Template:M summ Equity Derivatives 8: Difference between revisions

Amwelladmin (talk | contribs) |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

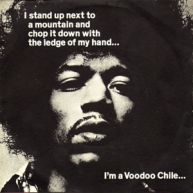

[[File:Slight return.jpg|left|thumb|193x193px|A [[Cash-settled - Equity Derivatives Provision|cash-settled]] [[slight return]] swap yesterday]] | [[File:Slight return.jpg|left|thumb|193x193px|A [[Cash-settled - Equity Derivatives Provision|cash-settled]] [[slight return]] swap yesterday]] | ||

{{equity swaps versus forwards}} | {{equity swaps versus forwards}} | ||

=== | === Section {{eqderivprov|8.6}}: {{eqderivprov|Cash Settlement of Equity Swap Transactions}} === | ||

{{eqderivprov|Equity Swap Transaction}}s can be settled either by reference to {{eqderivprov|Price Return}} or {{eqderivprov|Total Return}}, but not [[slight return]]. | {{eqderivprov|Equity Swap Transaction}}s can be settled either by reference to {{eqderivprov|Price Return}} or {{eqderivprov|Total Return}}, but not [[slight return]]. | ||

| Line 8: | Line 8: | ||

{{Type of Return and swaps on futures}} | {{Type of Return and swaps on futures}} | ||

==={{eqderivprov|Equity Amount}}=== | ===Section {{eqderivprov|8.7}}: {{eqderivprov|Equity Amount}}=== | ||

{{eqderivprov|Equity Amount}}s, then. Straightforward enough: Take your {{eqderivprov|Equity Notional Amount}} — helpfully filled out in the {{eqderivprov|Confirmation}} — multiply it by the {{eqderivprov|Rate of Return}}, being the performance of the underlying share over the period in question — and there’s your number. | {{eqderivprov|Equity Amount}}s, then. Straightforward enough: Take your {{eqderivprov|Equity Notional Amount}} — helpfully filled out in the {{eqderivprov|Confirmation}} — multiply it by the {{eqderivprov|Rate of Return}}, being the performance of the underlying share over the period in question — and there’s your number. | ||

Let’s put some numbers on this, because, as with many of the finer creations of {{icds}}, there is quite a lot of buried technology in there to unpack. | Let’s put some numbers on this, because, as with many of the finer creations of {{icds}}, there is quite a lot of buried technology in there to unpack. | ||

| Line 23: | Line 22: | ||

*'''Where the stock went ''up''''': USD1,000,000 * {{font colour|green|+5%}} = USD{{font colour|green|+50,000}}. | *'''Where the stock went ''up''''': USD1,000,000 * {{font colour|green|+5%}} = USD{{font colour|green|+50,000}}. | ||

*'''Where the stock went ''down''''': USD1,000,000 * {{font colour|red|-5%}} = USD{{font colour|red|-50,000}}. | *'''Where the stock went ''down''''': USD1,000,000 * {{font colour|red|-5%}} = USD{{font colour|red|-50,000}}. | ||

===Section {{eqderivprov|8.8}}: {{eqderivprov|Cash Settlement Payment Date}} === | |||

A provision that does very little to help an inquiring mind with the question “What is the {{eqderivprov|Cash Settlement Payment Date}} actually, like, ''for''?” | |||

For that, you would be advised to consult Section {{eqderivprov|8.6}}, {{eqderivprov|Cash Settlement of Equity Swap Transactions}}, which differentiates between “{{eqderivprov|Price Return}}”, which concerns itself purely with the prevailing equity price of the underlier, and “{{eqderivprov|Total Return}}” which also factors in [[dividend]]s paid on the relevant stock, and “[[slight return]]”, which is a Jimi Hendrix song.<ref>It doesn’t really relate to [[slight return]], though that is a Jimi Hendrix song.</ref> | |||

Note: {{eqderivprov|Dividend Amount}}s are typically payable on the {{eqderivprov|Cash Settlement Payment Date}} — though the Cash Settlement Payment Date following what — that is the question, whose answer, it turns out, is a little bit odd, as you will see if you investigate further. | |||

===Shorts, longs and flexi-transactions=== | ===Shorts, longs and flexi-transactions=== | ||

Now as you know, the {{isdama}} is a bilateral construct — In a funny way, a bit [[Bob Cunis]] like that — and while the [[equity derivatives]] market is largely conducted between dealers and their clients, this doesn’t mean the [[dealer]] is always the {{eqderivprov|Equity Amount Payer}}. The client — as often as not, a [[hedge fund]] — is as likely to be taking a [[short]] position — [[locusts]], right? — as a [[long]] one. One does this by reversing the roles of the parties in the {{eqderivprov|Confirmation}}: The {{eqderivprov|Equity Amount Payer}} for a ''[[long]]'' transaction will be a [[Swap dealer|dealer]]. The {{eqderivprov|Equity Amount Payer}} for a ''[[short]]'' transaction will be the [[Hedge fund|fund]]. | Now as you know, the {{isdama}} is a bilateral construct — In a funny way, a bit [[Bob Cunis]] like that — and while the [[equity derivatives]] market is largely conducted between dealers and their clients, this doesn’t mean the [[dealer]] is always the {{eqderivprov|Equity Amount Payer}}. The client — as often as not, a [[hedge fund]] — is as likely to be taking a [[short]] position — [[locusts]], right? — as a [[long]] one. One does this by reversing the roles of the parties in the {{eqderivprov|Confirmation}}: The {{eqderivprov|Equity Amount Payer}} for a ''[[long]]'' transaction will be a [[Swap dealer|dealer]]. The {{eqderivprov|Equity Amount Payer}} for a ''[[short]]'' transaction will be the [[Hedge fund|fund]]. | ||

Revision as of 08:43, 17 May 2022

On the difference between Final Price and Relevant Price

Final Price is defined in Article 5 of the 2002 ISDA Equity Derivatives Definitions and is germane therefore to Equity Swap Transactions only and not, say, Forward Transactions (which, circuitously, rely instead on Relevant Price, albeit defined in a similar way).

The Final Price also has separately broken-out scenarios for Basket Transactions (being just the weighted sums of the individual components in the basket). Relevant Price doesn’t bother to break these out — whether that is because Share Basket Forwards behave differently to Basket Swaps, or just because ISDA’s crack drafting squad™ was losing the will to live, is a question to which we have yet to get to the bottom.

Don’t hold your breath.

Section 8.6: Cash Settlement of Equity Swap Transactions

Equity Swap Transactions can be settled either by reference to Price Return or Total Return, but not slight return.

Under Section 8.6 (Cash Settlement of Equity Swap Transactions) where “Cash Settlement” applies, a payment is made on each Cash Settlement Payment Date depending on the Type of Return specified as follows:

Price Return

Price Return is simply a function of the price at the beginning and end, and takes no account of declared dividends or other income or distributions received off the underlier in the meantime. It is simply

Where “Rate of Return” is

((Final Price - Initial Price)/Initial Price) * any Multiplier

The Equity Amount is paid one way or the other depending on whether it is positive or negative.

Total Return

Total Return is the Price Return, but adjusted for income.

Where Re-investment of Dividends does not apply, the Equity Amount Payer must pay Dividend Amounts along with the Equity Amount, whichever way it might be paid, as per Price Return.

Where Re-investment of Dividends does apply, then Equity Amounts will be adjusted as per the “Re-investment of Dividends” provision.

Types of return when referencing futures

If you have an Equity Swap Transaction referencing a future, some debate — not all of it necessarily fruitful, but undoubtedly special in the hearts of those who enjoy metaphysical conundrums — can be had as to whether one should select Price Return or Total Return as your Type of Return, but since futures don’t generally pay dividends, on point of practical fact there is not a lot of difference, so such debate can aggravate intensely practical people such as my little sister, who despair of metaphysical conundrums.

But okay, dammit, let’s hop off the fence and stick Occam’s razor into the ointment: Since Total Return is Price Return with some extra fiddly bits relating to dividends — including the need to choose whether or not you want your dividends deemed to be reinvested — then all other things being equal — such as when, as for futures, there are no dividends for you to elect whether or not to reinvest — Price Return is the simpler, and therefore preferred, definition. There: for Equity Swaps on futures, go for Price Return.

Section 8.7: Equity Amount

Equity Amounts, then. Straightforward enough: Take your Equity Notional Amount — helpfully filled out in the Confirmation — multiply it by the Rate of Return, being the performance of the underlying share over the period in question — and there’s your number.

Let’s put some numbers on this, because, as with many of the finer creations of ISDA’s crack drafting squad™, there is quite a lot of buried technology in there to unpack.

The first component is the Rate of Return. This is a calculation of the performance of the Share over the period, times a Multiplier which might apply if you are doing some kind of kooky leveraged trade, but more likely will account for capital gains or stamp duty payable by the broker on the underlying hedge — so you might expect something like 85%. But that makes the mathematics too complicated for this old fellow, so let’s call the Multiplier 100%, so you can ignore it, and say the Initial Price is 100. And let’s do two scenarios: where the stock has gone up — here say the Final Price is 105, and where the stock has gone down — here, say the Final Price is 95.

The Rate of Return formula is (Final Price - Initial Price)/Initial Price) * Multiplier, which works out as:

- Where the stock went up: (105-100)/100 * 100% = 5/100 = +5%.

- Where the stock went down: (95-100)/100 * 100% = -5/100 = -5%.

Now to calculate your Equity Amount, we take the Equity Notional Amount (for ease of calculation, say USD1,000,000?) and times it by the Rate of Return:

- Where the stock went up: USD1,000,000 * +5% = USD+50,000.

- Where the stock went down: USD1,000,000 * -5% = USD-50,000.

Section 8.8: Cash Settlement Payment Date

A provision that does very little to help an inquiring mind with the question “What is the Cash Settlement Payment Date actually, like, for?”

For that, you would be advised to consult Section 8.6, Cash Settlement of Equity Swap Transactions, which differentiates between “Price Return”, which concerns itself purely with the prevailing equity price of the underlier, and “Total Return” which also factors in dividends paid on the relevant stock, and “slight return”, which is a Jimi Hendrix song.[1]

Note: Dividend Amounts are typically payable on the Cash Settlement Payment Date — though the Cash Settlement Payment Date following what — that is the question, whose answer, it turns out, is a little bit odd, as you will see if you investigate further.

Shorts, longs and flexi-transactions

Now as you know, the ISDA Master Agreement is a bilateral construct — In a funny way, a bit Bob Cunis like that — and while the equity derivatives market is largely conducted between dealers and their clients, this doesn’t mean the dealer is always the Equity Amount Payer. The client — as often as not, a hedge fund — is as likely to be taking a short position — locusts, right? — as a long one. One does this by reversing the roles of the parties in the Confirmation: The Equity Amount Payer for a long transaction will be a dealer. The Equity Amount Payer for a short transaction will be the fund.

So much so uncontroversial. But then there are flexi-transactions: in these modern times of high-frequency trading, unique transaction identifiers and trade and transaction reporting, dealers and their clients are increasingly interested in consolidating the multiple trade impulses they have on the same underlyer into single positions and single transactions: this makes reconciling reporting far easier, and also means you don’t have to be assigning thousands of UTIs every day — at a couple of bucks a throw — to what is effectively a single stock position.

What does this have to do with Equity Notional Amounts? Well, the Equity Notional Amount of that single “position” transaction is now a moving target. A short trade impulse on a (larger) existing long position will reduce the Equity Notional Amount, but it won’t necessarily change who is the Equity Amount Payer, unless the total notional of the position flips from positive to negative. Then it will. This is kind of weird if you stand back and look at it from a stuffy, theoretical point of view, but once you slip into that warm negligee of pragmatism in which almost all legal eagles love to drape themselves, you get over it.

Well, I did, anyway.

- ↑ It doesn’t really relate to slight return, though that is a Jimi Hendrix song.