Template:M summ Equity Derivatives 12.9(a): Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{extraordinary events capsule}} | {{extraordinary events capsule}} | ||

==Section-by-section== | |||

==={{eqderivprov|12.9(a)(ix)}} {{eqderivprov|Hedging Party}}=== | |||

{{M summ Equity Derivatives 12.9(a)(ix)}} | |||

===Section {{eqderivprov|12.9(a)(xii)}} {{eqderivprov|Non-Hedging Party}}=== | ===Section {{eqderivprov|12.9(a)(xii)}} {{eqderivprov|Non-Hedging Party}}=== | ||

Note hugely controversial, you | {{M summ Equity Derivatives 12.9(a)(xii)}} | ||

Note hugely controversial, you would think, but it does sort of imply that the {{eqderivprov|Hedging Party}} is itself a party to the transaction - otherwise ''both'' parties are {{eqderivprov|Non-Hedging Parties}}. But if so, then there's not really any need for the definition of {{eqderivprov|Hedging Party}} at all ... | |||

===Section {{eqderivprov|12.9(a)(xiii)}} {{eqderivprov|Maximum Stock Loan Rate}}=== | ===Section {{eqderivprov|12.9(a)(xiii)}} {{eqderivprov|Maximum Stock Loan Rate}}=== | ||

{{M summ Equity Derivatives 12.9(a)(xiii)}} | |||

Relevant only where {{eqderivprov|Increased Cost of Stock Borrow}} or {{eqderivprov|Loss of Stock Borrow}} apply to a {{eqderivprov|Transaction}}. (You will know because there will be a "{{eqderivprov|Maximum Stock Loan Rate}}" specified in the {{isdaprov|Confirmation}}). | Relevant only where {{eqderivprov|Increased Cost of Stock Borrow}} or {{eqderivprov|Loss of Stock Borrow}} apply to a {{eqderivprov|Transaction}}. (You will know because there will be a "{{eqderivprov|Maximum Stock Loan Rate}}" specified in the {{isdaprov|Confirmation}}). | ||

Revision as of 13:06, 19 May 2022

Break these “Extraordinary Events” into four categories:

Corporate events on Issuers: Corporate Events are generally benign[1] but not always expected or even wanted adjustments to the corporate structure and management of specific underlying Shares — Tender Offers, Mergers, management buyouts and events that change the economic proposition represented by those Shares, and not the equity derivative contract. So: Merger Events and Tender Offers;

Index adjustments: For Index trades, unexpected adjustments and changes to methodologies and publishing strategies of underlying Index (as opposed to changes in the composition of the Index according to its pre-existing rules) — collectively call these “Index Adjustment Events”. So:

- Index Modification: Changes in the calculation methodology for the Index

- Index Cancellation: Where Indexes are discontinued with replacement;

- Index Disruption: disruption in the calculation and publication of Index values;

Negative events affecting Issuers: Nationalizations, Insolvency, Delisting of underlying Issuers;

Additional Disruption Events: Events which directly impair performance and risk management of the Transaction itself. These often cross over with market- and Issuer-dependent events above, but the emphasis here is their direct impact on the parties’ abilities to perform and hedge the derivative Transaction itself. So:

- The Triple Cocktail: The Triple Cocktail of Change in Law, Hedging Disruption and Increased Cost of Hedging;

- Stock borrow events: Specific issues relating to short-selling (Loss of Stock Borrow and Increased Cost of Stock Borrow); and

- Random ones that aren’t needed or used: Two random ones that don’t brilliantly fit with this theory, and which people tend to disapply — possibly for that exact reason, but they are fairly well covered by the Triple Cocktail anyway — Failure to Deliver under the Transaction on account of illiquidity and, even more randomly, Insolvency Filing[2].

Section-by-section

12.9(a)(ix) Hedging Party

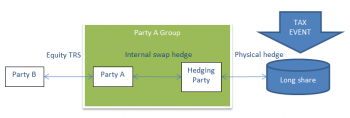

Relevant in the context of Additional Disruption Events and hedging disruption, the Hedging Party will be the entity actually carrying out the hedging activity, if it isn’t the party to the ISDA Master Agreement itself. If no Hedging Party is specified, it defaults to the parties themselves.

Note also the related concept of the Determining Party, who is the person calculating the replacement cost of the Transaction following an Extraordinary Event (e.g. termination following a Hedging Disruption, Change in Law or Increased Cost of Hedging).

In this case there will be a string of intermediate hedging contracts — usually derivatives — but these may not behave in exactly the way that a real underlier would (in terms of market disruption, tax events, liquidity etc). and what the Equity Derivatives Definitions are meant to do is pass on the risk associated with the actual underlier.

So for example in the example pictured, Party A provide exposure to client, hedges that with a equity TRS to Hedging Party, which goes long the physical share. Now the Hedging Party, not Party A, has the risk of the physical assets. If there is a market disruption, or a tax event on the physical hedge this is reflected in the price that Hedging Party will have to pay to Party A, but it isn’t a market disruption or tax event directly on Party A itself (and in fact might not be – Party A might be domiciled in a jurisdiction benefitting from a different tax treaty with the jurisdiction of the underlier, for example). So in this case we need to reference the position as held by a person other than the counterparty to the swap.

Note also that “Non-Hedging Party” definition somewhat assumes that the Hedging Party will indeed be the actual counterparty to the Transaction.

Section 12.9(a)(xii) Non-Hedging Party

Not epochally controversial, you would think, but it does sort of imply that the Hedging Party is itself a party to the Transaction — otherwise both parties are Non-Hedging Parties. But if so, then there's not really any need for the definition of Hedging Party at all.

What it is getting at is who is the dealer and who is the customer. Now in some cases a master agreement may be between two and users, but in the context of equity derivatives this is unlikely. The dealer will be delta hedging its position, and therefore essentially staying market neutral while the end user will come up by definition, not colon it's entire purpose for entering the equity derivative is to gain or lose some exposure to a Share or eqderivprov|Index}}.

JC has a lengthy essay on the relationship between dealers and customers under an ISDA Master Agreement. Two, in fact.

Note hugely controversial, you would think, but it does sort of imply that the Hedging Party is itself a party to the transaction - otherwise both parties are Non-Hedging Parties. But if so, then there's not really any need for the definition of Hedging Party at all ...

Section 12.9(a)(xiii) Maximum Stock Loan Rate

Relevant only where Increased Cost of Stock Borrow or Loss of Stock Borrow apply to a Transaction. (You will know because there will be a "Maximum Stock Loan Rate" specified in the Confirmation). Relevant only where Increased Cost of Stock Borrow or Loss of Stock Borrow apply to a Transaction. (You will know because there will be a "Maximum Stock Loan Rate" specified in the Confirmation).

- ↑ “Benign” from the point of view of the target company’s solvency and market prospects; not quite so benign from its management team’s prospects of ongoing employment.

- ↑ especially since there is already an “Insolvency” event covering most of this).