Definitions: Difference between revisions

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit |

Amwelladmin (talk | contribs) No edit summary Tags: Mobile edit Mobile web edit |

||

| Line 1: | Line 1: | ||

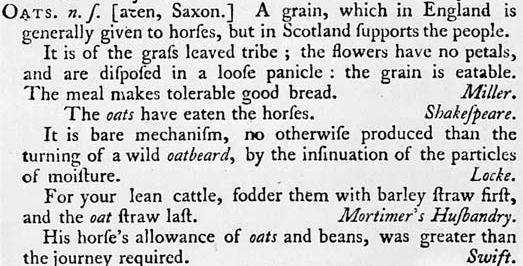

{{a|drafting|{{image|Oats|png|}}}} There is nothing that gives away a commercial quite like her innate yen for particularity. Whether borne of a basic fear of the unexpected, should one leave things unclarified — a common enough standpoint — or of a personality so besotted with crushing detail as to be unable to resist minutiae when the opportunity arises, the trait manifests in the [[defined term]]: a brief passage that puts a given ''noun'' or ''concept'' in relation to a specified ''designator'' — these days the fashionable term is “''token''” of some kind. | {{a|drafting|{{image|Oats|png|}}}}There is nothing that gives away a commercial solicitor quite like her innate yen for particularity. Whether borne of a basic fear of the unexpected, should one leave things unclarified — a common enough standpoint — or of a personality so besotted with crushing detail as to be unable to resist minutiae when the opportunity arises, the trait manifests in the [[defined term]]: a brief passage that puts a given ''noun'' or ''concept'' in relation to a specified ''designator'' — these days the fashionable term is “''token''” of some kind. | ||

This provides our legal eagle the satisfaction, or deliverance from evil of knowing that the referent is adequately ''elucidated'' in one place, and efficiently ''designated'' everywhere else. | This provides our legal eagle the satisfaction, or deliverance from evil of knowing that the referent is adequately ''elucidated'' in one place, and efficiently ''designated'' everywhere else. | ||

Revision as of 19:04, 19 December 2022

|

The JC’s guide to writing nice.™

|

There is nothing that gives away a commercial solicitor quite like her innate yen for particularity. Whether borne of a basic fear of the unexpected, should one leave things unclarified — a common enough standpoint — or of a personality so besotted with crushing detail as to be unable to resist minutiae when the opportunity arises, the trait manifests in the defined term: a brief passage that puts a given noun or concept in relation to a specified designator — these days the fashionable term is “token” of some kind.

This provides our legal eagle the satisfaction, or deliverance from evil of knowing that the referent is adequately elucidated in one place, and efficiently designated everywhere else.

A definition is thus a kind of legal “technology”: an evolutionary trick that solves a perennial problem — or at any rate scratches a perennial itch.

And it manifests just the same familiar unexpected consequences: a device designed to make passages easier to digest can have the effect of making them harder.

A boon and a bane. On one hand they can cut through needless word-proliferation:

“ERISA” means The Employee Retirement Income Security Act of 1974 (Pub.L. 93–406, 88 Stat. 829, enacted September 2, 1974, codified in part at 29 U.S.C. ch. 18) as amended, restated or superseded from time to time.”

On the other, they can complicate a document by obliging the reader to flip back and forth to find what the definitions mean, especially where the definitions are embedded in the body of the agreement and not set out in a separate definitions section. And let’s face it: if you work in international finance and you don’t already know what “ERISA” means, you really need to get your coat.

Now dear old ISDA loves definitions, and you will be obliged to consult one or several definitions booklets, often with conflicting definitions, as well as the definitions in ISDA Master Agreement, the Schedule and the Confirmation to work out what a capitalised expression might mean.

Approach

How to use definitions

How many? Err on the side of fewer rather than more, but a decent rule of thumb is how much text do you save?. The longer a turgid expression is; the more it appears, the more justified you are in defining it.

Where? If a term appears throughout the agreement, put its definition in a glossary or definitions section at the end. This is a core design principle. Definitions should be bits of extraneous detail that are not critical to the general thrust of the text, but useful amplification should a reader need it: rather like footnotes. For God’s sake, don’t put them at the start of an agreement. Would you start reading a book with the footnotes? If the expression only appears in one clause, define it inline in the clause. Guiding principle: how easy is it to find? Is the reader’s “user experience” better putting the definition at the back or inline? Use your common sense.

When to use definitions

In two cases:

Firstly, to save repetition of a wordy phrase that appears a LOT in the agreement: to gather together disparate concepts into a single expression which would not otherwise be obvious. But if the phrase, however prolix, only appears twice or three times, why define it? “Securities, financial instruments or other financial assets standing to the credit of the custody account” is harder to get through than “Custody Assets”. Though do you really need to define this at all? What else, realistically, could you mean by “custody assets”?

Secondly, to create a new technical expression that doesn’t otherwise mean anything: Let’s say US accounting rules require an investor has the right to exchange its asset-backed security for the beneficial interest in the assets underlying the note. (Well, you never know, right?) You might call this the “BIE Option”. Sure, it’s confusing, but no more confusing than the actual obligation in the first place.

When not to use definitions

When the meaning you propose to give to your definition is obvious. Everyone knows what the “EU” means. Everyone knows what “MiFID 2” means. Everyone (right?) knows what “ERISA” means.

This is especially when the proposition sought to be achieved is not in the slightest bit controversial in the first place. Take the dear old financial collateral regulations, which impose sensible standardisations and strike out pointless formalities when registering security interests on financial assets. Everyone knows what they are, everyone likes them, everyone agrees they save time, effort and box-ticking angst. So do you need to define exactly what they are? No. So, does this markup at any value to anyone in the world, in any way whatsoever?

this security interest constitutes a financial collateral arrangement as defined in the Financial Collateral Regulations (No. 2) Regulations 2003 (SI 2003/3226)(as amended from time to time (the “Financial Collateral Regulations”)

I humbly submit it does not. Especially since, notwithstanding all that towering anality, the miserable blighter didn’t even get it right. It is the “The Financial Collateral Arrangements (No.2) Regulations 2003”.

Git.

Components

The signifier

Make the signifier — the label — as short and snappy as you can whilst remaining intuitive enough that an attentive reader can easily infer to what what it refers, so the reader needing to flip to the definitions to see what the signifier means. You might not know what “ERISA” means first time you come across it, but once you do, you will never forget it (trust me) so it is an excellent signifier for “The Employee Retirement Income Security Act of 1974 (Pub.L. 93–406, 88 Stat. 829, enacted September 2, 1974, codified in part at 29 U.S.C. ch. 18) as amended, restated or superseded from time to time.”

By contrast “Applicable Amount”, “Relevant Date”, or “Notice” — these are not effective signifiers. Applicable to what? Relevant to what? Notice of what? If you are eighty pages into a security trust deed at 3 o’clock the morning before signing, stumbling across as meaningless a signifier as this will not help your frame of mind.

On the other hand, you can take things too far: “Noteholder Early Redemption Option Exercise Notice” — real life example — barely saves any space at all, especially when all it means is “a notice in the form set out in Schedule 4 (Form of Noteholder Early Redemption Option Exercise Notice) of the Agency Agreement.” This definition falls into the other trap of being so intuitive that is doesn’t need to be a definition at all (see When to use definitions above).

The definition as Biggs Hoson

The final way to use definitions is as some kind of hymn to pedantry. This appeals to fans of Havid Dilbert’s programme to find a complete and consistent set of axiomatic legal propositions. Dilbert’s programme eschews the undefined use of any expression, however banal or self-evident, in any agreement, on the grounds that it opens the way to Cardozo indeterminacy. Thus where we find undefined words, we define them exactly as they are, to avoid a doubt so minuscule it heartily crosses the threshold between completeness and paranoia:

An insured person (the “insured person”) may cancel (“cancel”) a policy (the “policy”) by providing us as insurer (“us” or the “insurer”) a written notice (the “written notice”) of the cancellation (the “cancellation”).[1]

There is a vigorous debate presently going on in the halls of eaglery as to whether these definitions add anything at all: do they, at their limit, convey some sort of asymptotic safety by silently constraining buried metaphorical dimensions to otherwise unfettered characters? There are those who say they do — that this effect, however subliminal is there: this is, in effect, a surprising instance of a Biggs Hoson — and those that say they cannot: delimiting a textual artefact to exactly itself cannot convey even that minimal particle of legal meaning that the great J. M. F. Biggs once so famously discovered.

See also

- Certainty

- Doubt

- Definitions - ISDA Master Agreement

- Definitions - 2010 GMSLA

- Definitions - Global Master Repurchase Agreement

- Definitions - 1995 CSA

References

- ↑ We were inspired by the ever-resourceful, ever-patient Andrew Pegler Media for this example, which we fully admit to exaggerating.