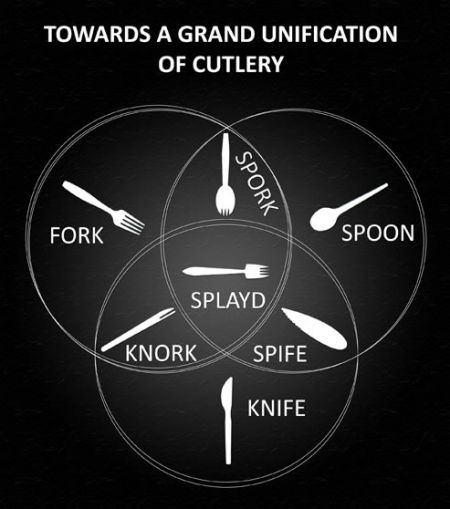

Grand unifying theory

|

What follows presumes you are in an institutional financial services world where even small client revenues are in the hundreds of thousands of dollars per year. I am thinking specifically of prime brokerage, since that’s what I know. But it ought to apply elsewhere too.

The commercial imperative, above all else, is to have clients coming back. How to have clients come back: have them want to come back. You catch more flies with honey than with vinegar.

Commitment

How to ensure clients stay with you? You indicate commitment to them. Indications of commitment:

- Expense/effort of communication: the thick card, embossed envelope — Rory Sutherland (this isn’t far from reciprocity: you make an overt investment that the client can see that you wouldn’t have made if they weren’t important to you)

- Build interpersonal relationships: Call them, weekly. Know who is who. Be on first-name terms with the receptionist. Don’t send mass-mailers to them. Ever. Invest time and capital with them. Let your operations people and their operations people get to know one another.

- Consider Robert Cialdini’s catalog of persuasive communication techniques: plenty are in play: reciprocity, commitment, scarcity, social proof.

“Your call is important to us”: Avoid the appearance of commoditisation

- Don’t commoditise: In your dealings with clients, avoid the appearance that they are just another customer, and you are managing to margins. Never put them in a triage queue. If you build automated products (direct market access for example), do this for their convenience, not yours, and charge accordingly. Your premium services should not be commoditised, and if it is (eg DMA) then augment it with a premium overlay of personally delivered analysis, insight, and market colour. By all means use tech below the waterline to help you deliver that personal insight, but only deliver it electronically where the client asks for that, and even there overlay that with more meta-coverage.

- This is not just a matter of appearances. Commoditised products have lower margins and provide less value. Standardisation and commoditisation:

- guarantee margins will tend to zero (if you have solved the risk you have also eliminated the premium, and in this day and age, it will vanish almost immediately: if you have automated it then so can everyone else: your market advantage is gone)

- Of course because of non-linear effects, in most cases you haven’t solved the risk; it is just that the market prices itself as if it has, because everyone labouring under the same modernist delusion that “we have comprehensively syndicated risk/banished boom and bust/reached the sunlit uplands”. Yet, black swan. And no, you cannot crunch more data and thereby anticipate/solve black swans.

- Indicates absence of commitment

- Allows a lack of client commitment: products and offerings are fungible: you can rebadge the same old crap and send to someone else.

- The risk/reward of greater effort to attract customers isn’t there. Hence the headlong rush to lean production management.

- Targets your offering at the mean — yet commitment is to be found at the edges — Rory Sutherland

- Embrace the non-standard: Target the bespoke, the tail events, the risk scenarios, off-piste; here be dragons:

- This is where the best opportunities are. This is where innovation will come from. This is where developments will emerge. Here the stakes are higher.

- Here you can’t manage by algorithm. You need experience; you need diversity; you need expertise. You need people comfortable with doubt and without certainty. Standard tropes and management bullshit will get found out. Ruthlessly.

- Here redundancy is an advantage — an imperative, not at all a competitive disadvantage.

- Here the bureaucratic layer can make itself useful in another way — instead of being the main player, the bureaucrats become the janitors, keeping the channels clean for the subject matter experts:

- Bureaucrats work on culling those clients who are not generating sufficient fees, despite the commitment and relationship capital thrown at them. This incentives salespeople, using their expertise, to either double down with clients, perhaps creating a scarcity dynamic in the client’s perception which is in itself persuasive (see Cialdini) and likely to improve yield, or to let the clients go. If each sales person is allotted only five clients, and told to treat them like royalty, then suddenly sales is incentivised to drop the non-performers, and seek the bureaucrats’s help to make that happen.

- Note also that the scale problems of managing a large portfolio of clients kick in precisely when you have too many tail clients and the cost ratio of providing top end service to all of them is out of all proportion, and some clot goes “why don’t we just send everyone a Silverpop”. The answer is to not have so many-low yielding tail clients that you can’t properly look after all of them. Also bear in mind the total cost of onboarding new clients is monstrous, and you are bringing in a class of clients that QED have a much shallower relationship than the ones who are exiting. The job is not to make the onboarding more efficient to deprecate the cost of churn, but to slow down or stop the churn.

Random thoughts

The high-modernist disposition has reorganised, not banished redundancy cost and slack but rerouted it from productive units into the administration layer. The generals/troops mix has inverted, with the atomisation of functions, each with its own colossal bureaucratic machine. It has converted functional redundancy — which in a complex environment, is a competitive advantage and only a drawback in a simple environment, as it maximises reactivity, creativity, agility and adaptability, but minimises central controllability — into administrative redundancy, which is a competitive advantage in a simple environment, as it prioritises control and mechanisation over a basically unnecessary (and dangerous) creativity and diversity. In a simple system control, discipline and execution is all there is: your perfect ratio is all administration and only machines executing