Specified Transaction - ISDA Provision: Difference between revisions

Amwelladmin (talk | contribs) No edit summary |

Amwelladmin (talk | contribs) |

||

| Line 12: | Line 12: | ||

===Enter the fiddlers=== | ===Enter the fiddlers=== | ||

ISDA’s verbal profligacy won’t stop enthusiastic credit officers amplifying the list even further, of course. What about [[precious metals|precious metal]] transactions? {{tag|Letter of credit | ISDA’s verbal profligacy won’t stop enthusiastic credit officers amplifying the list even further, of course. What about [[precious metals|precious metal]] transactions? {{tag|Letter of credit}} reimbursement obligations? [[Indebtedness]]? What indeed? | ||

====An odd cognitive dissonance==== | ====An odd cognitive dissonance==== | ||

Revision as of 11:09, 14 November 2017

|

ISDA Anatomy™

NB - paragraph breaks do not appear in the printed form.

|

See also: Failure to Pay, DUST and Cross Default under the ISDA

Used in the Default under Specified Transaction Event of Default under Section 5(a)(v) — fondly known to those in the know as “DUST”.

What?

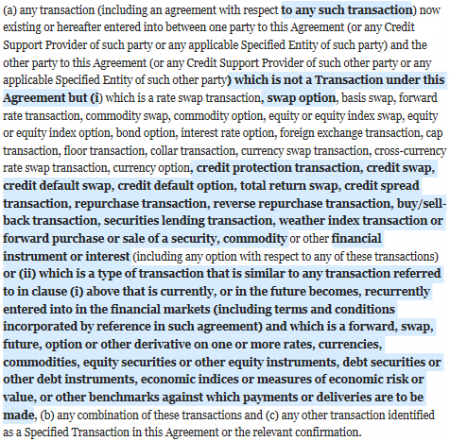

Specified Transactions are those financial markets transactions between you and your counterparty other than those under the present ISDA Master Agreement, default under which justifies the wronged party closing out the present ISDA. “Specified Transactions” therefore specifically exclude Transactions under the ISDA itself for the sensible reason that a default under those is covered by by Failure to Pay or Deliver and Breach of Obligation. It might lead to a perverse result if misadventure under an ISDA Master Agreement Transaction which did not otherwise amount to an Event of Default, became one purely as a result of the DUST provision, however unlikely that may be.

Different formulations between the versions

A Specified Transaction under the 1992 ISDA is, by ISDA standards, monosyllabic to the point of being terse.

Under the 2002 ISDA it is expressed with far more of ISDA's signature sense of the Byzantine, expanding the basic definition to specifically include futures credit derivatives, repo, stock lending, weather derivatives,[1] NDFs, transactions executed under terms of business and other commodities or similar transactions that is presently or in future becomes common in the financial markets.

Enter the fiddlers

ISDA’s verbal profligacy won’t stop enthusiastic credit officers amplifying the list even further, of course. What about precious metal transactions? Letter of credit reimbursement obligations? Indebtedness? What indeed?

An odd cognitive dissonance

The framers of DUST deliberately neglected to include borrowed money or indebtedness, because these are picked up under the wider scope of the Cross Default provision which, of course, applies to indebtedness your counterparty owes to anyone, not just you. Still, there is weirdness: Cross Default contemplates a Threshold Amount before it can be triggered. DUST doesn’t. So this leads to an odd gap:

- A (sub Threshold Amount) default under Specified Indebtedness between the two contractual parties would not entitle the innocent party to close out;

- A default under any other Specified Transaction between them would even if a smaller quantum of default. This is kind of counterintuitive. If you were to define DUST to include indebtedness, of course, you'd be covered.