Stakeholder capitalism: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{a|devil| | {{a|devil| | ||

[[File:Stakeholder.png|450px|thumb|center|A stakeholder yesterday. Well, it was this or a picture of Peter Cushing, folks.]] | [[File:Stakeholder.png|450px|thumb|center|A stakeholder yesterday. Well, it was this or a picture of Peter Cushing, folks.]] | ||

}}Once upon a time, not terribly long ago, the [[shareholder]] was an opaque yet sacred being, somewhat divine, to whose improving ends everyone engaged in the company’s operation twitched their every fibre. This ''will to shareholder return'' sprang from the brow of {{author|Adam Smith}} | }}Once upon a time, not terribly long ago, the [[shareholder]] was an opaque yet sacred being, somewhat divine, to whose improving ends everyone engaged in the company’s operation twitched their every fibre. | ||

This ''[[Shareholder capitalism|will to shareholder return]]'' sprang from the brow of {{author|Adam Smith}} and his [[invisible hand]]: | |||

{{quote|“...Though the sole end which they propose from the labours of all the thousands whom they employ, be the gratification of their own vain and insatiable desires, they divide with the poor the produce of all their improvements...They are led by an invisible hand to make nearly the same distribution of the necessaries of life, which would have been made, had the earth been divided into equal portions among all its inhabitants, and thus without intending it, without knowing it, advance the interest of the society, and afford means to the multiplication of the species”<ref> ''The Theory of Moral Sentiments'' (1759) Part IV, Chapter 1.</ref>}} | {{quote|“...Though the sole end which they propose from the labours of all the thousands whom they employ, be the gratification of their own vain and insatiable desires, they divide with the poor the produce of all their improvements...They are led by an invisible hand to make nearly the same distribution of the necessaries of life, which would have been made, had the earth been divided into equal portions among all its inhabitants, and thus without intending it, without knowing it, advance the interest of the society, and afford means to the multiplication of the species”<ref> ''The Theory of Moral Sentiments'' (1759) Part IV, Chapter 1.</ref>}} | ||

This is, by the way, a ''breathtaking'' insight; no less [[Darwin’s Dangerous Idea|dangerous]] or revolutionary than [[Charles Darwin]]’s: from collected unfettered, venal, selfish actions [[emerges]] | This is, by the way, a ''breathtaking'' insight; no less [[Darwin’s Dangerous Idea|dangerous]] or revolutionary than [[Charles Darwin]]’s: from the collected unfettered, venal, selfish actions [[emerges]] optimised community welfare. | ||

The modern corporation is an embodiment of | The modern corporation is an embodiment of just that idea. ''Everything is predicated upon the enrichment of [[shareholder]]<nowiki/>s.'' | ||

Therefore, performance measurement is simple: we can evaluate every impulse, every decision, every project, every transaction against a single yardstick: ''is this in the [[shareholder]]s’ best interest?'' | |||

That interest, in turn, can also be measured along a single dimension: ''profit''. Nothing else matters. This puts a tidy gate the [[agency problem]], which otherwise afflicts the company’s directors, officers, servants and agents: it is | That interest, in turn, can also be measured along a single dimension: ''profit''. Nothing else matters. This puts a tidy gate the [[agency problem]], which otherwise afflicts the company’s directors, officers, servants and agents: it is hard to hide from after-tax profit. | ||

But we live in a post-millennial world. Given their founding ethos, it is hard to deny that [[corporation]]s are venal, selfish things, riven with [[unconscious bias|biases]], whose unseemly stampede for profit demonstrates an abject want of care for unseen victims. As long ago as 2003 it was Joel Bakan’s thrust in ''The Corporation:''<ref>[https://www.amazon.com/Corporation-Pathological-Pursuit-Profit-Power/dp/0743247469 ''The Corporation: The Pathological Pursuit of Profit and Power'']</ref> a legal personality whose soul motive is the short-term enrichment of its shareholders has the character traits to earn a clinical diagnosis as a ''psychopath''. | |||

To date, Bakan is on the right side of history. Unalloyed selfishness has become, to the modern conscience, intolerable. We are redrawing the world: let us redraw our corporate aspirations too. [[Wall Street|Gordon Gekko]] is out. [[Arif Naqvi]] is in.<ref>“Can you see what it is yet?”</ref> | |||

And so it has come to pass: “[[stakeholder capitalism]]” has displaced [[shareholder capitalism]]. We ask the corporation to orient itself not just toward its shareholders, but ''all'' its “stakeholders” — its customers, [[creditor]]<nowiki/>s, suppliers, [[employee]]<nowiki/>s, the surrounding community, the [[Environmental, social and corporate governance|environment]], the marginalised multitude that suffers invisibly under the awful [[Externality|externalities]] of its industry ''and'' — last but not least! — its shareholders. | |||

Under this new, enlightened purpose a corporation is duty-bound to increase long-term value for all who are impacted by its operation. It must not maximise profit at the expense of the wider world. | |||

This view seems so modern, compassionate and intuitively right — so ''fit for [[Twitter]]'' — that it is hard to see how anyone can have thought otherwise. Yet think otherwise they did — at times, exclusively — from the publication of Smith’s ''Theory of Moral Sentiments'' onward, through the centuries, through the titans of American commerce, the Chicago School, right down until the collective failure of nerve we see before us today. | |||

However obvious it seems, it is a striking reversal. Even that trade union for boomer gammons, the business roundtable<ref>https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans</ref> has joined: last year it redefined the purpose of a corporation away from the outright pursuit of profit to instead promote “an economy that serves all Americans”. “It affirms the essential role corporations can play in improving our society,” said Alex Gorsky, Chairman of the Board and Chief Executive Officer of Johnson & Johnson and Chair of the Business Roundtable Corporate Governance Committee,<ref>Now I don’t want to intrude here, but is being Chairman ''and'' CEO really the best example for the chair of a corporate governance committee to set? [https://hbr.org/2020/03/why-the-ceo-shouldnt-also-be-the-board-chair Here] is the Harvard Business Review on the subject.</ref> “when [[CEO]]<nowiki/>s are truly committed to meeting the needs of all stakeholders.” | |||

We find ourselves taking a contrarian view. | We find ourselves taking a contrarian view. | ||

This not an “a[[woke]]ning” so much as ''a kind of national concussion occasioned by a stout blow on the head''. | This not an “a[[woke]]ning” so much as ''a kind of national concussion occasioned by a stout blow on the head''. | ||

These people are either talking their own book, or they have all gone mad. | |||

The class of a company’s shareholders need have — no, no: ''will'' have — nothing whatever in common ''beyond their shareholding''. | Skeptics of the mass delusion conspiracy theories can relax: all this can be explained by vested interests. This is executives talking their own book. For stakeholder capitalism ''codifies'' the [[agency problem]]. It diffuses the executive’s accountability for anything the corporation does, putting the executive beyond the reproach of its shareholders. | ||

=== About those shareholders=== | |||

Under Bakan’s theory, it is not the shareholders who are the psychopaths,<ref>Shareholders ''who themselves are corporations'' probably count as psychopaths, come to think of it, but the point remains valid. Shareholders are not necessarily corporate, and at some point all shareholdings must (right? ''Right''?) resolve back to some living, breathing individual.</ref> but the corporation as a distinct [[legal personality]] itself. Its shareholders are only its motivation for its pathology. Shareholders, as a class, have no such common characteristics. Indeed, shareholders are [[diverse]] in every conceivable dimension ''bar one''. They can be young or old, rich or poor, left or right, tall or short, male or female, gay or straight, black or white or, in each case, any gradation in between.They don’t have to ''know'' each other, ''like'' each other or ''care less'' about each other. They almost certainly won’t. The class of a company’s shareholders need have — no, no: ''will'' have — nothing whatever in common ''beyond their shareholding''. | |||

In all other walks of life, their respective interests, aspirations and priorities might jar, clatter and conflict. If you put them in a room to discuss any topic ''but'' their shareholding, you should not be surprised if a fight breaks out. | In all other walks of life, their respective interests, aspirations and priorities might jar, clatter and conflict. If you put them in a room to discuss any topic ''but'' their shareholding, you should not be surprised if a fight breaks out. | ||

But on that one subject, they are | But on that one subject, they are totally, magically, necessarily aligned: “whatever else I care about in my life, members of the board, know this: ''I expect you to maximise my return''.” | ||

=== | ===About that return=== | ||

And nor is there dispute about what counts as return, or how | And nor is there dispute about what counts as a shareholder return, or how one should measure it. | ||

Long ago, our forebears<ref>No, not enlightened, white, male, cis-gendered, colonial oppressors: ancient Babylonians.</ref> figured out how to distil pure, abstract, immaterial ''[[value]]'' from the relativising commodities or perishable [[substrate]]s in which it is usually embedded:<ref>Granted, it is imperfect: until recently much cash did have a substrate (paper send coins), and its value is still coloured by the credit consensus of its issuing bank, which can control its supply and demand, but the substrate issues are largely resolved, and consensus in the bona fides of the [[Federal Reserve]], [[ECB]] and [[Bank of England]] has proven a lot more robust then that of crypto currencies. Don’t @ me, [[bitcoin]] maximalists.</ref> [[cash|''money'']]. | |||

In discharging their sacred quest, [[Chief executive officer|those stewarding the affairs of corporation]] could not have clearer instructions: should the return they generate, valued in folding green stuff, not pass muster, there will be no excuses. There is no dog who can eat a [[Chief executive officer|chief executive]]’s homework, no looking on the bright side because employee engagement numbers are up, no shelter to be taken in the popularity of the company’s float in the May Day parade. If the annual return disappoints, executives, ''you get shot''. | |||

Shareholder return is not a device to systematically gouge the environment on behalf of an anonymous capitalist class. It is a device to stop executives systematically gouging their shareholders. | |||

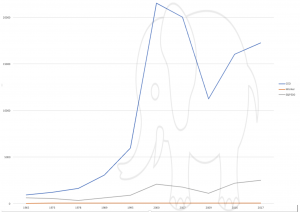

[[File:CEO compensation.png|thumb|CEO compensation (in thousands) mapped against worker compensation (in thousands) and performance of the S&P500. For some reason there seems to be an elephant in the room, too.]] | |||

Now, before you throw up your hands and cry, “but shareholders do not need protection from their chief executive officers!” I invite you to consider the following chart, taken from data I found at the economic policy institute, which, in mapping CEO compensation against worker compensation and the performance of the S&P500, gives a pretty good picture of how shareholders, workers and executives are doing relative to each other. | |||

==[[Stakeholder capitalism]] means never having to say you’re sorry== | |||

All that clarity of purpose evaporates the moment you expand your list of stakeholders, and corporate objectives, beyond that single monetary goal. | All that clarity of purpose evaporates the moment you expand your list of stakeholders, and corporate objectives, beyond that single monetary goal. | ||

You have multiple goals, multiple stakeholders, and their interests — which are | You have multiple goals, multiple stakeholders, and their interests — which are indeterminate, by the way — profoundly conflict. How do you arbitrate between the interests of creditors and the local community? Between the environment and customers? How do you even know what the customer’s interests — beyond access to as much of your soda pop as it can get, as cheap as it can buy it — ''are''?<ref>There is a hand-wavy argument that executives should have in mind the “best interests of the community” and not anyone’s selfish needs and wants. This is so preposterous as to be quite unneeding of rebuttal, but for what it’s worth it is hard to see how a moral agenda determined by the executive agent class — mainly white, aging, cis-gendered, post colonial men — improves on none at all.</ref> | ||

Which goal has priority? Now a failure to generate a decent cash return can be blamed on — well, ''anything'' — your success in reducing the number of smokers in the accounts department, or your community outreach team spent all your excess cash on beautifying a local park, or you chose a buildings manager who was twice the going rate but had a better anti-modern slavery policy. | Which goal has priority? Now a failure to generate a decent cash return can be blamed on — well, ''anything'' — your success in reducing the number of smokers in the accounts department, or your community outreach team spent all your excess cash on beautifying a local park, or you chose a buildings manager who was twice the going rate but had a better anti-modern slavery policy. | ||

| Line 56: | Line 61: | ||

Yes, customers are your stakeholders, and they have an interest how you conduct your business, but — at least in a healthy marketplace — they have a means of controlling that a lot more direct, regular and effective than do shareholders: they can buy something else. You can only maximise shareholder return ''by persuading lots of customers to buy your stuff''. | Yes, customers are your stakeholders, and they have an interest how you conduct your business, but — at least in a healthy marketplace — they have a means of controlling that a lot more direct, regular and effective than do shareholders: they can buy something else. You can only maximise shareholder return ''by persuading lots of customers to buy your stuff''. | ||

===== Shareholders can’t | ===== Shareholders can’t look after themselves ===== | ||

Shareholders are a bit like voters in a representative democracy: their control over the enterprise is a lot less exacting that we like to think. One’s main weapon is the power of sale; beyond that, there’s the AGM, and unless you’re an institutional money manager, don’t expect anyone in the C suite to be massively bothered how you vote. | Shareholders are a bit like voters in a representative democracy: their control over the enterprise is a lot less exacting that we like to think. One’s main weapon is the power of sale; beyond that, there’s the AGM, and unless you’re an institutional money manager, don’t expect anyone in the C suite to be massively bothered how you vote. | ||

=====Employees '' | =====Employees ''can'' look after themselves===== | ||

Unlike shareholders, employees — especially those in the executive suite — have all the power they need to influence the company. | Unlike shareholders, employees — especially those in the executive suite — have all the power they need to influence the company. | ||

=====If shareholders | =====If shareholders want to beautify the inner city, they can do it themselves===== | ||

We assume shareholders are people with disposable income, and they have chosen to this sum into this company for the purpose of generating a return. If they wanted to donate to Oxfam, they could. It is not the company to second guess the moral priorities of its shareholding. As mentioned above, in all respect but the single one of the aspiration for a maximum return, the shareholders interests are | We assume shareholders are people with disposable income, and they have chosen to this sum into this company for the purpose of generating a return. If they wanted to donate to Oxfam, they could. It is not the company to second guess the moral priorities of its shareholding. As mentioned above, in all respect but the single one of the aspiration for a maximum return, the shareholders interests are opaque, and certainly conflicting. There will be democrats and republicans, vegans and carnivores, wets and dries on the share register. The executive cannot pander to these conflicting proclivities. | ||

{{sa}} | {{sa}} | ||

*[[Stakeholder]] | *[[Stakeholder]] | ||

Revision as of 14:09, 26 September 2021

|

Once upon a time, not terribly long ago, the shareholder was an opaque yet sacred being, somewhat divine, to whose improving ends everyone engaged in the company’s operation twitched their every fibre.

This will to shareholder return sprang from the brow of Adam Smith and his invisible hand:

“...Though the sole end which they propose from the labours of all the thousands whom they employ, be the gratification of their own vain and insatiable desires, they divide with the poor the produce of all their improvements...They are led by an invisible hand to make nearly the same distribution of the necessaries of life, which would have been made, had the earth been divided into equal portions among all its inhabitants, and thus without intending it, without knowing it, advance the interest of the society, and afford means to the multiplication of the species”[1]

This is, by the way, a breathtaking insight; no less dangerous or revolutionary than Charles Darwin’s: from the collected unfettered, venal, selfish actions emerges optimised community welfare.

The modern corporation is an embodiment of just that idea. Everything is predicated upon the enrichment of shareholders.

Therefore, performance measurement is simple: we can evaluate every impulse, every decision, every project, every transaction against a single yardstick: is this in the shareholders’ best interest?

That interest, in turn, can also be measured along a single dimension: profit. Nothing else matters. This puts a tidy gate the agency problem, which otherwise afflicts the company’s directors, officers, servants and agents: it is hard to hide from after-tax profit.

But we live in a post-millennial world. Given their founding ethos, it is hard to deny that corporations are venal, selfish things, riven with biases, whose unseemly stampede for profit demonstrates an abject want of care for unseen victims. As long ago as 2003 it was Joel Bakan’s thrust in The Corporation:[2] a legal personality whose soul motive is the short-term enrichment of its shareholders has the character traits to earn a clinical diagnosis as a psychopath.

To date, Bakan is on the right side of history. Unalloyed selfishness has become, to the modern conscience, intolerable. We are redrawing the world: let us redraw our corporate aspirations too. Gordon Gekko is out. Arif Naqvi is in.[3]

And so it has come to pass: “stakeholder capitalism” has displaced shareholder capitalism. We ask the corporation to orient itself not just toward its shareholders, but all its “stakeholders” — its customers, creditors, suppliers, employees, the surrounding community, the environment, the marginalised multitude that suffers invisibly under the awful externalities of its industry and — last but not least! — its shareholders.

Under this new, enlightened purpose a corporation is duty-bound to increase long-term value for all who are impacted by its operation. It must not maximise profit at the expense of the wider world.

This view seems so modern, compassionate and intuitively right — so fit for Twitter — that it is hard to see how anyone can have thought otherwise. Yet think otherwise they did — at times, exclusively — from the publication of Smith’s Theory of Moral Sentiments onward, through the centuries, through the titans of American commerce, the Chicago School, right down until the collective failure of nerve we see before us today.

However obvious it seems, it is a striking reversal. Even that trade union for boomer gammons, the business roundtable[4] has joined: last year it redefined the purpose of a corporation away from the outright pursuit of profit to instead promote “an economy that serves all Americans”. “It affirms the essential role corporations can play in improving our society,” said Alex Gorsky, Chairman of the Board and Chief Executive Officer of Johnson & Johnson and Chair of the Business Roundtable Corporate Governance Committee,[5] “when CEOs are truly committed to meeting the needs of all stakeholders.”

We find ourselves taking a contrarian view.

This not an “awokening” so much as a kind of national concussion occasioned by a stout blow on the head.

These people are either talking their own book, or they have all gone mad.

Skeptics of the mass delusion conspiracy theories can relax: all this can be explained by vested interests. This is executives talking their own book. For stakeholder capitalism codifies the agency problem. It diffuses the executive’s accountability for anything the corporation does, putting the executive beyond the reproach of its shareholders.

Under Bakan’s theory, it is not the shareholders who are the psychopaths,[6] but the corporation as a distinct legal personality itself. Its shareholders are only its motivation for its pathology. Shareholders, as a class, have no such common characteristics. Indeed, shareholders are diverse in every conceivable dimension bar one. They can be young or old, rich or poor, left or right, tall or short, male or female, gay or straight, black or white or, in each case, any gradation in between.They don’t have to know each other, like each other or care less about each other. They almost certainly won’t. The class of a company’s shareholders need have — no, no: will have — nothing whatever in common beyond their shareholding.

In all other walks of life, their respective interests, aspirations and priorities might jar, clatter and conflict. If you put them in a room to discuss any topic but their shareholding, you should not be surprised if a fight breaks out.

But on that one subject, they are totally, magically, necessarily aligned: “whatever else I care about in my life, members of the board, know this: I expect you to maximise my return.”

About that return

And nor is there dispute about what counts as a shareholder return, or how one should measure it.

Long ago, our forebears[7] figured out how to distil pure, abstract, immaterial value from the relativising commodities or perishable substrates in which it is usually embedded:[8] money.

In discharging their sacred quest, those stewarding the affairs of corporation could not have clearer instructions: should the return they generate, valued in folding green stuff, not pass muster, there will be no excuses. There is no dog who can eat a chief executive’s homework, no looking on the bright side because employee engagement numbers are up, no shelter to be taken in the popularity of the company’s float in the May Day parade. If the annual return disappoints, executives, you get shot.

Shareholder return is not a device to systematically gouge the environment on behalf of an anonymous capitalist class. It is a device to stop executives systematically gouging their shareholders.

Now, before you throw up your hands and cry, “but shareholders do not need protection from their chief executive officers!” I invite you to consider the following chart, taken from data I found at the economic policy institute, which, in mapping CEO compensation against worker compensation and the performance of the S&P500, gives a pretty good picture of how shareholders, workers and executives are doing relative to each other.

Stakeholder capitalism means never having to say you’re sorry

All that clarity of purpose evaporates the moment you expand your list of stakeholders, and corporate objectives, beyond that single monetary goal.

You have multiple goals, multiple stakeholders, and their interests — which are indeterminate, by the way — profoundly conflict. How do you arbitrate between the interests of creditors and the local community? Between the environment and customers? How do you even know what the customer’s interests — beyond access to as much of your soda pop as it can get, as cheap as it can buy it — are?[9]

Which goal has priority? Now a failure to generate a decent cash return can be blamed on — well, anything — your success in reducing the number of smokers in the accounts department, or your community outreach team spent all your excess cash on beautifying a local park, or you chose a buildings manager who was twice the going rate but had a better anti-modern slavery policy.

Stakeholder capitalism means the executive has an excuse. Always. For everything.

Customers can look after themselves

Yes, customers are your stakeholders, and they have an interest how you conduct your business, but — at least in a healthy marketplace — they have a means of controlling that a lot more direct, regular and effective than do shareholders: they can buy something else. You can only maximise shareholder return by persuading lots of customers to buy your stuff.

Shareholders are a bit like voters in a representative democracy: their control over the enterprise is a lot less exacting that we like to think. One’s main weapon is the power of sale; beyond that, there’s the AGM, and unless you’re an institutional money manager, don’t expect anyone in the C suite to be massively bothered how you vote.

Employees can look after themselves

Unlike shareholders, employees — especially those in the executive suite — have all the power they need to influence the company.

We assume shareholders are people with disposable income, and they have chosen to this sum into this company for the purpose of generating a return. If they wanted to donate to Oxfam, they could. It is not the company to second guess the moral priorities of its shareholding. As mentioned above, in all respect but the single one of the aspiration for a maximum return, the shareholders interests are opaque, and certainly conflicting. There will be democrats and republicans, vegans and carnivores, wets and dries on the share register. The executive cannot pander to these conflicting proclivities.

See also

References

- ↑ The Theory of Moral Sentiments (1759) Part IV, Chapter 1.

- ↑ The Corporation: The Pathological Pursuit of Profit and Power

- ↑ “Can you see what it is yet?”

- ↑ https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans

- ↑ Now I don’t want to intrude here, but is being Chairman and CEO really the best example for the chair of a corporate governance committee to set? Here is the Harvard Business Review on the subject.

- ↑ Shareholders who themselves are corporations probably count as psychopaths, come to think of it, but the point remains valid. Shareholders are not necessarily corporate, and at some point all shareholdings must (right? Right?) resolve back to some living, breathing individual.

- ↑ No, not enlightened, white, male, cis-gendered, colonial oppressors: ancient Babylonians.

- ↑ Granted, it is imperfect: until recently much cash did have a substrate (paper send coins), and its value is still coloured by the credit consensus of its issuing bank, which can control its supply and demand, but the substrate issues are largely resolved, and consensus in the bona fides of the Federal Reserve, ECB and Bank of England has proven a lot more robust then that of crypto currencies. Don’t @ me, bitcoin maximalists.

- ↑ There is a hand-wavy argument that executives should have in mind the “best interests of the community” and not anyone’s selfish needs and wants. This is so preposterous as to be quite unneeding of rebuttal, but for what it’s worth it is hard to see how a moral agenda determined by the executive agent class — mainly white, aging, cis-gendered, post colonial men — improves on none at all.