Agent lender: Difference between revisions

Jump to navigation

Jump to search

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 8: | Line 8: | ||

Agent lending is a different thing to [[rehypothecation]] (actually, it is often the exact counterpoint) and one shouldn't confuse the two, especially if one is reading Article {{ucits5prov|22(7)}} of the {{t|UCITS V}} regulation. | Agent lending is a different thing to [[rehypothecation]] (actually, it is often the exact counterpoint) and one shouldn't confuse the two, especially if one is reading Article {{ucits5prov|22(7)}} of the {{t|UCITS V}} regulation. | ||

{{ | {{sa}} | ||

*[[Pledge GMSLA]] | *[[Pledge GMSLA]] | ||

*[[Rehypothecation]] | *[[Rehypothecation]] | ||

*[[Triparty agent]] | *[[Triparty agent]] | ||

Revision as of 11:36, 18 January 2020

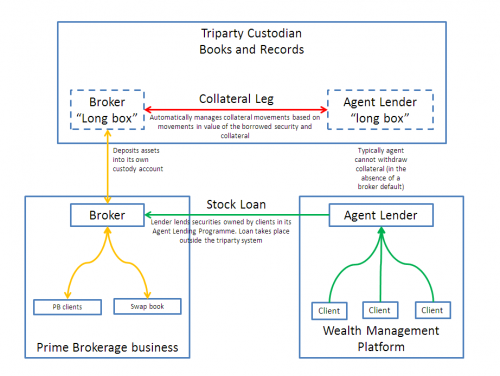

An agent (usually a financial institution with a significant wealth management or asset management business) who lends securities of its principals under stock lending arrangements.

Valuable counterparties to banks who can “upgrade” their portfolio of equity securities by using them as collateral when borrowing high quality assets.

Goes hand in hand with a tri-party collateral arrangement

Agent lending is a different thing to rehypothecation (actually, it is often the exact counterpoint) and one shouldn't confuse the two, especially if one is reading Article 22(7) of the UCITS V regulation.