Hindsight: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (10 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{a|devil| | {{a|devil|{{image|Concert flyer|png|Bring cushions.}}}}{{Quote| | ||

{{office scene|III|iv|gazes admiringly at his own Insta feed, which consists entirely of touched-up selfies|silently fumes while the [[JC]], who has managed to elbow his way into what was meant to be a private meeting of important people, will now not stop talking}} | {{office scene|III|iv|gazes admiringly at his own Insta feed, which consists entirely of touched-up selfies|silently fumes while the [[JC]], who has managed to elbow his way into what was meant to be a private meeting of important people, will now not stop talking}} | ||

:'''[[JC]]''': [''Winding down''] “... so, I ask you: why | :'''[[JC]]''': [''Winding down''] “... so, I ask you: why has the legal industry been so ''inept'' at preventing catastrophic risks? There are more lawyers than ever, but we don’t seem to be able to stop anything: Nick Leeson, [[LTCM]], [[Amaranth]], [[Enron]], Global Crossing, Kerviel, [[Madoff]], Bear Stearns, [[Lehman]], [[LIBOR]], Theranos, London Whale, Mossack Fonseca, 1MDB, Wirecard. All our immense legal firepower failed to prevent ''any'' of these.” | ||

:'''[[Head of Legal Ops]]''': ['' | :'''[[General Counsel]]''': [''Deploying the “[[Elephant|elephants hiding in custard]]” gambit''] Oh, but imagine how much ''worse'' it would have been had we [[legal eagle]]s ''not'' been on hand. It doesn’t bear thinking about. | ||

:'''[[Head of Legal Ops]]''': [''Darkening'']: Ah, yes! Well, it’s simple. Lawyers are not [[proactive]] enough in looking for it. They do not [[leverage]] [[data]] properly. | |||

:'''[[JC]]''': What? | :'''[[JC]]''': What? | ||

:'''[[Head of Legal Ops]]''': [''Gravely''] To add value as an [[Inhouse lawyer|in-house legal]] function we need to use [[Innovation|innovative]] tools to crunch [[data]], proactively spot emerging risks and escalate them to business.” | :'''[[Head of Legal Ops]]''': [''Gravely''] To add value as an [[Inhouse lawyer|in-house legal]] function we need to use [[Innovation|innovative]] tools to crunch [[data]], proactively spot emerging risks and escalate them to business.” | ||

| Line 11: | Line 12: | ||

On every [[disclaimer]] any [[financial services]] firm has ever sent — and ever ''will'' send, in the history of the world, until the [[End of days|End of Days]] — however paranoid, overblown, absurd, weird or wonderful, there will be one constant, ringing reminder: one thing, which, above all the others it will say: “[[past performance is no indicator of future results]]”. | On every [[disclaimer]] any [[financial services]] firm has ever sent — and ever ''will'' send, in the history of the world, until the [[End of days|End of Days]] — however paranoid, overblown, absurd, weird or wonderful, there will be one constant, ringing reminder: one thing, which, above all the others it will say: “[[past performance is no indicator of future results]]”. | ||

But how easily we | So we know this. It is encoded into what we do. But how easily we ''overlook'' it. | ||

===A cold night in Vienna, 1808=== | ===A cold night in Vienna, 1808=== | ||

| Line 36: | Line 37: | ||

This is the human condition, summarised. Only ''once it has happened'' — [[past tense]] — and often, only months or years after that, can we ''possibly'' appreciate the significance of the unexpected. | This is the human condition, summarised. Only ''once it has happened'' — [[past tense]] — and often, only months or years after that, can we ''possibly'' appreciate the significance of the unexpected. | ||

===The category error: providing for the future by reference to the past=== | ===The category error: providing for the future by reference to the past=== | ||

This is where my friend the middle manager makes his [[category error]]. [[Data]] all come from the same place: [[Past results are no guarantee of future performance|the past]]. When we review risks, catastrophes and step-changes; when we consider [[punctuated equilibrium|punctuations to the equilibrium]] be they fair or foul, our wisdom, our careful analysis, our sage opinions, our hot takes, our [[thought leader]]ship — ''all'' of these are [[Second-order derivative|derived]] from, predicated on, and delimited by [[data]] which, when the event played out, ''we did not have''. | This is where my friend the middle manager makes his [[category error]]. [[Data]] all come from the same place: [[Past results are no guarantee of future performance|the past]]. When we review risks, catastrophes and step-changes; when we consider [[punctuated equilibrium|punctuations to the equilibrium]] be they fair or foul, our wisdom, our careful analysis, our sage opinions, our [[Hot takes on Twitter|hot takes]], our [[thought leader]]ship — ''all'' of these are [[Second-order derivative|derived]] from, predicated on, and delimited by [[data]] which, when the event played out, ''we did not have''. | ||

And herein lies the tension and profound dilemma of the received approach to modern legal practice. For we commercial lawyers are charged with anticipating ''the [[future]]'' but we are sent out to battle armed with a methodology drawn exclusively from ''[[Past results are no guarantee of future performance|the past]]''. Just occasionally, this [[dissonance]] rears up and hits us, when the formal imperatives of [[legibility]] take priority over the logic of common sense. When, say, the financial controller insists {{sex|she}} must hold capital against undoubted shortcomings in a contract documenting a transaction that has already matured — a risk that ''did not come about and no longer can'', even though the reporting period rumbles on. That kind of thing. | And herein lies the tension and profound dilemma of the received approach to modern legal practice. For we commercial lawyers are charged with anticipating ''the [[future]]'' but we are sent out to battle armed with a methodology drawn exclusively from ''[[Past results are no guarantee of future performance|the past]]''. Just occasionally, this [[dissonance]] rears up and hits us, when the formal imperatives of [[legibility]] take priority over the logic of common sense. When, say, the financial controller insists {{sex|she}} must hold capital against undoubted shortcomings in a contract documenting a transaction that has already matured — a risk that ''did not come about and no longer can'', even though the reporting period rumbles on. That kind of thing. | ||

It is a persistent frame: by the time we get around to analysing any catastrophe and how it played out, all circumstances are known, all options have crystallised and all discretions have hardened. The employee who, with imperfect information and in the fog of war, tacked to ''starboard'' when hindsight revealed a safe harbour to ''port'' finds {{sex|himself}} short an very ugly option which those with executive responsibility for his performance will be mightily tempted to exercise. This is the lesson of {{fieldguide}}: the executive blames the [[meatware]], because by doing so, it exonerates the executive. | It is a persistent frame: by the time we get around to analysing any catastrophe and how it played out, all circumstances are known, all options have crystallised and all discretions have hardened. The employee who, with imperfect information and in the fog of war, tacked to ''starboard'' when hindsight revealed a safe harbour to ''port'' finds {{sex|himself}} short an very ugly option which those with executive responsibility for his performance will be mightily tempted to exercise. This is the lesson of {{fieldguide}}: the executive blames the [[meatware]], because by doing so, it exonerates the executive. | ||

{{rightbox|<youtube>https://www.youtube.com/watch?v=8PlLCKW4zuY</youtube>}} | |||

===[[Madoff]] and catastrophe=== | ===[[Madoff]] and catastrophe=== | ||

What caused the catastrophe — an inquiry one can only launch upstream — forms, informs, and reforms the ''down''stream [[narrative]]. Take [[Madoff]]: now we have [[No One Would Listen: A True Financial Thriller|the book]], the film, the exposés, the | What caused the catastrophe — an inquiry one can only launch upstream — forms, informs, and reforms the ''down''stream [[narrative]]. Take [[Madoff]]: now we have [[No One Would Listen: A True Financial Thriller|the book]], the film, the exposés, the fabulously gruesome congressional committee hearings (see panel) — now we know all that, ''everything'' about Madoff’s investment strategy is ''obviously'' bogus. How could this possibly have been allowed to happen? There can be only one explanation: ''someone further down the chain was asleep at the switch''. | ||

But ''were'' they? This is where the historian’s perspective is more useful than the [[thought leader]]’s.<ref>Sidebar: {{author|Thomas Kuhn}}, the greatest of all philosophers of science, was neither a scientist nor a professional philosopher but a ''historian''.</ref> We know [[Madoff]]’s regulators were ''not'' asleep at the switch because we have {{author|Harry Markopolos}}’s testimony that they ''can’t have been'': he kept prodding them in the ribs with a stick and pointing out exactly the anomalies they should have been alarmed by.<ref>His paper to the SEC, in November 2005 —more than ''three years'' before Madoff eventually shopped himself (even then the SEC didn’t see it!), was entitled “The World’s Largest Hedge Fund is a Fraud.” If that won’t wake you up, nothing will.</ref> | But ''were'' they? This is where the historian’s perspective is more useful than the [[thought leader]]’s.<ref>Sidebar: {{author|Thomas Kuhn}}, the greatest of all philosophers of science, was neither a scientist nor a professional philosopher but a ''historian''.</ref> We know [[Madoff]]’s regulators were ''not'' asleep at the switch because we have {{author|Harry Markopolos}}’s testimony that they ''can’t have been'': he kept prodding them in the ribs with a stick and pointing out exactly the anomalies they should have been alarmed by.<ref>His paper to the SEC, in November 2005 —more than ''three years'' before Madoff eventually shopped himself (even then the SEC didn’t see it!), was entitled “The World’s Largest Hedge Fund is a Fraud.” If that won’t wake you up, nothing will.</ref> | ||

| Line 52: | Line 55: | ||

''A “failure to crunch data” was not the problem here''. The problem was ''a failure of narrative''. Part of that failed narrative was ''the primacy of [[data]]''. [[In God we trust, all others must bring data]]. But will ''that'' be the lesson we all learn from this debacle? Like the certain death of a bricks-and-mortar company with an irretrievably broken business model, don’t bet on it. | ''A “failure to crunch data” was not the problem here''. The problem was ''a failure of narrative''. Part of that failed narrative was ''the primacy of [[data]]''. [[In God we trust, all others must bring data]]. But will ''that'' be the lesson we all learn from this debacle? Like the certain death of a bricks-and-mortar company with an irretrievably broken business model, don’t bet on it. | ||

It is interesting to that when executives appeal for change, for “[[revolution]]” — ironic, I know, but I’ve seen it happen — for “a new way of working” they are not talking about the revealed failings of their own narrative — | It is interesting to that when executives appeal for change, for “[[revolution]]” — ironic, I know, but I’ve seen it happen — for “a new way of working” they are not talking about the revealed failings of their own narrative — it’s got them where they are, after all, so it can't be ''all'' bad — but is upon the inconstant performance of those mortal, expensive, fallible [[Meatsack|meat-sack]]s snoozing away at the switch. Thanks to overwhelming [[confirmation bias]], the idea that ''the switch isn’t working'', and ''it’s the hierarchy supporting the broken switch that is not fit for purpose'', somehow fails to occur. | ||

And this is not to mention — no; no: it is [[Archegos|still too soon]]. | |||

{{sa}} | {{sa}} | ||

*[[Signal-to-noise ratio]] | *[[Signal-to-noise ratio]] | ||

| Line 59: | Line 64: | ||

*[https://www.youtube.com/watch?v=8PlLCKW4zuY The SEC [[general counsel]] trying to plead executive immunity from testifying before Congress]Representative Gary Ackerman (now retired) will forever be a ''Hero of the JC, First Class'', for this excoriation. | *[https://www.youtube.com/watch?v=8PlLCKW4zuY The SEC [[general counsel]] trying to plead executive immunity from testifying before Congress]Representative Gary Ackerman (now retired) will forever be a ''Hero of the JC, First Class'', for this excoriation. | ||

{{ref}} | {{ref}} | ||

{{nlp|5/2/2021}} | |||

Latest revision as of 08:34, 12 July 2024

|

Act III, Scene iv

A Zoom call amongst the thought leaders of Wickliffe Hampton’s inhouse legal operations team. The General Counsel gazes admiringly at his own Insta feed, which consists entirely of touched-up selfies. The Head of Legal Operations silently fumes while the JC, who has managed to elbow his way into what was meant to be a private meeting of important people, will now not stop talking.

- JC: [Winding down] “... so, I ask you: why has the legal industry been so inept at preventing catastrophic risks? There are more lawyers than ever, but we don’t seem to be able to stop anything: Nick Leeson, LTCM, Amaranth, Enron, Global Crossing, Kerviel, Madoff, Bear Stearns, Lehman, LIBOR, Theranos, London Whale, Mossack Fonseca, 1MDB, Wirecard. All our immense legal firepower failed to prevent any of these.”

- General Counsel: [Deploying the “elephants hiding in custard” gambit] Oh, but imagine how much worse it would have been had we legal eagles not been on hand. It doesn’t bear thinking about.

- Head of Legal Ops: [Darkening]: Ah, yes! Well, it’s simple. Lawyers are not proactive enough in looking for it. They do not leverage data properly.

- JC: What?

- Head of Legal Ops: [Gravely] To add value as an in-house legal function we need to use innovative tools to crunch data, proactively spot emerging risks and escalate them to business.”

- General Counsel: [Snapping shut his phone] Yes! That is it! Why don’t we just have a chatbot?

- Head of Legal Operations: [purring] Oh!

- JC: What? But that’s not what I meant at all!

On every disclaimer any financial services firm has ever sent — and ever will send, in the history of the world, until the End of Days — however paranoid, overblown, absurd, weird or wonderful, there will be one constant, ringing reminder: one thing, which, above all the others it will say: “past performance is no indicator of future results”.

So we know this. It is encoded into what we do. But how easily we overlook it.

A cold night in Vienna, 1808

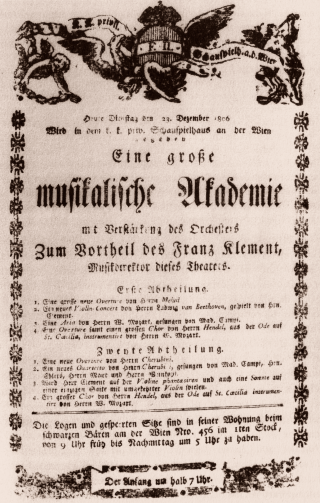

On a freezing night December 1808, about 1,500 people attended an akademie concert at the Theater an der Wien in suburban Vienna. The programme was to be four hours long, during which a young composer from out of town[1] would be debuting a number of works.

The run-up to the concert did not bode well: many of the musicians in theatre’s house orchestra had “conflicting commitments” with a better-paying gig across town at the Burgtheater, and even the solo soprano dropped out at the last minute, to be replaced by an unknown teenager— “I have to hop” is no modern excuse, it seems — and the composer, an irascible fellow, kept changing the music right up to the last minute. So poor were his relations with his musicians that, on some accounts, they refused his baton, and another conductor was drafted in to lead the orchestra on the day of the concert.

The concert was a disaster. What orchestra the organisers could scrape together was under-rehearsed — “lacking in all respects”, according to one reviewer — the poor young soprano suffered stage fright, the hall was freezing and the show badly overran. During one piece in the first half, the orchestra fell apart completely and had to restart from the top.

So why, two hundred years later, is there even a documentary record of this concert — most of Supercheese’s concerts were like that, and there’s no documentary record of any of them — and how has it found its way onto a Jolly Contrarian article about hindsight?

You will not be surprised to hear there is a punchline.

Of the scathing reviews that followed, one at least — in the Allgemeine musikalische Zeitung — was prescient enough to say the following: “To judge all these pieces after only one hearing, especially considering [...] that so many were performed in a row, and most are so grand and long, is impossible.”

To the punchline, then: the young foreign composer was, of course, Ludwig Van Beethoven, and in that one concert he premiered his Symphony No. 6 in F Major (“Pastoral”), his Piano Concerto No. 4, his Choral Fantasia, as well as playing a few choice cuts from his previously performed Mass in C Major. If that wasn’t enough — and surely, the Pastoral, by itself, would be enough: it would make any sensible shortlist of humankind’s highest achievements — after the interval, the orchestra debuted the most revolutionary music, bar none ever written: the Disco Theme to Saturday Night Fever[2] — although then known only as Symphony No. 5 in C Minor.[3]

If the JC could travel back in time — with thermals and a cushion, of course — for one night in all of human history, this is the night he’d choose. Imagine being one of those lucky 1,500 Austrians who heard Beethoven’s Fifth Symphony for the first time in history. There have been few watersheds in the cultural history of western civilisation quite as profound as this one. Western music would never be the same again.

Okay, so, hindsight?

“Hindsight” because I would choose that night, only thanks to the colossal cultural significance imbued upon it by the two hundred years of subsequent history from which we now benefit. The “lucky 1,500” probably found it quite tiresome. You can imagine them complaining to their spouses about it when they got home. To be sure, they may well have — most probably did — come, later in life, to freight that interminable, mediocre performance with a sacred quality, but only in hindsight: one could scarcely apprehend its significance without a context it was, on the night, categorically impossible to have.

This is the human condition, summarised. Only once it has happened — past tense — and often, only months or years after that, can we possibly appreciate the significance of the unexpected.

The category error: providing for the future by reference to the past

This is where my friend the middle manager makes his category error. Data all come from the same place: the past. When we review risks, catastrophes and step-changes; when we consider punctuations to the equilibrium be they fair or foul, our wisdom, our careful analysis, our sage opinions, our hot takes, our thought leadership — all of these are derived from, predicated on, and delimited by data which, when the event played out, we did not have.

And herein lies the tension and profound dilemma of the received approach to modern legal practice. For we commercial lawyers are charged with anticipating the future but we are sent out to battle armed with a methodology drawn exclusively from the past. Just occasionally, this dissonance rears up and hits us, when the formal imperatives of legibility take priority over the logic of common sense. When, say, the financial controller insists she must hold capital against undoubted shortcomings in a contract documenting a transaction that has already matured — a risk that did not come about and no longer can, even though the reporting period rumbles on. That kind of thing.

It is a persistent frame: by the time we get around to analysing any catastrophe and how it played out, all circumstances are known, all options have crystallised and all discretions have hardened. The employee who, with imperfect information and in the fog of war, tacked to starboard when hindsight revealed a safe harbour to port finds himself short an very ugly option which those with executive responsibility for his performance will be mightily tempted to exercise. This is the lesson of Sidney Dekker’s The Field Guide to Human Error Investigations: the executive blames the meatware, because by doing so, it exonerates the executive.

|

|

Madoff and catastrophe

What caused the catastrophe — an inquiry one can only launch upstream — forms, informs, and reforms the downstream narrative. Take Madoff: now we have the book, the film, the exposés, the fabulously gruesome congressional committee hearings (see panel) — now we know all that, everything about Madoff’s investment strategy is obviously bogus. How could this possibly have been allowed to happen? There can be only one explanation: someone further down the chain was asleep at the switch.

But were they? This is where the historian’s perspective is more useful than the thought leader’s.[4] We know Madoff’s regulators were not asleep at the switch because we have Harry Markopolos’s testimony that they can’t have been: he kept prodding them in the ribs with a stick and pointing out exactly the anomalies they should have been alarmed by.[5]

it wasn't that the operators were asleep, that is to say, but that their switch didn’t work. something about the narrative frame was amiss. But a maladroit switch is the responsibility of the executive, not the meatware.

GameStop and catastrophe

As of January 2021, we have an opportunity to see this dissonance live, in the wild, before it to ossifies into wise hindsight, with the GameStop phenomenon. Here, “lack of attention to data” is less plausible even than usual because the putative “victims” — hedge fund industry titans: tiny violins, right? — had more data, and more data-processing capability at their disposal than anyone in history. Their opponents, a rag-tag aggregation of retail deplorables coalescing around a Reddit channel, had the network effect and the wisdom of crowds in their corner, but nothing like the computer horsepower nor institutional support of the funds they took down. As I write the situation is ongoing: GME is fighting like a hooked Marlin, but you sense the end is near. But Melvin is down 53% already. Damage done.

A “failure to crunch data” was not the problem here. The problem was a failure of narrative. Part of that failed narrative was the primacy of data. In God we trust, all others must bring data. But will that be the lesson we all learn from this debacle? Like the certain death of a bricks-and-mortar company with an irretrievably broken business model, don’t bet on it.

It is interesting to that when executives appeal for change, for “revolution” — ironic, I know, but I’ve seen it happen — for “a new way of working” they are not talking about the revealed failings of their own narrative — it’s got them where they are, after all, so it can't be all bad — but is upon the inconstant performance of those mortal, expensive, fallible meat-sacks snoozing away at the switch. Thanks to overwhelming confirmation bias, the idea that the switch isn’t working, and it’s the hierarchy supporting the broken switch that is not fit for purpose, somehow fails to occur.

And this is not to mention — no; no: it is still too soon.

See also

- Signal-to-noise ratio

- Proactive

- GameStop

- The SEC general counsel trying to plead executive immunity from testifying before CongressRepresentative Gary Ackerman (now retired) will forever be a Hero of the JC, First Class, for this excoriation.

References

- ↑ Bonn, in northwestern Germany — a long way from the cultural capital of the Austrian Empire.

- ↑ I am sorry. I couldn’t resist.

- ↑ Anyone interested in Beethoven’s symphonies — and that is, as Hendrix put it, “everybody here with hearts, any kind of hearts, and ears” — should check out Professor Robert Greenberg’s wonderful lectures about Beethoven.

- ↑ Sidebar: Thomas Kuhn, the greatest of all philosophers of science, was neither a scientist nor a professional philosopher but a historian.

- ↑ His paper to the SEC, in November 2005 —more than three years before Madoff eventually shopped himself (even then the SEC didn’t see it!), was entitled “The World’s Largest Hedge Fund is a Fraud.” If that won’t wake you up, nothing will.