Agent lender: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{a|gmsla|[[File:Triparty Diagram.png|thumb|500px|Like so]]}} | {{a|gmsla|[[File:Triparty Diagram.png|thumb|500px|Like so]]}}An [[agent]] (usually a [[financial institution]] with a significant [[wealth management]] or [[asset management ]] business) who [[Stock Lending|lends]] securities of its principals under [[stock lending]] arrangements. | ||

An [[agent]] (usually a [[financial institution]] with a significant [[wealth management]] or [[asset management ]] business) who [[Stock Lending|lends]] securities of its principals under [[stock lending]] arrangements. | |||

Valuable counterparties to banks who can “[[collateral upgrade|upgrade]]” their portfolio of equity securities by using them as collateral when borrowing high quality assets. | Valuable counterparties to banks who can “[[collateral upgrade|upgrade]]” their portfolio of equity securities by using them as collateral when borrowing high quality assets. | ||

| Line 8: | Line 7: | ||

Agent lending is a different thing to [[rehypothecation]] (actually, it is often the exact counterpoint) and one shouldn't confuse the two, especially if one is reading Article {{ucits5prov|22(7)}} of the {{t|UCITS V}} regulation. | Agent lending is a different thing to [[rehypothecation]] (actually, it is often the exact counterpoint) and one shouldn't confuse the two, especially if one is reading Article {{ucits5prov|22(7)}} of the {{t|UCITS V}} regulation. | ||

{{ | {{sa}} | ||

*[[Securities financing]] | |||

*[[Pledge GMSLA]] | *[[Pledge GMSLA]] | ||

*[[Rehypothecation]] | *[[Rehypothecation]] | ||

*[[Triparty agent]] | *[[Triparty agent]] | ||

Latest revision as of 11:06, 13 April 2022

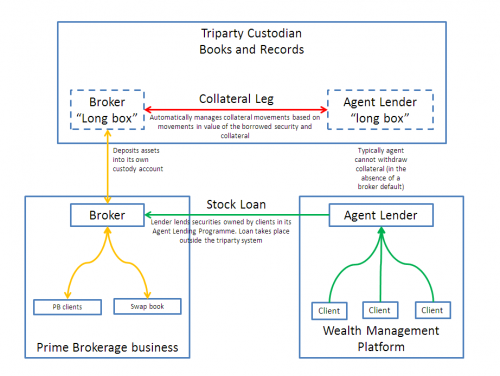

An agent (usually a financial institution with a significant wealth management or asset management business) who lends securities of its principals under stock lending arrangements.

Valuable counterparties to banks who can “upgrade” their portfolio of equity securities by using them as collateral when borrowing high quality assets.

Goes hand in hand with a tri-party collateral arrangement

Agent lending is a different thing to rehypothecation (actually, it is often the exact counterpoint) and one shouldn't confuse the two, especially if one is reading Article 22(7) of the UCITS V regulation.