s little to be said for concurrent liability. When one is exchanging cash and financial assets, one can generally observe a breach of contract, and the loss it precipitates, instantly.[6]

But in the grubbier world of building and manufacturing, the formal differences concerning when ones cause of action arises make a difference: a cause of action arises on breach, regardless of whether the breach is apparent or the loss has materialised; where liability depends proof of damage, as it does in negligence, the period starts when plaintiff suffers loss.[7] Thus, builders liability cases are the difficult children; cases about swaps and loans tend not to be.

The fact pattern in these builders cases is little different from that in Donoghue v Stevenson - the paradigm negligence case par excellence — where the buyer of the ginger-beer was not the one consuming it[8]. In a straightforward bilateral contract with no aggrieved Person B, it would be absurd for tortious duties that arise at general law to widen or constrict the allocation of risk set out in the contract. You can contract out of tortious duties (even if that isn’t obvious in principle to you, Lord Goff said so in Henderson v Merrett). Unless your contract is uncommonly vague, by just having one you will have done so. You can always explicitly exclude tortious liability in the contract if you are really worried about it (though it does look a little “for the avoidance of doubt” to this pair of eyes. It’s not hard to do:

- “This is a contract. Neither party will be liable to the other in tort under it.”

But explicitly referencing a tortious standard in your contract hardly helps with that exercise.

Gross negligence

If you really must, see the article on gross negligence. But in short, try saying this into a mirror and keeping a straight face:

- “All right your honour: I admit there’s been a loss. I admit I caused it. I even admit I was negligent in doing so. But I wasn’t very negligent, so I don’t think I should have to pay for it.”

See how far you get.

Strike out the word “gross” wherever you see it. Even in America.

See - Fardell v Potts. No, really. Go there. You won’t regret it.

The exception that proves the rule: Indemnities

An indemnity is the one time in a contract that it makes sense to exclude liability for negligence, fraud or wilful default, a contractual standard which otherwise is the product of muddy logic.

Generally the standard of conduct one must be held to in a contract is, of course, the contractual one. But where an indemnity is concerned, one party has agreed to assume liability for the other’s loss even though the indemnifier has not breached the contract or even acted foolishly in any way. And nor is the fact that indemnified party has itself performed the contract the end of it: The loss in question arises through the agency of some third party, away from the contract in which the indemnity lies. (A loss as between the two parties to the contract would be governed by the law of contract and breach and not an indemnity).

Here the eventuality is one the parties have not bargained upon, and that is beyond their control. This is just the sort of place where the courts can step in to imply reasonable boundaries on liability. A “negligence” carve out invites that.

Hence the indemnifier may seek to restrict its liability under the indemnity to compensate only losses which the beneficiary has not itself been negligent in incurring, in that tortious sense.

See also

References

- ↑ Let me Google that for you

- ↑ see also “wilful misconduct”, a formulations which Americans seem to prefer, but which to these cloth ears carries even less legal meaning.

- ↑ Assuming your contract was competently drafted, of course.

- ↑ Or, perhaps, should be excused should a force majeure come about.

- ↑ Emphasis added.

- ↑ Not always the case for some of the loonier representations and warranties, it is true. But —

- ↑ Pirelli Cable Works Ltd v Oscar Faber & Partners Ltd [1983] 2WLR 6. There is a very good, detailed and famous, but looong, monograph about all of this from then LLB honours student, now New Zealand Court of Appeal judge Christine French, which was published in the Otago Law Review in 1983 and reverentially praised in Henderson v Merrett. You can access it here.

- ↑ The difference is that the purchaser gave the ginger-beer to the victim, and did not sell it.