Additional Disruption Event definitions - Equity Derivatives Provision

|

2002 ISDA Equity Derivatives Definitions A Jolly Contrarian owner’s manual™

12.9(a) in all its glory

Resources and Navigation |

Overview

Section 12.9(a): The actual Additional Disruption Events

Section 12.9(a): Other definitions relating to Additional Disruption Events

To follow what’s going on you’ll need to understand the Consequences of an Additional Disruption Event, which is set out at Section 12.9(b).

Summary

Break these “Extraordinary Events” into four categories:

Corporate events on Issuers: Corporate Events are generally benign[1] but not always expected or even wanted adjustments to the corporate structure and management of specific underlying Shares — Tender Offers, Mergers, management buyouts and events that change the economic proposition represented by those Shares, and not the equity derivative contract. So: Merger Events and Tender Offers;

Index adjustments: For Index trades, unexpected adjustments and changes to methodologies and publishing strategies of underlying Index (as opposed to changes in the composition of the Index according to its pre-existing rules) — collectively call these “Index Adjustment Events”. So:

- Index Modification: Changes in the calculation methodology for the Index

- Index Cancellation: Where Indexes are discontinued with replacement;

- Index Disruption: disruption in the calculation and publication of Index values;

Negative events affecting Issuers: Nationalizations, Insolvency, Delisting of underlying Issuers;

Additional Disruption Events: Events which directly impair performance and risk management of the Transaction itself. These often cross over with market- and Issuer-dependent events above, but the emphasis here is their direct impact on the parties’ abilities to perform and hedge the derivative Transaction itself. So:

- The Triple Cocktail: The Triple Cocktail of Change in Law, Hedging Disruption and Increased Cost of Hedging;

- Stock borrow events: Specific issues relating to short-selling (Loss of Stock Borrow and Increased Cost of Stock Borrow); and

- Random ones that aren’t needed or used: Two random ones that don’t brilliantly fit with this theory, and which people tend to disapply — possibly for that exact reason, but they are fairly well covered by the Triple Cocktail anyway — Failure to Deliver under the Transaction on account of illiquidity and, even more randomly, Insolvency Filing[2].

Section 12.9(a)(i)

Template:M summ Equity Derivatives 12.9(a)(i)

Section 12.9(a)(ii)

“It has become illegal”

For those inclined to look even gift horses in the mouth, this provision may appear to leave some things unsaid.

What if it has become illegal to hold Shares the way the Hedging Party is holding them, but it remains legal to hold them some other way? For example, if Shares needed to be listed on a certain Exchange, or cleared across a certain clearinghouse? At first blush this seems fanciful but before you laugh don’t forget this was one of the potential consequences of Brexit — and for the Swissies — when the EU share trading obligation row blew up in 2019.

Even leaving aside the direction that one must act in good faith in arriving at one’s conclusion, it is hard to see how one could say it was “illegal to hold Shares” if in fact one could legally hold those Shares some other way. So this one’s a bit silly.

What if one could hedge via futures, derivatives, GDRs or some other instrument without significant extra cost or inconvenience? Would that still count as a Change in Law, just because you couldn't hedge with actual Shares?

But is “hold, acquire or dispose of Shares relating to such Transaction” too narrow when a Hedging Party may be able to hedge some other way (i.e., via futures, swaps, depositary receipts and so on)?

Well, as fussy as it may seem, it is hard to fault in its basic logic. The scope entertained by ISDA’s crack drafting squad™ does seem a shade narrow, talking as it does only of Shares and not other instruments by which one could hedge an exposure. Not even our old friend the good faith rider can win the day here, since the clause only talks about acquiring, holding or disposing of Shares themselves. On the other hand, if a jurisdiction has declared the very act of holding a physical Share illegal, it is hard to see anyone in the jurisdiction offering a swap on it, so this may be more of a theoretical than a practical objection, especially where it is a synthetic equity swap where the hedging party has no incentive not to accommodate its client if it can source an alternative legal, somehow-derivative, hedge.

You may be inclined, therefore, gracefully to concede. We don’t think you’ll have to do this often, this is a bit of an aficionado’s point. So, knee-slide and jet wings to the whoever the negotiator was who thought of it.

Section 12.9(a)(iii)

Not generally stipulated as an Additional Disruption Event because firstly it would only be relevant in a physically-settled equity swap, and for a host of reasons taking physical settlement at the conclusion of a synthetic transaction, whose point is partly to avoid a physical exposure, is a bit of a contradiction in terms. Now where you do, for reasons best known to yourself, elect physical settlement this provision allows the innocent party to buy-in and charge any cost differential to the failing party.

You may want to head over to Consequences of Failure to Deliver under 12.9(b)(ii), where you will discover that ISDA’s crack drafting squad™ have ploughed their own long, lonely, weird furrow about how to resolve settlement failures instead of copying what the cash equity markets and stock lending markets do. They’re fun like that, are the ’squad.

Section 12.9(a)(iv)

One tends to disapply this and instead rely on the famous Triple Cocktail so somewhat academic, but if you are minded to include it, note that an Insolvency Filing is wider than “Insolvency” Section 12.6(a)(ii). Also it differs from Bankruptcy in the ISDA Master Agreement, in that it has no grace period and cannot be triggered by creditor petitions etc.

As with Change in Law, an Insolvency Filing allows either party to terminate the Transaction upon at least two Scheduled Trading Days’ notice, whereupon the Transaction will terminate and the Determining Party will determine the Cancellation Amount.

Section 12.9(a)(v)

It isn’t brilliantly worded, but the spirit is clear: it is not just that your particular hedge that you actually had on went kaput, but that you could find any reasonably suitable replacement for it. You can’t be picky. Okay, the equities market might be locked up, but what about futures? I grant you, if the underlying market is disrupted, it’s likely the listed futures market will be too, but you never know. How about ADRs or GDRs?

Section 12.9(a)(vi)

Compare with Increased Cost of Stock Borrow, the equivalent provision where the Hedging Party is short.

Part of the famed “triple cocktail” of protections against unexpected problems hedging and risk managing Transactions, together with Hedging Disruption and Change in Law. Note also references to Hedging Party.

Excluding own credit deterioration

Increased Cost of Hedging excludes costs a Hedging Party incurs through the deterioration of its own credit — so it will tend to capture market wide cost increases, and exclude those that are personal to the Hedging Party. Assiduous sell-side brokers will try to cut out the “deterioration of own credit” wording. Muscular asset managers will tell them where to go.

Section 12.9(a)(vii)

Template:M summ Equity Derivatives 12.9(a)(vii)

Section 12.9(a)(viii)

A gentler provision than Loss of Stock Borrow — wherein the non-hedging party has to either find a stock borrow for the Hedging Party to execute, or be closed out of its position like that, under an Increased Cost of Stock Borrow, if the Hedging Party notifies an Increased Cost of Stock Borrow, specifying a proposed Price Adjustment, the non-Hedging Party has three options:

- Accept the Price Adjustment, the Transaction is amended and carries on as repriced;

- Make a one-off payment of the determined Price Adjustment; or

- Allow the dealer[3] to terminate the Transaction on the second Scheduled Trading Day.

Only if the Non-Hedging Party has failed to give any such election by the end of the second Scheduled Trading Day can the Hedging Party terminate the Transaction. The Non-Hedging Party can lend the Hedging Party the relevant Shares in the intervening period to mitigate its loss.

Section 12.9(a)(ix)

Relevant in the context of Additional Disruption Events and hedging disruption, the Hedging Party will be the entity actually carrying out the hedging activity, if it isn’t the party to the ISDA Master Agreement itself. If no Hedging Party is specified, it defaults to the parties themselves.

Note also the related concept of the Determining Party, who is the person calculating the replacement cost of the Transaction following an Extraordinary Event (e.g. termination following a Hedging Disruption, Change in Law or Increased Cost of Hedging).

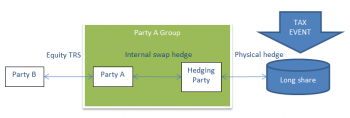

In this case there will be a string of intermediate hedging contracts — usually derivatives — but these may not behave in exactly the way that a real underlier would (in terms of market disruption, tax events, liquidity etc). and what the Equity Derivatives Definitions are meant to do is pass on the risk associated with the actual underlier.

So for example in the example pictured, Party A provide exposure to client, hedges that with a equity TRS to Hedging Party, which goes long the physical share. Now the Hedging Party, not Party A, has the risk of the physical assets. If there is a market disruption, or a tax event on the physical hedge this is reflected in the price that Hedging Party will have to pay to Party A, but it isn’t a market disruption or tax event directly on Party A itself (and in fact might not be – Party A might be domiciled in a jurisdiction benefitting from a different tax treaty with the jurisdiction of the underlier, for example). So in this case we need to reference the position as held by a person other than the counterparty to the swap.

Note also that “Non-Hedging Party” definition somewhat assumes that the Hedging Party will indeed be the actual counterparty to the Transaction.

Section 12.9(a)(x)

Template:M summ Equity Derivatives 12.9(a)(x)

Section 12.9(a)(xi)

Template:M summ Equity Derivatives 12.9(a)(xi)

Section 12.9(a)(xii)

Not epochally controversial, you would think, but it does sort of imply that the Hedging Party is itself a party to the Transaction — otherwise both parties are Non-Hedging Parties. But if so, then there's not really any need for the definition of Hedging Party at all.

What it is getting at is who is the dealer and who is the customer. Now in some cases a master agreement may be between two and users, but in the context of equity derivatives this is unlikely. The dealer will be delta hedging its position, and therefore essentially staying market neutral while the end user will come up by definition, not colon it's entire purpose for entering the equity derivative is to gain or lose some exposure to a Share or eqderivprov|Index}}.

JC has a lengthy essay on the relationship between dealers and customers under an ISDA Master Agreement. Two, in fact.

Premium content

Here the free bit runs out. Subscribers click 👉 here. New readers sign up 👉 here and, for ½ a weekly 🍺 go full ninja about all these juicy topics 👇

|

- The JC’s famous Nutshell™ summary of this clause

- Section-by-section analysis

See also

References

- ↑ “Benign” from the point of view of the target company’s solvency and market prospects; not quite so benign from its management team’s prospects of ongoing employment.

- ↑ especially since there is already an “Insolvency” event covering most of this).

- ↑ The dealer will always be the Hedging Party, though you may on occasion have trouble persuading buy-side counsel of this patently obvious fact.