When variation margin attacks: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (32 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

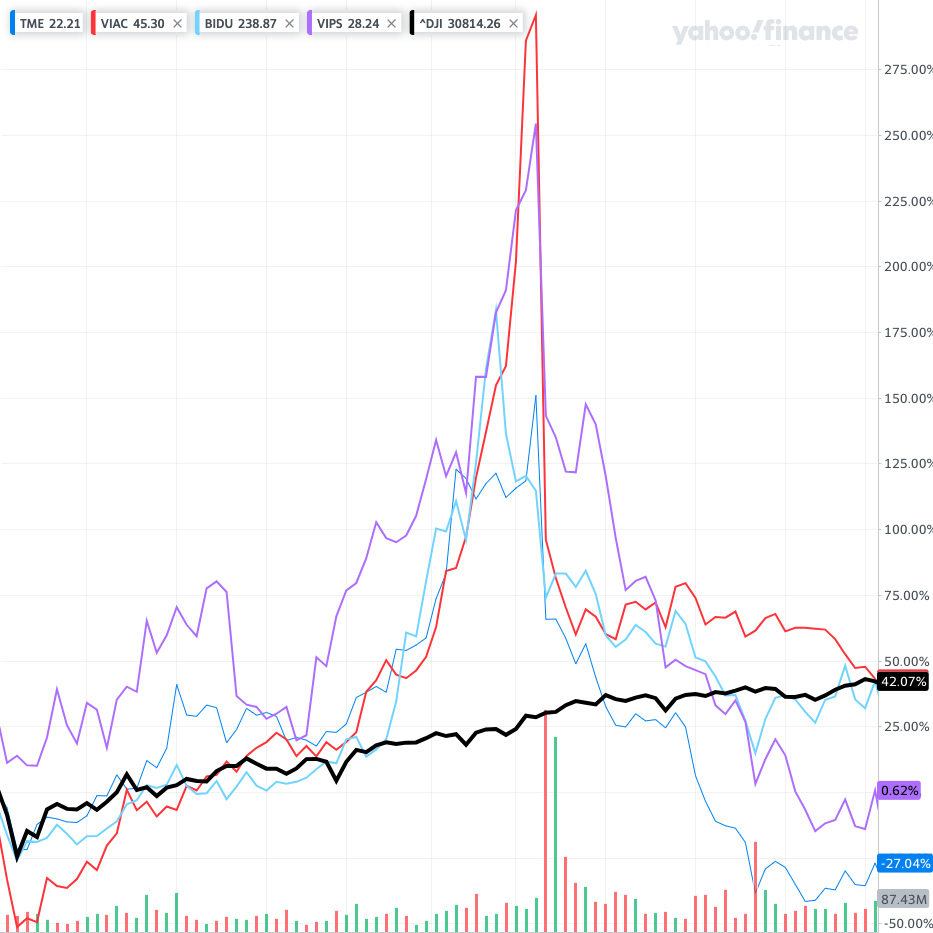

{{ | {{aessay|isda|When variation margin attacks|{{image|Archegos Positions|png|When [[variation margin]] attacks: ViacomCBS, Tencent, Baidu and Vipshop against the Dow (black)}}}} | ||

{{ | |||

Latest revision as of 11:39, 15 September 2024

BLACKADDER: Look, there’s no need to panic. Someone in the crew will know how to steer this thing.

CAPTAIN RUM: The crew, milord? What crew?

BLACKADDER: I was under the impression that it was common maritime practice for a ship to have a crew?

CAPTAIN RUM: Opinion is divided on the subject.

BLACKADDER: Oh, really?

RUM: Yes. All the other captains say it is; I say it isn’t.

- —Blackadder, Series 2: Potato

Variation margin

/ˌveəriˈeɪʃᵊn ˈmɑːʤɪn/ (n.)

Variation margin, or “VM”, is a credit mitigation technique designed to minimise the credit risk parties have to each other under bilateral derivative transactions. It requires the counterparties give each other collateral — typically cash — each day to ensure that their net collateralised exposure is effectively nil. For example, if the net “replacement cost” of the swaps between two counterparties on a given day is $10 million, the “out-of-the-money” party, who would have to pay it were all the transactions terminated, has to pay the “in-the-money” counterparty $10 million in cash (subject to agreed Thresholds and Minimum Transfer Amounts). This happens every day; variation margin can be paid either way, depending on how the net portfolio moves. Volatile markets can quickly move — a day is a long time when black swans are on the wing — so parties often want a little something extra to tide them over for expected movements between now and the next variation margin payment date. For that, you need initial margin.

Any of the standard reference works[1] will tell you that variation margin is a good thing, apt for ridding the world of the kinds of systemic risk that have the habit of building up in the financial system. Since, like Captain Redbeard Rum, your correspondent is going to run against the conventional wisdom, let us set the scene with a story.

Once upon a time in America

Shares of ViacomCBS closed down 9% Tuesday, a day after the company said it would raise $3 billion from stock offerings. The stock offerings come just a few weeks after the company launched its Paramount+ streaming service, and the offerings will help the company bulk up its content. ViacomCBS said it would use the funds to power “investments in streaming,” among other general corporate purposes.

- —CNBC, March 23, 2021

In the months leading up to March 2021, Archegos Capital Management took synthetic positions on margin on a handful of comparatively illiquid stocks — ViacomCBS, Tencent Music, Baidu and Vipshop — in sizes that, across multiple prime brokers, were big enough to move the market sharply up. As the stocks appreciated, so did Archegos’ profit, and thus the net equity it held with its prime brokers. Archegos used that net equity to double down, buying the same stocks, pushing them up yet further. The higher they went, the thinner their trading volume, and the more of the market Archegos represented.

Now, hindsight is a wonderful thing, but really there was only one way this was ever going to turn out.

On 22 March, Archegos’ position in Viacom had a gross market value of US$5.1bn.[2] In a cruel irony, Viacom interpreted this to mean market sentiment was so strong that it should take the opportunity to raise capital.[3] Alas, no one was buying. Not even Archegos, since it was tapped out of equity with its prime brokers.

Viacom’s capital raising therefore failed, and all hell broke loose.

The curious regulation of variation margin

Now here is an interesting thing: instead of buying the stocks outright, Archegos put on its positions using a product called “synthetic prime brokerage”. Being based on equity swaps, synthetic prime brokerage is caught by uncleared margin regulations. This meant Archegos’ prime brokers were obliged to pay out unrealised gains[4] or “net equity” to Archegos, every day, in cash, in the form of “regulatory variation margin”. To be sure, prime brokers could impose thresholds by way of initial margin — oh, that’s another story altogether — but over those thresholds, variation margin is — at least till the next margin call —the client’s money. It is entitled to withdraw it upon request.

Now this is all completely normal in the world of latter-day derivatives: regulators mandated variation margin into pretty much every major market on the planet following the global financial crisis in the name of reducing systemic risk — but all the same, in the context of Archegos, it made a bad situation worse. It forced swap dealers to lend to their client against appreciating assets that were increasingly likely to then depreciate again.

Imagine if your bank, by law, had to pay you out the cash value of any increase in your home’s value during the term of your mortgage. Nuts, right?

Now had Archegos bought real shares using margin loans from its prime brokers, the brokers would not have had to pay out the cash value any asset appreciation. To be sure, they may well have willingly done so – margin lending is how prime brokers make their money, after all — but being able to lend a customer money, and having to lend it money, are quite different propositions, especially on the day the whole world is going to hell.[5]

A dissonance

So there is a dissonance between physical prime brokerage, where lending against assets is at the prime broker’s discretion — oh, sure, you may withdraw your net equity at any time, but you have to take it in kind[6] or liquidate your position, if you want it in cash — and synthetic prime brokerage, where cash payout of variation margin is required by law.

That’s worth dwelling on, by the way: if you buy a share, it goes up and you then sell it — sure, you get all your cash, but you go off risk. If the share price tanks the next day, no-one loses anything. You’ve closed out your stake and taken your money off the table. With variation margin, you get to keep your stake and take your money off the table.

Since, for swaps, this is required by co-ordinated world-wide regulation, it doesn’t take great imagination to read across to physical positions since they are, to all intents and purposes, economically identical. “Hang on a minute,” clients will say, “you have to pay out my cash equity value under a swap, right? So why can’t you may me the cash value of my physical positions in the same way?”

On its face, this is a fair question, to which the answer is either: “Huh. I hadn’t thought of that. Yes, I suppose you are right. Here you go!” — call this the “all other captains” argument; or: “Well that just goes to show what a misconceived idea compulsory two-way variation margin is. There’s no way on God’s green earth I’m automatically paying out your equity in cash”.

The JC prefers the latter position.

“Come on, JC: we you delight in pretending to be a cranky old bugger. But, really, do you mean to swim against the tide of all that consensus?”

Hold my beer.

Banking, in the good old days

In the good old days — in the time of the Children of the Forest, before the First Men — the overall vibe of the financial system was circumspect, self-imposed prudence: musty institutions, staffed by Captain Mainwaring-types, providing stodgy, unflamboyant loans and broking services to clients who were grateful to be offered them, and who would produce whatever sureties their banks required as a condition to being allowed to do business.

The financial services industry cleaved, basically, into two types of participant: intermediaries and customers. We have waxed elsewhere about the countless ways financial services institutions can contrive to interpose themselves into processes that oughtn’t to need intermediating, but let us, for today’s outing, take it as we find it.

Intermediaries

Intermediaries come in many shapes and sizes: market infrastructure — stock exchanges, clearing systems, securities depositories and so on; those who earn only a commission from their involvement, and take no principal risk[7] — cash brokers, investment managers, clearers, market-makers and intermediate brokers; and those who do take principal risk, but only by lending to their customers, and generally don’t participate in the upside[8] of the investments they are financing: banks.

All of these intermediaries have one thing in common: their remuneration does not depend on how their customer’s investments perform, until they perform so badly they cause the customer’s bankruptcy. Intermediaries do not have skin in the game. They are not supposed to lose any money, let alone billions of dollars of the stuff.

Customers

Customers, of course, do have skin in the game: they take all the benefits — less their intermediaries’ fees, commissions and financing costs — and are first[9] to absorb the losses of their investments. They may be institutional (pension funds, investment funds, multinationals) or retail and while the range of investment products they can invest in will depend on their sophistication and financial resources, usually they are not subject to any kind of prudential regulation. Customers can, and do, blow up.

Speculative investment vehicles like hedge funds may be highly geared and quite likely to blow up. This is where intermediaries have some second-loss tail risk: if the customer has blown up, the intermediary loses anything the customer still owes it. Investment funds have no capital buffer. When they “gap” through zero, their counterparties absorb all remaining market risk, despite wishing to have none of it. Brokers, banks and and dealers do have a capital buffer, and if their clients’ positions gap through zero, can usually absorb even significant losses.

In any weather, until the early 1980s, you were either a customer or an intermediary and the above was all quite well settled.

But innovations in the market, technology and regulation began to change things.

The multi-coloured swap shop

The history of swaps is interesting and well-documented. It all started in earnest in 1981, with a bright idea Salomon Brothers had to match up IBM, who needed U.S. dollars but had a load of Swiss francs and Deutschmarks, with the World Bank, which had all the dollars anyone could need but needed to meet obligations in CHF and DEM which it wasn’t able to borrow. The two institutions “swapped” their debts, exchanging dollars for the European currencies and paying coupons on them, with an agreement to return the the same values of the respective currencies at maturity.

Everyone else recognised this to be a cool idea, and before you know it, swaps trading was a trillion dollar industry. Okay; this took twenty years, but in the geological history of finance from the time of Hammurabi, a couple of decades is the blink of an eye.

But anyway, note a few things: unlike traditional banking activity where there is a lender and a borrower, and they stay put throughout the loan, swaps are bilateral. In one sense, both parties were lending to each other — hence they were not just parties, but “counterparties”.[10] In another sense, neither was: as long as you could offset the swapped loans at inception, a swap trade is market neutral: each “lends” the other something of equal value.[11]

But the respective values of those lent “somethings” do not stay put, and so the economic profile of a swap — being the prevailing value of one of those “somethings” minus the prevailing value of the other — does not stay neutral. Its “mark-to-market value” will change. Depending on how the cross-rates move, either party can be owed money. Hence, the concept of “moneyness”: on any day, either party to a swap can be “in-the-money” — if the “something” it owes the other party is smaller than the “something” the other party owes it — or out-of-the-money, if it owes more than it is due.

This whole idea of “moneyness”, and either party potentially being owed money, was quite a new thing, and it really challenged the philosophy of financial services regulation. Until now, there had always been an intermediary and a customer, and you always knew who was who: the intermediary was authorised, regulated to provide its services and appropriately capitalised to protect the customer;[12] the customer didn’t need to be regulated as it the intermediary could obviously look after itself.

Swaps challenged all that: now either party could be creditor or debtor. It was hard to know who to regulate. Who needed protecting from whom? Did they both have to be regulated? Or neither? For the first couple of decades, the answer was basically “neither”.[13]

Intermediaries, redux

So, the clarity about who was an intermediary broke down a little. Swaps did not necessarily need an intermediary at all, though in practice these days there usually is one: the very first swap, between IBM and the World Bank, was between two customers, or “end-users”, in that each took principal risk to the transaction. And there is an entire realm of swap trades between intermediaries, where neither side is a “customer” as such.

But the huge preponderance of swap volume is between an intermediary — a “swap dealer” — on one side and a customer — on the other.

So, are swap dealers “intermediaries” in the traditional sense, having no “skin in the game”? In one sense, no: being a principal to the swap contract, the dealer takes the other side of the trade to its customer, and is fully exposed to the underlier’s performance. But in another sense, yes: it is an intermediary: swap dealers generally delta-hedge their risk. In many cases are prohibited by regulation from taking proprietary positions.[14] In the classic case of equity swaps, the dealer executes a physical trade in the cash market, holds or finances that position, and prices its swap at exactly that price. It has no net exposure to the trade at all. Economically, it is no different from a broker lending on margin.

And there’s the thing: if you regard a margin loan as an intermediary lending a customer a fixed sum to buy an asset, it seems absurd that the banker should in some cases be obliged to pay the borrower more money. It’s like, no, dude, you borrowed from me. If you want your profit, sell your position, pay me back, and then you can have your profit. Why should it be different because you traded on a swap?

The conventional answer is, “because under a swap, I now have credit exposure to you for that profit and, you know, Lehman.” Yes, it is our old friend the Lehman horcrux. Let’s come back to that.

Deregulation and electronic trading

At about the same time computer-based trading was revolutionising the financial markets, the madcap spirit of 1980s free-love laissez-faire delivered their radical deregulation. It is not unreasonable to suppose these conditions contributed to an explosion in the market for swaps during the 1980s.[15]

It did not take long for folks to realise that these new swap things presented a whole new class of risks.[13] Swaps provide “unfunded” financial exposure to assets: you don’t own the assets, much less pay for them: the idea of exchanging notional amounts fell away and, besides initial margin, you didn’t have to put any money down at all. Given the size of individual swap transactions — typically in the millions of dollars — it didn’t take many transactions before total notional exposures were collossal. Practitioners in the market hit upon two neat tricks to manage these risks: netting and credit support.

Netting

We are not really concerned with netting here — the JC has plenty to say on that topic elsewhere — so let’s quickly deal with it: just as you could offset the present value of the opposing legs of each transaction to calculate a positive or negative mark-to-market value for that swap, so too could you offset positive and negative mark-to-market values for different swap transactions with the same customer to arrive at a single net exposure for your whole ISDA Master Agreement. This idea — close-out netting — was a stroke of genius, and the brave commandos of ISDA’s crack drafting squad™ encoded this “single agreement” concept into the 1987 ISDA and its successors. Giving effect to netting contracts, and attaining the capital relief they promise is now a multi-million-dollar industry of weaponised tedium.

Credit support

But even with netting, the levered nature of swap transactions means that overall net exposures can still swing around wildly.

In 1994 ISDA released a “credit support annex” to the ISDA Master Agreement under which the parties could exchange “credit support” to offset their respective net exposures. This is all rather complicated and fiddly[16] but the gist of it is that you calculate your net exposure under an ISDA Master Agreement on any day and, if it is over an agreed threshold, you can require your counterparty to “post” you collateral for that exposure. If the exposure then swings back towards your counterparty tomorrow, it can require you to return equivalent assets. Rinse and repeat.

This is rather neat, because it “zeroes out” each party’s credit exposure to the other each day.

Like the ISDA Master Agreement, the CSA is a bilateral document: it assumes the parties are equal, arm’s-length counterparties and that each can post to the other. In the early days, swap dealers often adjusted their CSAs so that only the customer posted credit support. This made sense, since swap customers tend not to be prudentially regulated or heavily capitalised, whereas intermediaries and swap dealers usually are.

The solvency risk of banks and intermediaries was managed by prudential regulation, risk weighting and capital ratios. Over this period, the Basel Committee published increasingly stringent and detailed rules[17] about how much capital banks should hold against their trading exposures to their customers.

If at first customers were less bothered about the creditworthiness of their swap dealers,[18] this all changed, fast, during the 2008 financial crisis in which every major dealer had at least a near-death experience, and a number — Lehman, Merrill Lynch, Bear Stearns, and literally dozens of others[19] had actual ones.

Suddenly the dealers, themselves were a source of systemic risk.

The regulatory reform machine moved into overdrive; the era of unregulated derivatives was over. Regulators the world over began requiring all swap counterparties, prudentially regulated or not, to provide variation margin on all common forms of swap contract: bilateral, daily, and in cash.

|

Premium content

Here the free bit runs out. Subscribers click 👉 here. New readers sign up 👉 here and, for ½ a weekly 🍺 go full ninja about all these juicy topics👇

|

See also

References

- ↑ Goldsmith, Armitage & Berlin, Teach Yourself Law, Book IV; The Open University Criminology Course, Part I; The Perry Mason Book For Boys, 1962, needless to say.

- ↑ Report on Archegos Capital Management

- ↑ As it was a synthetic position, Viacom may not have realised that Archegos was the only buyer in town: if it had, it may never have tried to raise capital in the first place.

- ↑ For prime brokers charging “dynamic margin” this was partly offset by the effect of increased initial margin required on the inflated value of the position in question; for those charging only a static margin amount, there was not even that fig-leaf.

- ↑ It is fair to note that — with the possible exception of the vampire squid — Archegos’s brokers did not believe the world was going to hell, at least not until it was far too late. But the principle remains.

- ↑ Withdrawing net equity in the form of the shares themselves, rather than their cash value, has a very different effect on the prime broker’s risk profile. It makes the client’s portfolio less volatile; withdrawing cash makes it more volatile.

- ↑ I include here “quasi-agent” roles that are conducted on a riskless principal, but (absent insolvency) are economically neutral: thse participants are remunerated by commission or fixed mark-up and do not have “skin in the game”.

- ↑ Nor, for the most part, down-side, barring “gap losses” where, due to portfolio losses, the customer is insolvent and cannot repay its loan.

- ↑ Of course, if the investors should run out of sponges, or their buckets are all full, while there are still some losses left to go round, these get passed to the poor bankers and intermediaries who may still be owed something. This is why we say investors have a “first-loss” risk: once they have been wiped from the horizon, any remaining losses go to the investors’ creditors, who thus have “second-loss” risk, whether they like it, or even know it, or not.

- ↑ Or maybe this just means they sat at a counter. This has just occurred to me. Why not? These are over-the-counter derivatives, after all.

- ↑ Law students will know this notion of enforceable set-off is a tricky one, especially if you are trading across international markets, where insolvency regimes are capricious, and might struggle to understand it, in a way they tended not to struggle with ordinary secured lending. Hence the great, tedious topic of netting, which isn’t wildly germane to this essay except to point out that credit mitigation for swaps by set-off, not security, and credit risk can swing around, depending on the market value of the underlying obligations.

- ↑ And its depositors: also customers.

- ↑ 13.0 13.1 Hence widespread allusions to the wild west, locusts, black swans, casino banking, financial weapons of mass destruction and so on.

- ↑ This is the famous “Volcker Rule”.

- ↑ These three forces combined to create a mammoth. Citadel estimates USD interest rate swaps volumes went from from zero in 1981 to over half a billion dollars by 1987.

- ↑ See our CSA Anatomy, for as much detail as any one person could want.

- ↑ Basel I was 30 pages. Basel II, published June 2006 (whoops!) was 347 pages. Basel III, as of September 2021, is 1626 pages.

- ↑ To be sure, sophisticated investment managers were already requiring their dealers post variation margin by the the start of the new millennium.

- ↑ This is a fun list.